Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Five months ago an investor paid $1,050,000 of the US small-cap portfolio. The Russell 2000 index was 1750 when the position was purchased. By

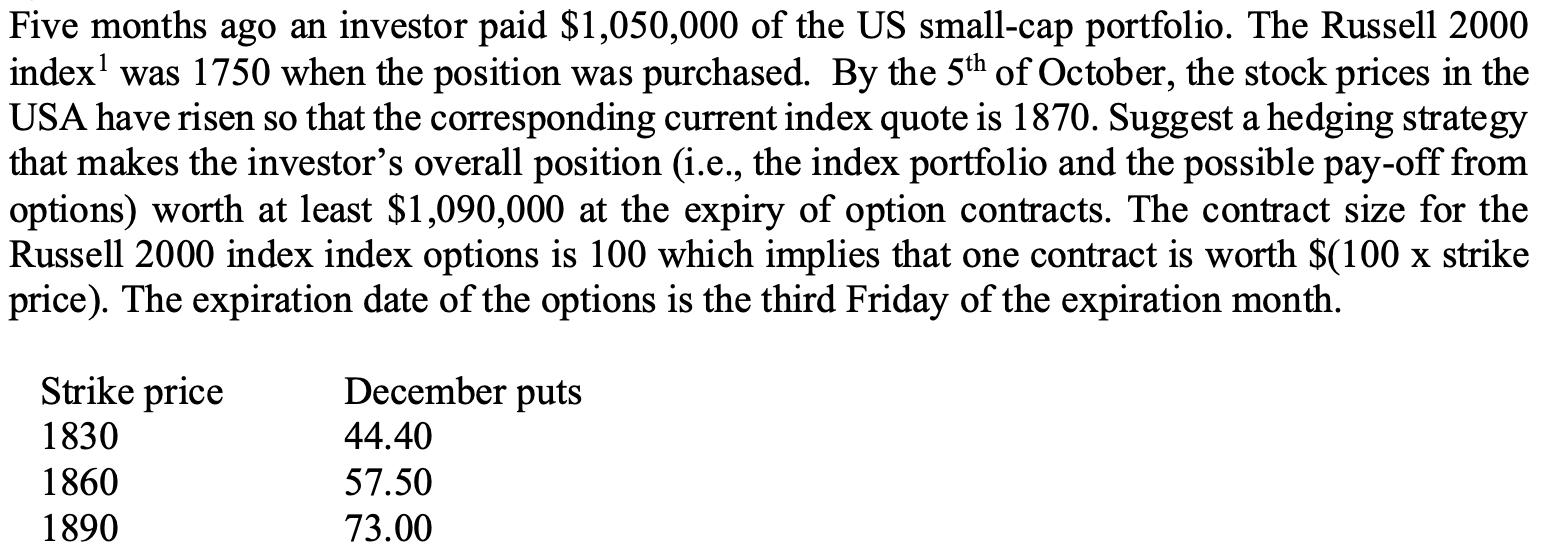

Five months ago an investor paid $1,050,000 of the US small-cap portfolio. The Russell 2000 index was 1750 when the position was purchased. By the 5th of October, the stock prices in the USA have risen so that the corresponding current index quote is 1870. Suggest a hedging strategy that makes the investor's overall position (i.e., the index portfolio and the possible pay-off from options) worth at least $1,090,000 at the expiry of option contracts. The contract size for the Russell 2000 index index options is 100 which implies that one contract is worth $(100 x strike price). The expiration date of the options is the third Friday of the expiration month. Strike price 1830 1860 1890 December puts 44.40 57.50 73.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To suggest a hedging strategy that ensures the investors overall position is worth at least 1090000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started