Question

Five years ago, Caleb and his brother Luke formed Cabrera Corp, a golf apparel manufacturing corporation At that time, Caleb contributed $ 354,000 to the

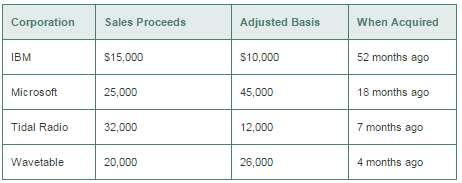

Five years ago, Caleb and his brother Luke formed Cabrera Corp, a golf apparel manufacturing corporation At that time, Caleb contributed $ 354,000 to the corporation in exchange for 65 %of its stock During the current year, Caleb needed some cash to purchase a golf course so he sold a third of his interest in Cabrera Corp for $ 89,000 He also sold stock in the following companies for the amounts indicated.

During the year Caleb hired a collection agency to collect a $14,000 loan he made to an old friend, which was due in full on January 1 of the current year. The agency found no trace of his friend. Also during the year, BTR Corporation, in which he owns stock, went bankrupt. His investment was worth $94,000 on January 1, he purchased it six years ago for $100,000, and he expects to receive only $8,000 in redemption of his stock. Finally, Caleb's salary for the year was $114,000 for his work as an associate professor.

a. What are the net gains and losses from the above items and their character?

b. What is Caleb's AGI for the year assuming he has no other items of income or deduction?

Corporation Sales Proceeds Adjusted Basis When Acquired IBM S15.000 S10,000 52 months ago Microsoft 25,000 45,000 18 months ago Tidal Radio 32,000 12,000 7 months ago Wavetable 20,000 26,000 4 months ago

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Stewart Corp 13 interest sold LTCL of 15000 IBM LTCG of 5000 Microsoft LTCL of 20000 Tidal Radio STC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started