Answered step by step

Verified Expert Solution

Question

1 Approved Answer

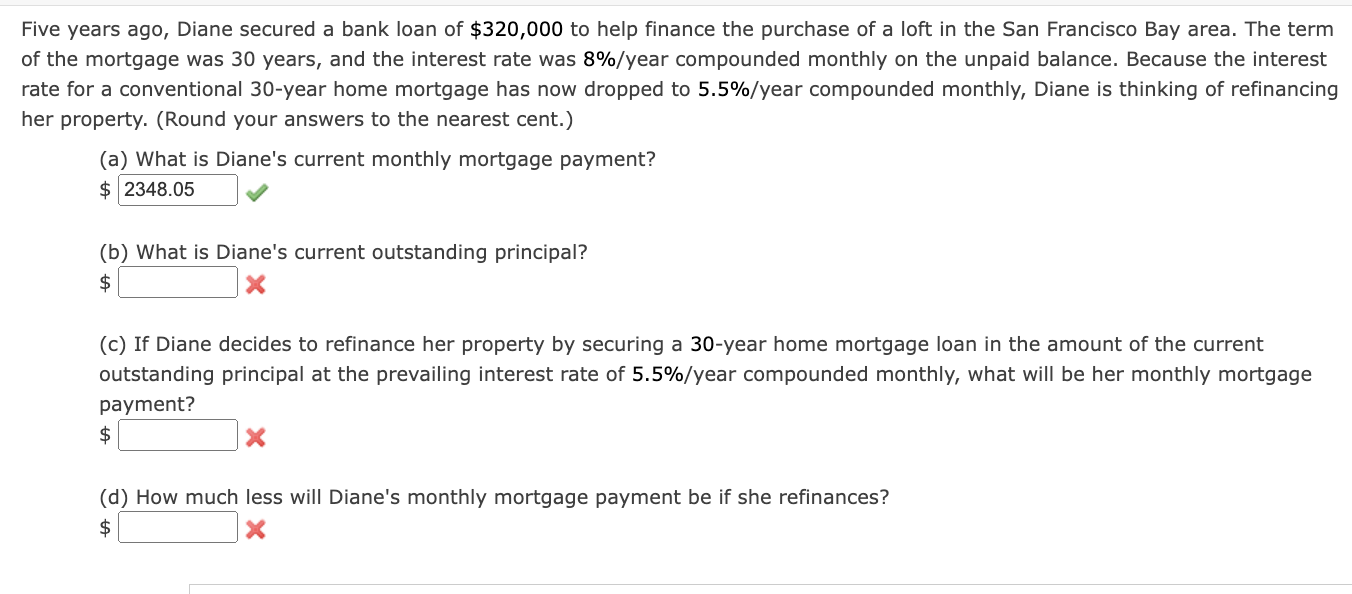

Five years ago, Diane secured a bank loan of $ 3 2 0 , 0 0 0 to help finance the purchase of a loft

Five years ago, Diane secured a bank loan of $ to help finance the purchase of a loft in the San Francisco Bay area. The term

of the mortgage was years, and the interest rate was year compounded monthly on the unpaid balance. Because the interest

rate for a conventional year home mortgage has now dropped to year compounded monthly, Diane is thinking of refinancing

her property. Round your answers to the nearest cent.

a What is Diane's current monthly mortgage payment?

$

b What is Diane's current outstanding principal?

$

c If Diane decides to refinance her property by securing a year home mortgage loan in the amount of the current

outstanding principal at the prevailing interest rate of year compounded monthly, what will be her monthly mortgage

payment?

$

d How much less will Diane's monthly mortgage payment be if she refinances?

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started