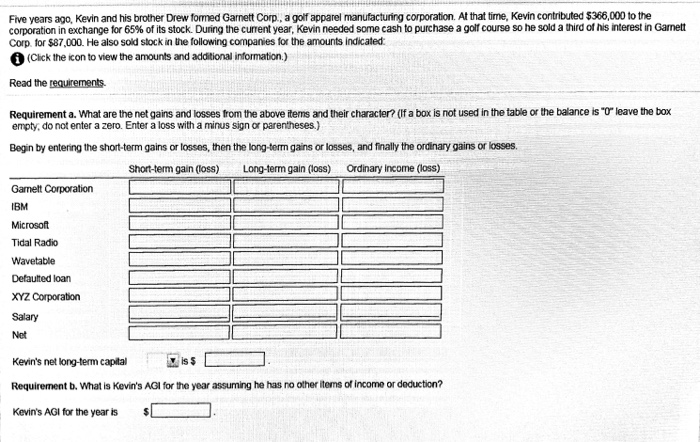

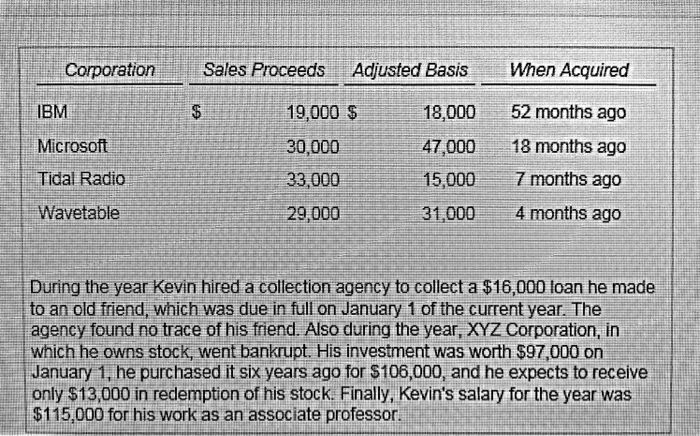

Five years ago, Kevin and his brother Drew formed Garnett Corp, a golf apparel manufacturing corporation. At that time, Kevin contributed $366,000 to the corporatio in exchange for 65% of its stock. During he current year, Kevin needed some cash o purchase a golf course so he sold a third of his nterest i Garnett Corp. for $87,000. He also sod slock in the following companies for the amounts indicated o (Cick the icon to view the amounts and additional inormation.) Read the reguirements Requirement a. What are the net gains and losses from the above items and their character? (If a box is not used in the table or the balance is "Or leave the box empty, do not enter a zero. Enter a loss with a minus sign or parentheses.) Begin by entering the short-term gains or losses, then the long-term gains or losses, and finally the ordinary gains or losses. Short-term gain (loss) Long-term gain (loss) Ordinary income (loss) Gamelt Corporation BM Microsoft Tidal Radio Wavetable Detauted loan XYZ Corporation Salary Net Kevin's net longterm capital ; Requirement b. What is Kevin's AGI for the year assuming he has no other items of income or deduction? Kevin's AGI for the year is is S Five years ago, Kevin and his brother Drew formed Garnett Corp, a golf apparel manufacturing corporation. At that time, Kevin contributed $366,000 to the corporatio in exchange for 65% of its stock. During he current year, Kevin needed some cash o purchase a golf course so he sold a third of his nterest i Garnett Corp. for $87,000. He also sod slock in the following companies for the amounts indicated o (Cick the icon to view the amounts and additional inormation.) Read the reguirements Requirement a. What are the net gains and losses from the above items and their character? (If a box is not used in the table or the balance is "Or leave the box empty, do not enter a zero. Enter a loss with a minus sign or parentheses.) Begin by entering the short-term gains or losses, then the long-term gains or losses, and finally the ordinary gains or losses. Short-term gain (loss) Long-term gain (loss) Ordinary income (loss) Gamelt Corporation BM Microsoft Tidal Radio Wavetable Detauted loan XYZ Corporation Salary Net Kevin's net longterm capital ; Requirement b. What is Kevin's AGI for the year assuming he has no other items of income or deduction? Kevin's AGI for the year is is S