Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fix the trial balance. Alex is preparing the final accounts for his business for the year to 30 November 2020. The following is the trial

Fix the trial balance.

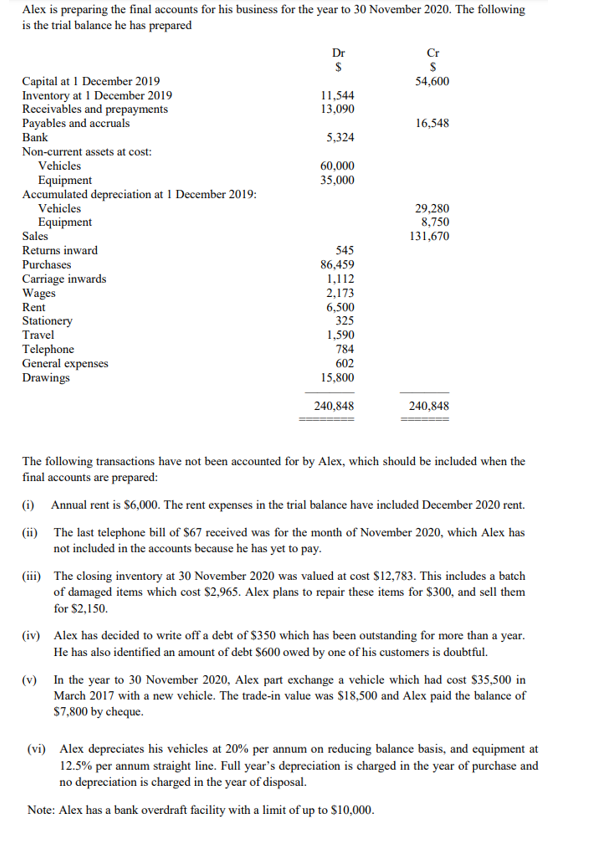

Alex is preparing the final accounts for his business for the year to 30 November 2020. The following is the trial balance he has prepared Dr Cr $ Capital at 1 December 2019 54,600 Inventory at 1 December 2019 11,544 Receivables and prepayments 13,090 Payables and accruals 16,548 Bank 5,324 Non-current assets at cost: Vehicles 60,000 Equipment 35,000 Accumulated depreciation at 1 December 2019: Vehicles 29,280 Equipment 8,750 Sales 131,670 Returns inward 545 Purchases 86,459 Carriage inwards 1,112 Wages 2,173 Rent 6,500 Stationery 325 Travel 1,590 Telephone 784 General expenses 602 Drawings 15,800 240,848 240,848 The following transactions have not been accounted for by Alex, which should be included when the final accounts are prepared: (1) Annual rent is $6,000. The rent expenses in the trial balance have included December 2020 rent. (ii) The last telephone bill of $67 received was for the month of November 2020, which Alex has not included in the accounts because he has yet to pay. (iii) The closing inventory at 30 November 2020 was valued at cost $12,783. This includes a batch of damaged items which cost $2,965. Alex plans to repair these items for $300, and sell them for $2,150 (iv) Alex has decided to write off a debt of $350 which has been outstanding for more than a year. He has also identified an amount of debt $600 owed by one of his customers is doubtful. (v) In the year to 30 November 2020, Alex part exchange a vehicle which had cost $35,500 in March 2017 with a new vehicle. The trade-in value was $18,500 and Alex paid the balance of $7,800 by cheque. (vi) Alex depreciates his vehicles at 20% per annum on reducing balance basis, and equipment at 12.5% per annum straight line. Full year's depreciation is charged in the year of purchase and no depreciation is charged in the year of disposal. Note: Alex has a bank overdraft facility with a limit of up to $10,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started