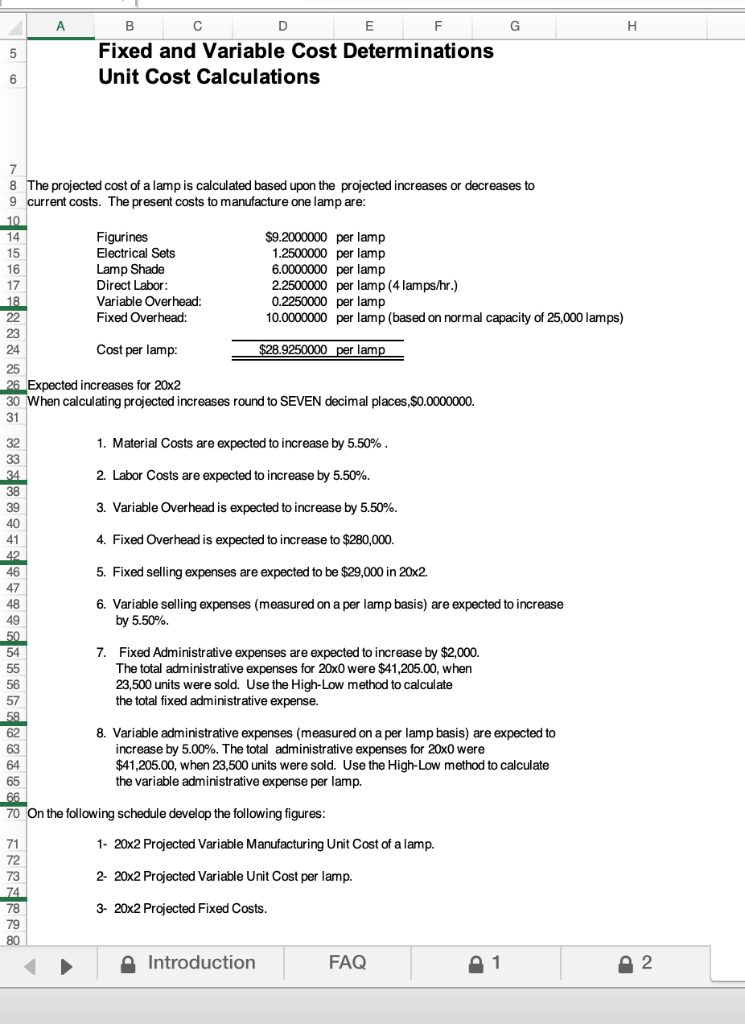

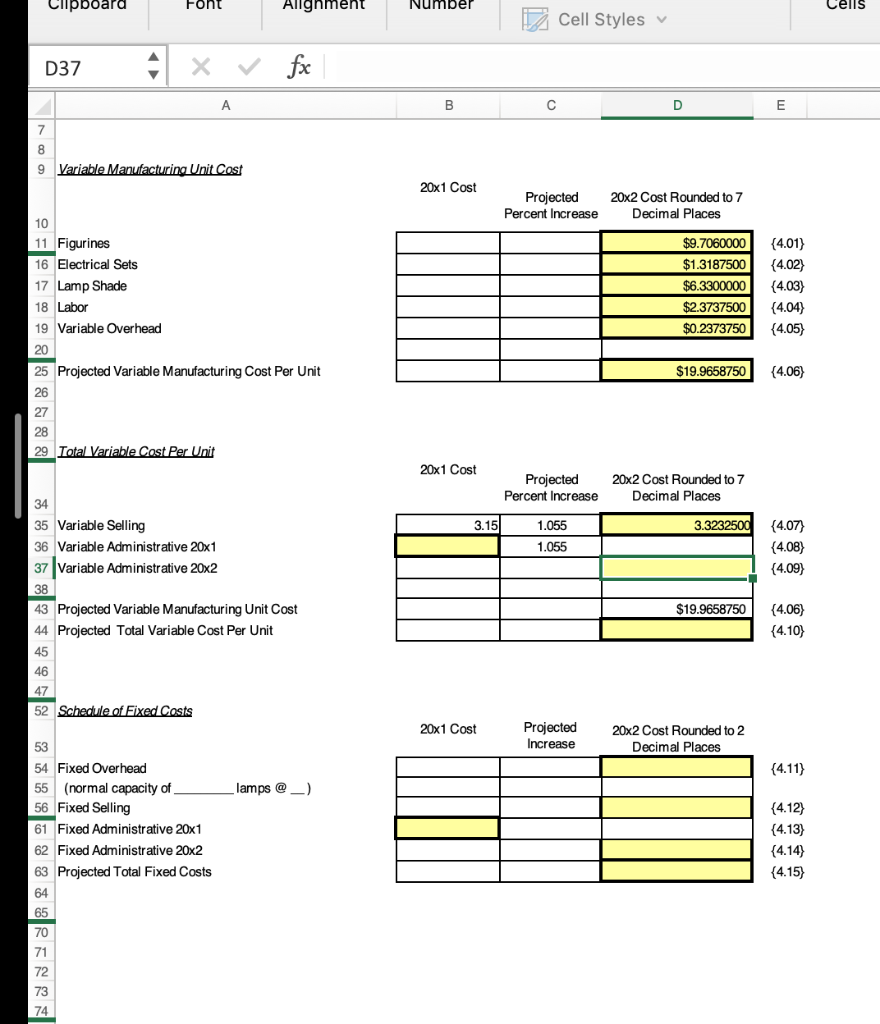

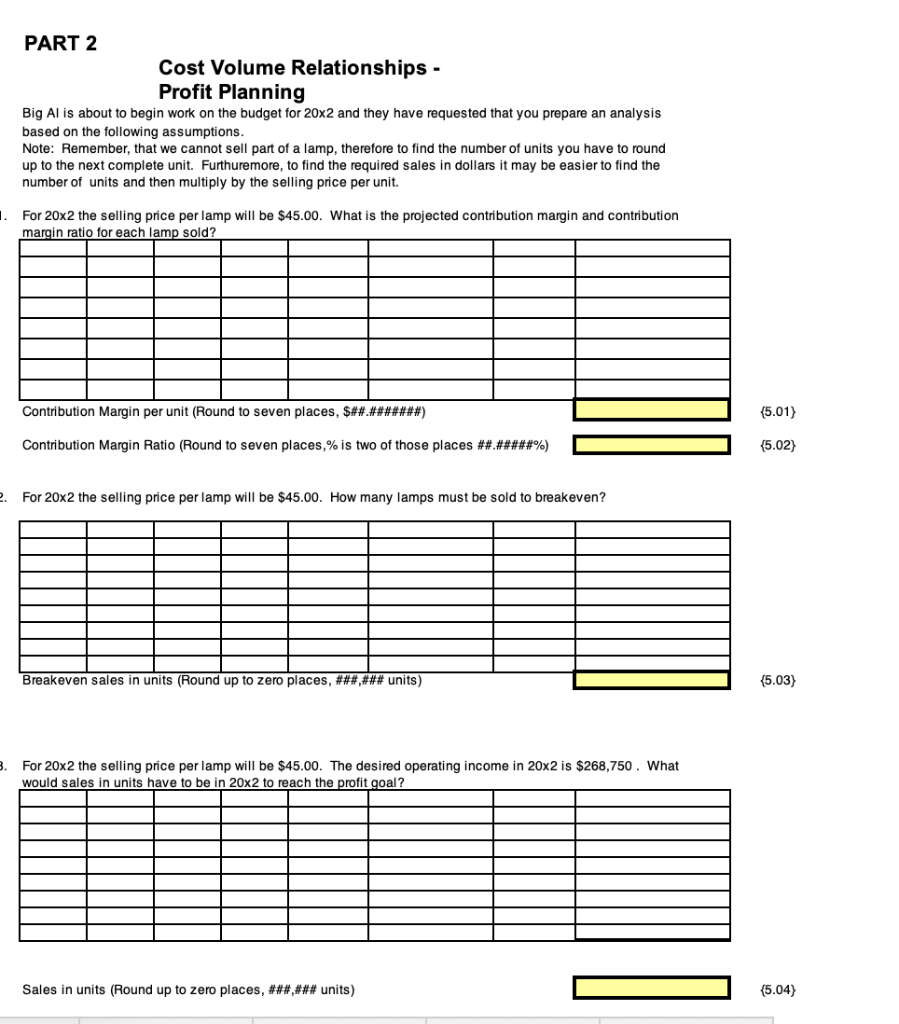

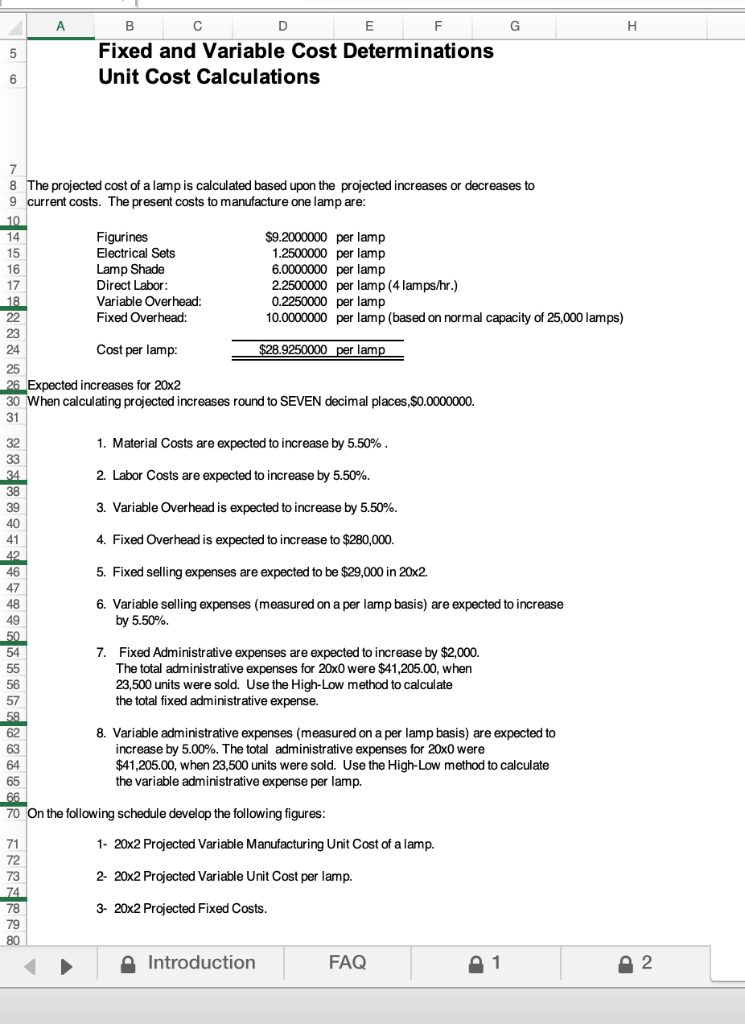

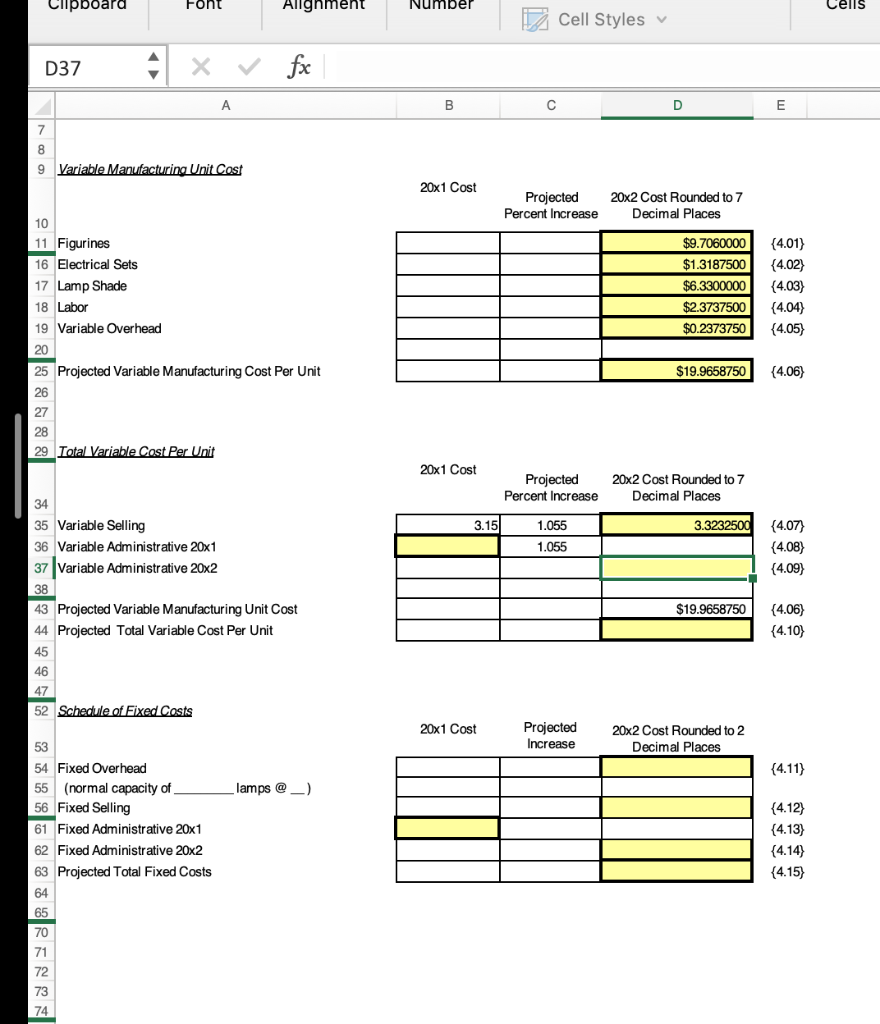

Fixed and Variable Cost Determinations Unit Cost Calculations projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: 15 16 17 18 Figurines Electrical Sets Lamp Shade Direct Labor Variable Overhead: Fixed Overhead: $9.2000000 per lamp 1.2500000 per lamp 6.0000000 per lamp 2.2500000 per lamp (4 lamps/hr.) 0.2250000 per lamp 10.0000000 per lamp (based on normal capacity of 25,000 lamps) 24 Cost per lamp: $28.9250000 per larm- 25 26 Expected increases for 20x2 30 When calculating projected increases round to SEVEN decimal places,$0.0000000. 31 1. Material Costs are expected to increase by 5.50% 2, Labor Costs are expected to increase by 5.50%. 3, Variable Overhead is expected to increase by 5.50%. 4. Fixed Overhead is expected to increase to $280,000. 5. Fixed selling expenses are expected to be $29,000 in 20x2. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase 47 by 55% 7. Fixed Administrative expenses are expected to increase by $2,000. The total administrative expenses for 20x0 were $41,205.00, when 23,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 5.00%. The total administrative expenses for 20x0 were $41,205.00, when 23,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. 70 On the following schedule develop the following figures 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs. 78 Introduction FAQ Clipboard oht Allghment Number Cells Cell Styles D37 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 7 Decimal Places 10 11 Figurines 16 Electrical Sets 17 Lamp Shade 18 Labor 9 Variable Overhead $9.70600004.01) $1.3187500 (4.02) $6.33000004.03 $2.37375004.04) (4.05) 25 Projected Variable Manufacturing Cost Per Unit 26 $19.96587504.06 20x1 Cost Projected 20x2Cost Rounded to 7 Decimal Places 34 35 Variable Selling 36 Variable Administrative 20x1 37 Variable Administrative 20x2 Percent Increase 1.055 1.055 (4.07) 4.08) (4.09) 3.15 43 $19.9658750 (4.06) Projected Variable Manufacturing Unit Cost Projected Total Variable Cost Per Unit 44 4.10 47 Projected20x2Cost Rounded to 2 Increase 20x1 Cost 53 54 Fixed Overhead 55 (normal capacity of 56 Fixed Selling 61 Fixed Administrative 20x1 62 Fixed Administrative 20x2 63 Projected Total Fixed Costs 64 65 70 Decimal Places 4.11) lamps _) (4.12 (4.13) 4.14) (4.15 73 74 PART 2 Cost Volume Relationships Profit Planning Big Al is about to begin work on the budget for 20x2 and they have requested that you prepare an analysis based on the following assumptions Note: Remember, that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to find the number of units and then multiply by the selling price per unit. For 20x2 the selling price per lamp will be $45.00. What is the projected contribution margin and contribution margin ratio for each lamp sold? Contribution Margin per unit (Round to seven places, $##.#######) (5.01) Contribution Margin Ratio (Round to seven places,96 is two of those places #######%) (5.02) For 20x2 the selling price per lamp will be $45.00. How many lamps must be sold to breakeven? Breakeven sales in units (Round up to zero places, ###,### units) (5.03) . For 20x2 the selling price per lamp will be $45.00. The desired operating income in 20x2 is $268,750. What would sales in units have to be in 20x2 to reach the profit goal2 Sales in units (Round up to zero places, ###,### units) (5.04) Fixed and Variable Cost Determinations Unit Cost Calculations projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: 15 16 17 18 Figurines Electrical Sets Lamp Shade Direct Labor Variable Overhead: Fixed Overhead: $9.2000000 per lamp 1.2500000 per lamp 6.0000000 per lamp 2.2500000 per lamp (4 lamps/hr.) 0.2250000 per lamp 10.0000000 per lamp (based on normal capacity of 25,000 lamps) 24 Cost per lamp: $28.9250000 per larm- 25 26 Expected increases for 20x2 30 When calculating projected increases round to SEVEN decimal places,$0.0000000. 31 1. Material Costs are expected to increase by 5.50% 2, Labor Costs are expected to increase by 5.50%. 3, Variable Overhead is expected to increase by 5.50%. 4. Fixed Overhead is expected to increase to $280,000. 5. Fixed selling expenses are expected to be $29,000 in 20x2. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase 47 by 55% 7. Fixed Administrative expenses are expected to increase by $2,000. The total administrative expenses for 20x0 were $41,205.00, when 23,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 5.00%. The total administrative expenses for 20x0 were $41,205.00, when 23,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. 70 On the following schedule develop the following figures 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs. 78 Introduction FAQ Clipboard oht Allghment Number Cells Cell Styles D37 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 7 Decimal Places 10 11 Figurines 16 Electrical Sets 17 Lamp Shade 18 Labor 9 Variable Overhead $9.70600004.01) $1.3187500 (4.02) $6.33000004.03 $2.37375004.04) (4.05) 25 Projected Variable Manufacturing Cost Per Unit 26 $19.96587504.06 20x1 Cost Projected 20x2Cost Rounded to 7 Decimal Places 34 35 Variable Selling 36 Variable Administrative 20x1 37 Variable Administrative 20x2 Percent Increase 1.055 1.055 (4.07) 4.08) (4.09) 3.15 43 $19.9658750 (4.06) Projected Variable Manufacturing Unit Cost Projected Total Variable Cost Per Unit 44 4.10 47 Projected20x2Cost Rounded to 2 Increase 20x1 Cost 53 54 Fixed Overhead 55 (normal capacity of 56 Fixed Selling 61 Fixed Administrative 20x1 62 Fixed Administrative 20x2 63 Projected Total Fixed Costs 64 65 70 Decimal Places 4.11) lamps _) (4.12 (4.13) 4.14) (4.15 73 74 PART 2 Cost Volume Relationships Profit Planning Big Al is about to begin work on the budget for 20x2 and they have requested that you prepare an analysis based on the following assumptions Note: Remember, that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to find the number of units and then multiply by the selling price per unit. For 20x2 the selling price per lamp will be $45.00. What is the projected contribution margin and contribution margin ratio for each lamp sold? Contribution Margin per unit (Round to seven places, $##.#######) (5.01) Contribution Margin Ratio (Round to seven places,96 is two of those places #######%) (5.02) For 20x2 the selling price per lamp will be $45.00. How many lamps must be sold to breakeven? Breakeven sales in units (Round up to zero places, ###,### units) (5.03) . For 20x2 the selling price per lamp will be $45.00. The desired operating income in 20x2 is $268,750. What would sales in units have to be in 20x2 to reach the profit goal2 Sales in units (Round up to zero places, ###,### units) (5.04)