Answered step by step

Verified Expert Solution

Question

1 Approved Answer

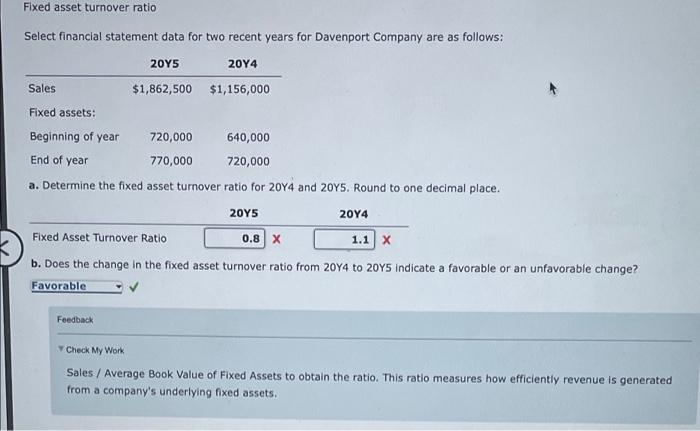

Fixed asset turnover ratio Select financial statement data for two recent years for Davenport Company are as follows: Sales 2015 20Y4 $1,862,500 $1,156,000 Fixed

Fixed asset turnover ratio Select financial statement data for two recent years for Davenport Company are as follows: Sales 2015 20Y4 $1,862,500 $1,156,000 Fixed assets: Beginning of year 720,000 640,000 End of year 770,000 720,000 a. Determine the fixed asset turnover ratio for 20Y4 and 20Y5. Round to one decimal place. Fixed Asset Turnover Ratio 20Y5 0.8 X 20Y4 1.1 X b. Does the change in the fixed asset turnover ratio from 20Y4 to 20Y5 indicate a favorable or an unfavorable change? Favorable Feedback Check My Work Sales / Average Book Value of Fixed Assets to obtain the ratio. This ratio measures how efficiently revenue is generated from a company's underlying fixed assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started