Fixed Costs Consider now that the supplier has decided to include a delivery charge of $200 per order. What should be the new pooled policy? a) Calculate the ordering quantity and reorder point to provide a 99% fill rate using the Poisson distribution of demand. b) Calculate the performance metrics (fill rate, backorders and inventory) of the resulting solution

Fixed Costs Consider now that the supplier has decided to include a delivery charge of $200 per order. What should be the new pooled policy? a) Calculate the ordering quantity and reorder point to provide a 99% fill rate using the Poisson distribution of demand. b) Calculate the performance metrics (fill rate, backorders and inventory) of the resulting solution

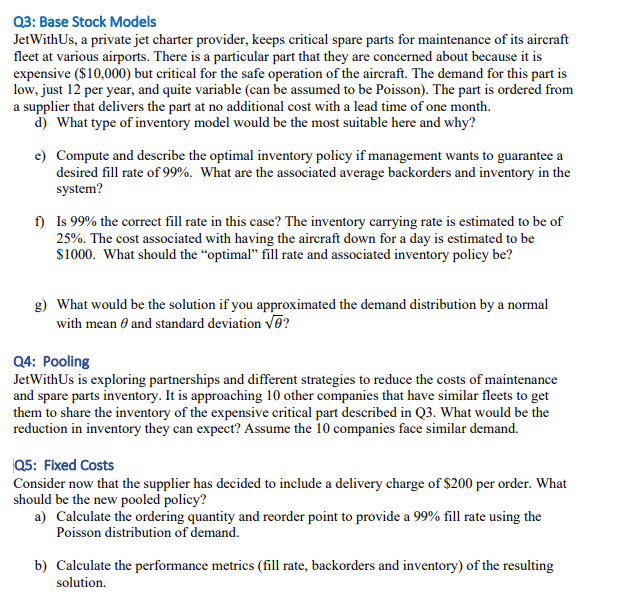

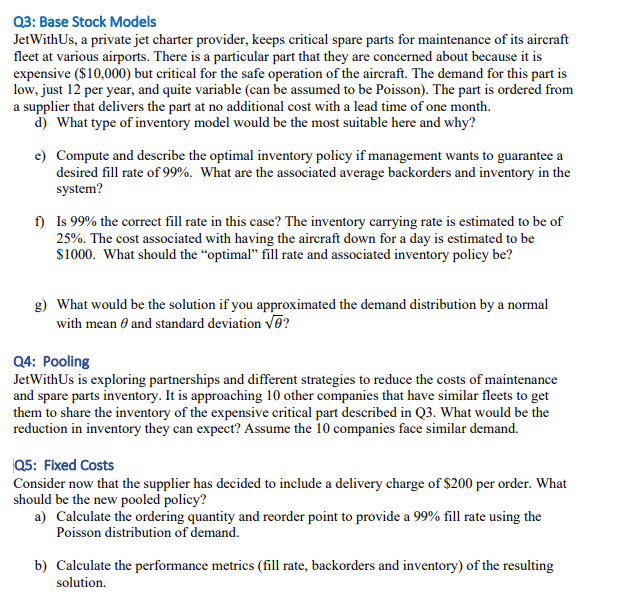

Q3: Base Stock Models JetWithUs, a private jet charter provider, keeps critical spare parts for maintenance of its aircraft fleet at various airports. There is a particular part that they are concerned about because it is expensive ($10,000) but critical for the safe operation of the aircraft. The demand for this part is low, just 12 per year, and quite variable (can be assumed to be Poisson). The part is ordered from a supplier that delivers the part at no additional cost with a lead time of one month. d) What type of inventory model would be the most suitable here and why? e) Compute and describe the optimal inventory policy if management wants to guarantee a desired fill rate of 99%. What are the associated average backorders and inventory in the system? f) Is 99% the correct fill rate in this case? The inventory carrying rate is estimated to be of 25%. The cost associated with having the aircraft down for a day is estimated to be $1000. What should the "optimal" fill rate and associated inventory policy be? g) What would be the solution if you approximated the demand distribution by a normal with mean 0 and standard deviation Vo? Q4: Pooling JetWithUs is exploring partnerships and different strategies to reduce the costs of maintenance and spare parts inventory. It is approaching 10 other companies that have similar fleets to get them to share the inventory of the expensive critical part described in Q3. What would be the reduction in inventory they can expect? Assume the 10 companies face similar demand. Q5: Fixed Costs Consider now that the supplier has decided to include a delivery charge of $200 per order. What should be the new pooled policy? a) Calculate the ordering quantity and reorder point to provide a 99% fill rate using the Poisson distribution of demand. b) Calculate the performance metrics (fill rate, backorders and inventory) of the resulting solution. Q3: Base Stock Models JetWithUs, a private jet charter provider, keeps critical spare parts for maintenance of its aircraft fleet at various airports. There is a particular part that they are concerned about because it is expensive ($10,000) but critical for the safe operation of the aircraft. The demand for this part is low, just 12 per year, and quite variable (can be assumed to be Poisson). The part is ordered from a supplier that delivers the part at no additional cost with a lead time of one month. d) What type of inventory model would be the most suitable here and why? e) Compute and describe the optimal inventory policy if management wants to guarantee a desired fill rate of 99%. What are the associated average backorders and inventory in the system? f) Is 99% the correct fill rate in this case? The inventory carrying rate is estimated to be of 25%. The cost associated with having the aircraft down for a day is estimated to be $1000. What should the "optimal" fill rate and associated inventory policy be? g) What would be the solution if you approximated the demand distribution by a normal with mean 0 and standard deviation Vo? Q4: Pooling JetWithUs is exploring partnerships and different strategies to reduce the costs of maintenance and spare parts inventory. It is approaching 10 other companies that have similar fleets to get them to share the inventory of the expensive critical part described in Q3. What would be the reduction in inventory they can expect? Assume the 10 companies face similar demand. Q5: Fixed Costs Consider now that the supplier has decided to include a delivery charge of $200 per order. What should be the new pooled policy? a) Calculate the ordering quantity and reorder point to provide a 99% fill rate using the Poisson distribution of demand. b) Calculate the performance metrics (fill rate, backorders and inventory) of the resulting solution

Fixed Costs Consider now that the supplier has decided to include a delivery charge of $200 per order. What should be the new pooled policy? a) Calculate the ordering quantity and reorder point to provide a 99% fill rate using the Poisson distribution of demand. b) Calculate the performance metrics (fill rate, backorders and inventory) of the resulting solution

Fixed Costs Consider now that the supplier has decided to include a delivery charge of $200 per order. What should be the new pooled policy? a) Calculate the ordering quantity and reorder point to provide a 99% fill rate using the Poisson distribution of demand. b) Calculate the performance metrics (fill rate, backorders and inventory) of the resulting solution