Question

Fixed income Please don't use chqt gpt it is false most of time. Question 27 Given a 20-year bond which pays a coupon of 7%

Fixed income

Please don't use chqt gpt it is false most of time.

Question 27

Given a 20-year bond which pays a coupon of 7% annually with a YTM or 8%, a modified duration of 16.3 and a convexity of 268.2. Suppose that the actuarial yield drops to 6.5%. What will be the change in the estimated price under the duration with convexity rule?

a. +22.51%

b. -22.51%

c. +30.1%

d. -30.1%

e. +27,46%

Question 28

Assume that the yield curve is flat at 2%. Calculate the convexity of a bullet portfolio with a single stream of $1500 paid at the end of the 4th year.

a. 19.22

b. 185.54

c. 188.47

d. 190.25

e. 223.65

Question 29 :

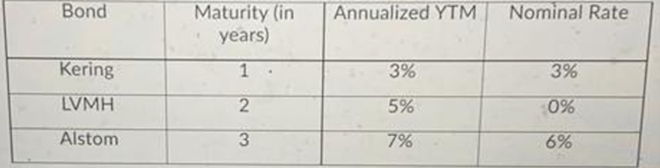

All three bonds have a par value of 100 . Construct a dedicated portfolio (cash-flow matching strategy) that funds exactly these liabilities.

What fraction of the Kering bonds should be purchased?

a. 0.8657

b. 0.9717

c. 1.0000

d. 1.0134

e. 1.0225

Question 30

For your dedicated portfolio above with Kering, LVMH and Alstom bonds, what would be the total outflow of funds today to build the portfolio that funds exactly these commitments?

a. $220.61

b. $250.35

c. $270.22

d. $300.00

e. $302.00

\begin{tabular}{|c|c|c|c|} \hline Bond & Maturity(inyears) & Annualized YTM & Nominal Rate \\ \hline Kering & 1 & 3% & 3% \\ \hline LVMH & 2 & 5% & 0% \\ \hline Alstom & 3 & 7% & 6% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started