Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fizer Pharmaceutical paid $85 million on January 2, 2024, for 4 million shares of Carne Cosmetics common stock. The investment represents a 30% interest

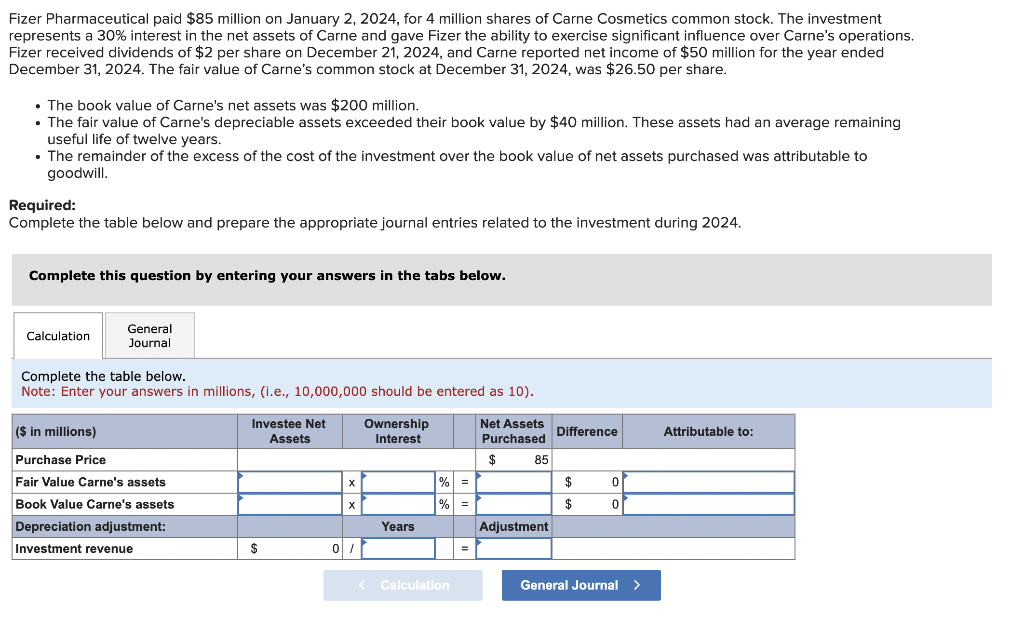

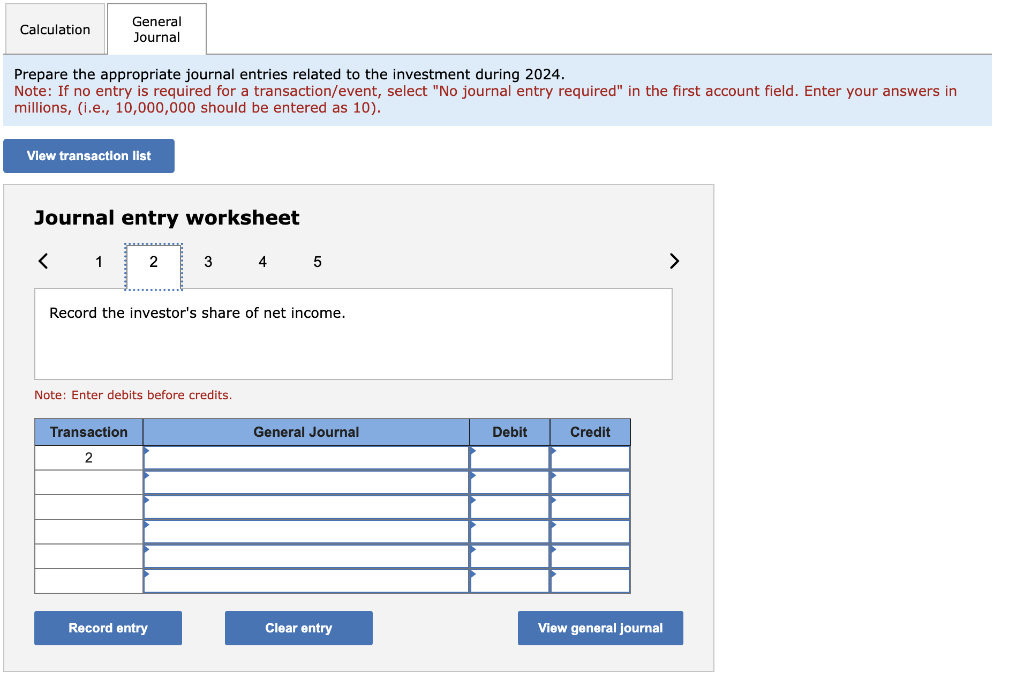

Fizer Pharmaceutical paid $85 million on January 2, 2024, for 4 million shares of Carne Cosmetics common stock. The investment represents a 30% interest in the net assets of Carne and gave Fizer the ability to exercise significant influence over Carne's operations. Fizer received dividends of $2 per share on December 21, 2024, and Carne reported net income of $50 million for the year ended December 31, 2024. The fair value of Carne's common stock at December 31, 2024, was $26.50 per share. The book value of Carne's net assets was $200 million. The fair value of Carne's depreciable assets exceeded their book value by $40 million. These assets had an average remaining useful life of twelve years. The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill. Required: Complete the table below and prepare the appropriate journal entries related to the investment during 2024. Complete this question by entering your answers in the tabs below. Calculation General Journal Complete the table below. Note: Enter your answers in millions, (i.e., 10,000,000 should be entered as 10). ($ in millions) Purchase Price Fair Value Carne's assets Book Value Carne's assets Depreciation adjustment: Investment revenue Investee Net Assets Ownership Interest Net Assets Purchased Difference Attributable to: $ 85 % = $ 0 x % = $ 0 Years Adjustment 0/ < Calculation General Journal > Calculation General Journal Prepare the appropriate journal entries related to the investment during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet < 1 2 3 4 5 Record the investor's share of net income. Note: Enter debits before credits. Transaction 2 General Journal Debit Credit Record entry Clear entry View general journal >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation Investee Net Assets 200 Ownership Interest 30 Net Assets P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6643057307c00_953008.pdf

180 KBs PDF File

6643057307c00_953008.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started