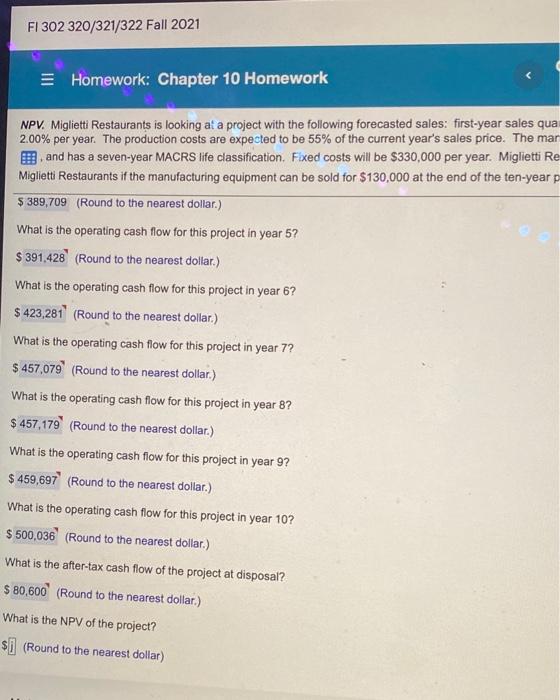

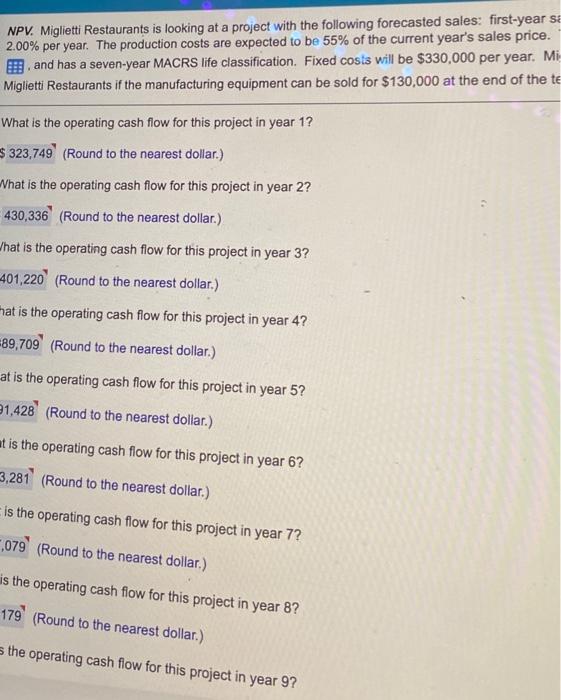

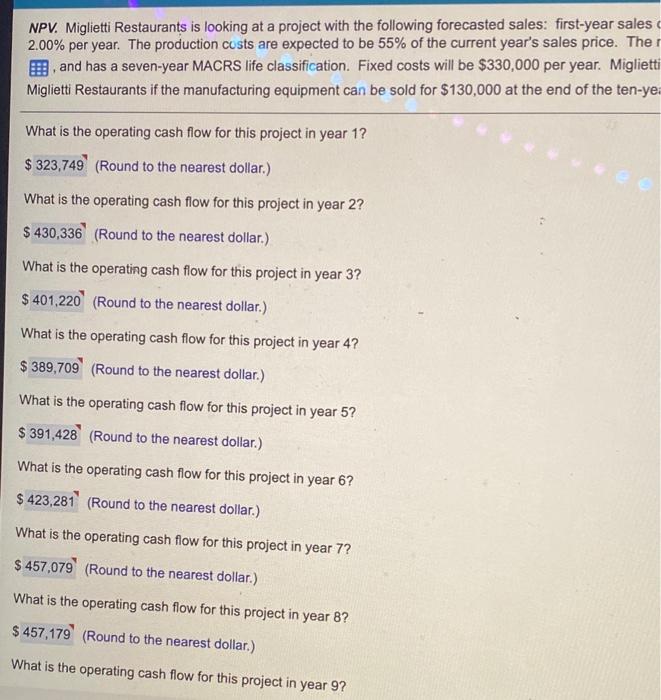

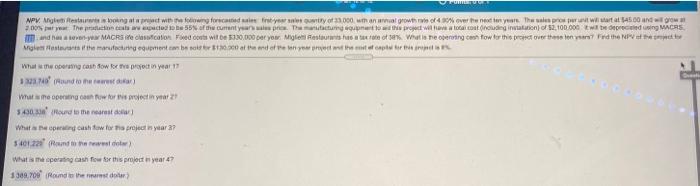

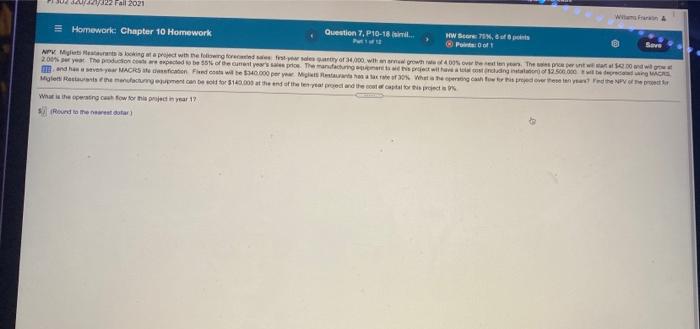

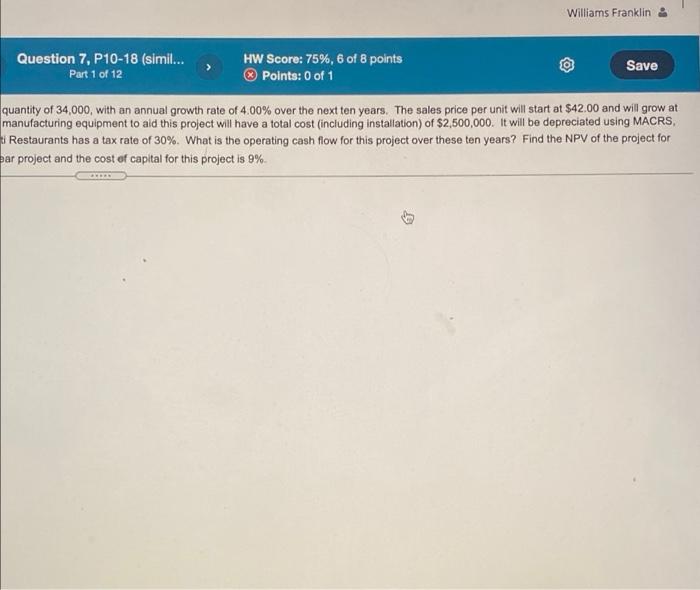

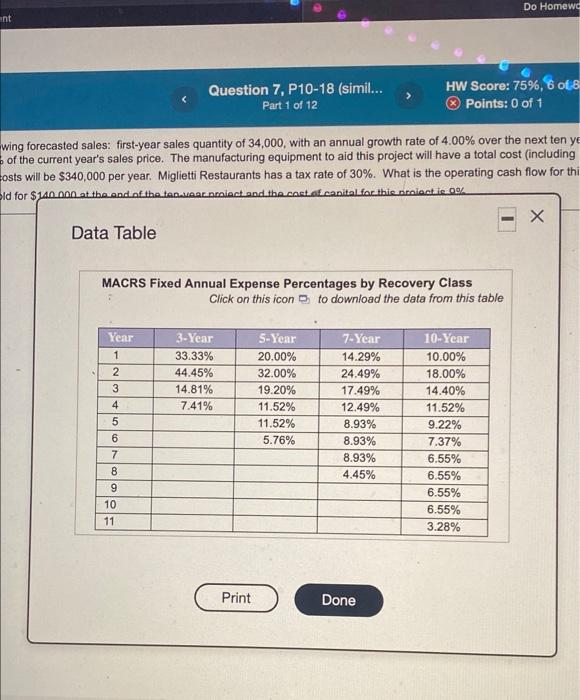

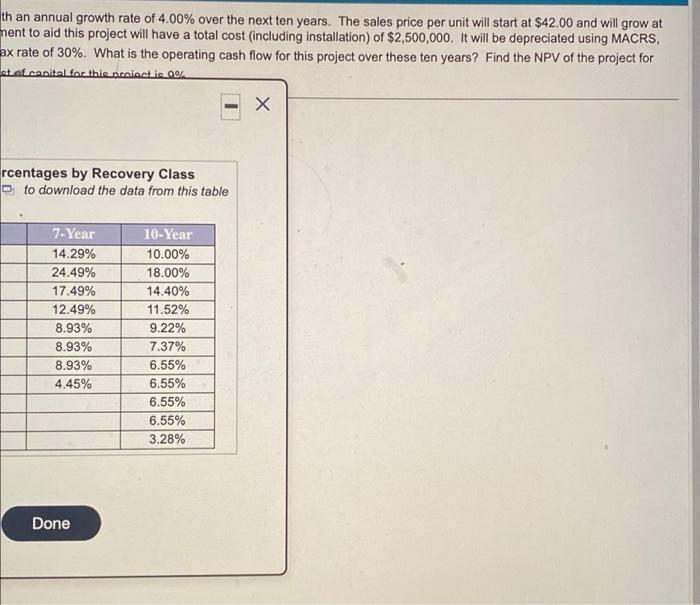

Fl 302 320/321/322 Fall 2021 Homework: Chapter 10 Homework NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales qua 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The mar and has a seven-year MACRS life classification. Fixed costs will be $330,000 per year. Miglietti Re Miglietti Restaurants if the manufacturing equipment can be sold for $130,000 at the end of the ten-year p $ 389,709 (Round to the nearest dollar.) What is the operating cash flow for this project in year 5? $ 391.428 (Round to the nearest dollar.) What is the operating cash flow for this project in year 6? $ 423,281' (Round to the nearest dollar) What is the operating cash flow for this project in year 7? $ 457,079 (Round to the nearest dollar.) What is the operating cash flow for this project in year 8? $ 457,179 (Round to the nearest dollar.) What is the operating cash flow for this project in year 9? $ 459,697 (Round to the nearest dollar.) What is the operating cash flow for this project in year 10? $ 500,036 (Round to the nearest dollar.) What is the after-tax cash flow of the project at disposal? $ 80,600 (Round to the nearest dollar) What is the NPV of the project? si (Round to the nearest dollar) NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year se 2.00% per year. The production costs are expected to be 55% of the current year's sales price. and has a seven-year MACRS life classification. Fixed costs will be $330,000 per year. Mi Miglietti Restaurants if the manufacturing equipment can be sold for $130,000 at the end of the te What is the operating cash flow for this project in year 1? $ 323,749 (Round to the nearest dollar.) What is the operating cash flow for this project in year 2? 430,336 (Round to the nearest dollar.) What is the operating cash flow for this project in year 3? 401,220 (Round to the nearest dollar.) That is the operating cash flow for this project in year 4? =89,709 (Round to the nearest dollar.) at is the operating cash flow for this project in year 5? 1,428 (Round to the nearest dollar.) at is the operating cash flow for this project in year 6? 3,281 (Round to the nearest dollar.) is the operating cash flow for this project in year 7? 5,079 (Round to the nearest dollar.) is the operating cash flow for this project in year 8? 179 (Round to the nearest dollar.) the operating cash flow for this project in year 9? NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The E. and has a seven-year MACRS life classification. Fixed costs will be $330,000 per year. Miglietti Miglietti Restaurants if the manufacturing equipment can be sold for $130,000 at the end of the ten-ye: What is the operating cash flow for this project in year 1? $ 323,749 (Round to the nearest dollar.) What is the operating cash flow for this project in year 2? $ 430,336 (Round to the nearest dollar.) What is the operating cash flow for this project in year 3? $ 401,220 (Round to the nearest dollar.) What is the operating cash flow for this project in year 4? $ 389,709 (Round to the nearest dollar.) What is the operating cash flow for this project in year 5? $ 391,428 (Round to the nearest dollar) What is the operating cash flow for this project in year 6? $ 423,281' (Round to the nearest dollar.) What is the operating cash flow for this project in year 7? $ 457,079 (Round to the nearest dollar.) What is the operating cash flow for this project in year 8? $ 457,179 (Round to the nearest dollar) What is the operating cash flow for this project in year 9? NPV. Angestionat pract with forecated in fronty 33000 manual growth of over the next to the prostaat 545.00 now 200 yea Thects www paded to 55% of the current preturn to prope it have to code into 52.100.000 dereceding MARS and - MACRS i classication Fored out wit be 120.000 per year. Mglemesis has a total of sex was recorting can tow tr this recover the loved the Molen sitter med equement can be toler130.00 at the end of these por What bering cash fow con year 17 und to the We wordenar 3.00 ord to the nearest What are pushow for this project in year 37 3.28 to the west What is the operating cash row for this post year 47 1389.709 Round the rest NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: 2.00% per year. The production costs are expected to be 55% of the current year's sa . and has a seven-year MACRS life classification. Fixed costs will be $340,000 p Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the e What is the operating cash flow for this project in year 1? $i (Round to the nearest dollar.) dad322 Fall 2021 w Homework: Chapter 10 Homework Question 7, P10-18 ini.. HW Ser7, upis Save NPV Meting with Degreestyle yor 1400 w grown way. The two 2005 porywat the production and to be recent year's sp. The mandag with thing to be con ACS and her MACRS in Flende wie 40.000 person What the words and the ver Myles Restaurierunt can be for 140.000 at the end of the tentar redan tercatoris What is the person show for the year 19 Seurd to restor Homework Question 7, P10-18 (simil... Part 1 of 12 > HW Score: 75%, 6 Points: 0 of 1 roject with the following forecasted sales: first-year sales quantity of 34,000, with an annual growth rate of 4.00% over the next te xpected to be 55% of the current year's sales price. The manufacturing equipment to ald this project will have a total cost (includ ssification. Fixed costs will be $340,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow fo quipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 9%. ect in year 1? Williams Franklin Question 7, P10-18 (simil... HW Score: 75%, 6 of 8 points Save Part 1 of 12 Points: 0 of 1 quantity of 34,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $42.00 and will grow at manufacturing equipment to ald this project will have a total cost (including installation) of $2,500,000. It will be depreciated using MACRS. Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for par project and the cost of capital for this project is 9% Do Homewd ent Question 7, P10-18 (simil... Part 1 of 12 HW Score: 75%, 6 of 8 Points: 0 of 1 wing forecasted sales: first-year sales quantity of 34,000, with an annual growth rate of 4.00% over the next ten ye of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including Eosts will be $340,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for thi old for $140.000 at the end of the ten proiect and the cost of capital for this protectie 99 Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3-Year 33.33% 44.45% 14.81% 7.41% 3 S-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 4 5 6 7 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% 8 9 10 11 Print Done th an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $42.00 and will grow at ment to aid this project will have a total cost (including installation) of $2,500,000. It will be depreciated using MACRS, ax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for stof capital for this scalactis 90/ rcentages by Recovery Class to download the data from this table 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Done NPV. Miglietti Restaurants is looking at a project with the following forecast 2.00% per year. The production costs are expected to be 55% of the currer and has a seven-year MACRS life classification. Fixed costs will be $ Miglietti Restaurants if the manufacturing equipment can be sold for $1400 What is the operating cash flow for this project in year 1? s] (Round to the nearest dollar.)