Answered step by step

Verified Expert Solution

Question

1 Approved Answer

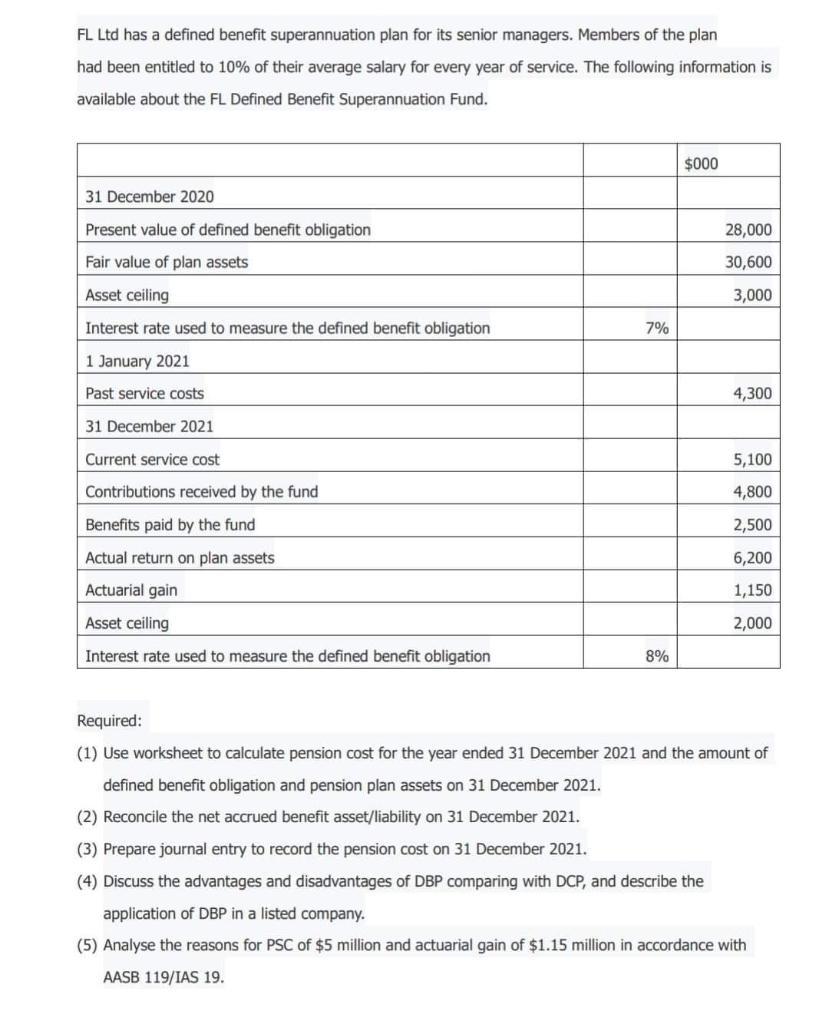

FL Ltd has a defined benefit superannuation plan for its senior managers. Members of the plan had been entitled to 10% of their average

FL Ltd has a defined benefit superannuation plan for its senior managers. Members of the plan had been entitled to 10% of their average salary for every year of service. The following information is available about the FL Defined Benefit Superannuation Fund. 31 December 2020 Present value of defined benefit obligation Fair value of plan assets Asset ceiling Interest rate used to measure the defined benefit obligation 1 January 2021 Past service costs 31 December 2021 Current service cost Contributions received by the fund Benefits paid by the fund Actual return on plan assets Actuarial gain Asset ceiling Interest rate used to measure the defined benefit obligation 7% 8% $000 28,000 30,600 3,000 4,300 5,100 4,800 2,500 6,200 1,150 2,000 Required: (1) Use worksheet to calculate pension cost for the year ended 31 December 2021 and the amount of defined benefit obligation and pension plan assets on 31 December 2021. (2) Reconcile the net accrued benefit asset/liability on 31 December 2021. (3) Prepare journal entry to record the pension cost on December 2021. (4) Discuss the advantages and disadvantages of DBP comparing with DCP, and describe the application of DBP in a listed company. (5) Analyse the reasons for PSC of $5 million and actuarial gain of $1.15 million in accordance with AASB 119/IAS 19.

Step by Step Solution

★★★★★

3.32 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

DEFINED BENEFIT OBLIGATION DBO Defined benefit obligation 123120 Add Current Service costs Ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started