Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Flame Company adopted the FIFO approach of inventory pricing in connection with the use of the retail inventory method. The retail records showed the

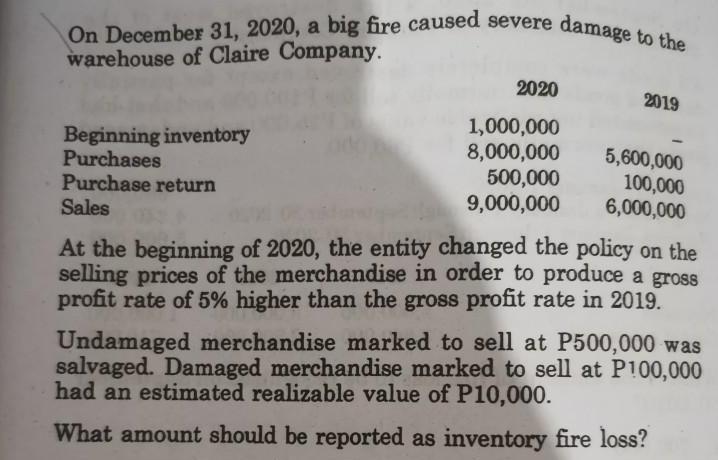

Flame Company adopted the FIFO approach of inventory pricing in connection with the use of the retail inventory method. The retail records showed the following: 2020 Cost Beginning inventory Purchases Net markup Net markdown Sales 2021 Purchases Net markup Net markdown Sales 556,800 4,576,000 4,760,000 Retail 928,000 7,028,000 42,000 30,000 6,840,000 6,812,000 56,000 68,000 6,928,000 Required: Determine the estimated cost of inventory on December 31, 2020 and 2021 applying the FIFO retail approach. On December 31, 2020, a big fire caused severe damage to the warehouse of Claire Company. Beginning inventory Purchases Purchase return Sales 2020 1,000,000 8,000,000 500,000 9,000,000 2019 5,600,000 100,000 6,000,000 At the beginning of 2020, the entity changed the policy on the selling prices of the merchandise in order to produce a gross profit rate of 5% higher than the gross profit rate in 2019. Undamaged merchandise marked to sell at P500,000 was salvaged. Damaged merchandise marked to sell at P100,000 had an estimated realizable value of P10,000. What amount should be reported as inventory fire loss?

Step by Step Solution

★★★★★

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Solution A Calculation of Cost of inventory as on December 312020 Particulars Cost Retail Beginning ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started