Question

Flanders Corporations income statement for the year ended June 30, 20x8 and its comparative balance sheets as of June 30, 20x8 and 20x7 appear on

Flanders Corporation’s income statement for the year ended June 30, 20x8 and its comparative balance sheets as of June 30, 20x8 and 20x7 appear on the opposite page. During 20x8, the corporation sold equipment that cost $48,000, on which it had accumulated depreciation of $34,000, at a loss of $8,000. It also purchased land and a building for $200,000 through an increase of $200,000 in Mortgage Payable; made a $40,000 payment on the mortgage; repaid notes but borrowed an additional $60,000 through the issuance of a new note payable; and declared and paid a $120,000 cash dividend.

Required

1. Using the indirect method, prepare a statement of cash flows. Include a supporting schedule of noncash investing and financing transactions.

2. User Insight: What are the primary reasons for Flanders Corporation’s large increase in cash from 20x7 to 20x8?

3. User Insight: Compute and assess cash flow yield and free cash flow for 20x8. How would you assess the corporation’s cash-generating ability?

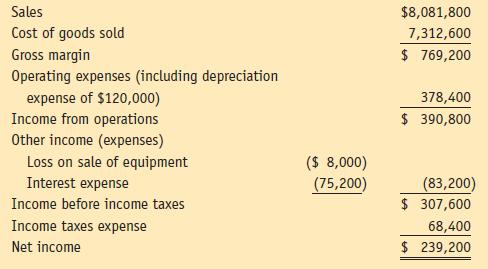

Flanders Corporation Income Statement For the Year Ended June 30, 20x8

Flanders Corporation Comparative Balance Sheets June 30, 20x8 and 20x7

Sales $8,081,800 Cost of goods sold 7,312,600 $ 769,200 Gross margin Operating expenses (including depreciation expense of $120,000) Income from operations Other income (expenses) 378,400 $ 390,800 ($ 8,000) (75,200) Loss on sale of equipment Interest expense (83,200) $ 307,600 Income before income taxes Income taxes expense 68,400 Net income $ 239,200

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started