Question

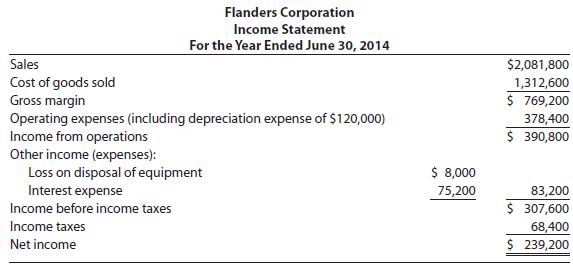

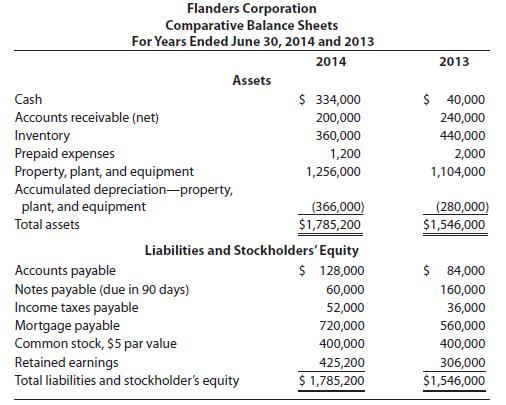

Flanders Corporations 2014 income statement and comparative balance sheet as of June 30, 2014 and 2013 follow. The following is additional information about 2014: (a)

Flanders Corporation’s 2014 income statement and comparative balance sheet as of June 30, 2014 and 2013 follow.

The following is additional information about 2014: (a) equipment that cost $48,000 with accumulated depreciation of $34,000 was sold at a loss of $8,000; (b) land and building were purchased in the amount of $200,000 through an increase of $200,000 in the mortgage payable; (c) a $40,000 payment was made on the mortgage; (d) the notes were repaid, but the company borrowed an additional $60,000 through the issuance of a new note payable; and (e) a $120,000 cash dividend was declared and paid.

REQUIRED

1. Use the direct method to prepare a statement of cash flows. Include a supporting schedule of noncash investing and financing transactions. Do not include a reconciliation of net income to net cash flows from operating activities.

2. What are the primary reasons for Flanders’ large increase in cash from 2013 to 2014?

3. Compute and assess cash flow yield and free cash flow for 2014. (Round to one decimal place.)

Sales Cost of goods sold Gross margin Flanders Corporation Income Statement For the Year Ended June 30, 2014 Operating expenses (including depreciation expense of $120,000) Income from operations Other income (expenses): Loss on disposal of equipment Interest expense Income before income taxes Income taxes Net income $ 8,000 75,200 $2,081,800 1,312,600 $ 769,200 378,400 $ 390,800 83,200 $ 307,600 68,400 $ 239,200

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 9 Operating Activities Activities relating to the day to d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started