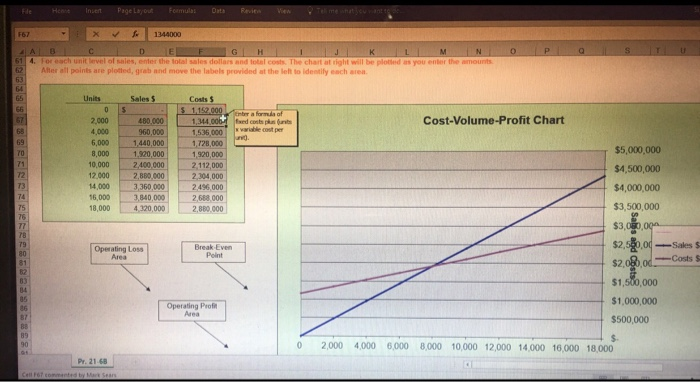

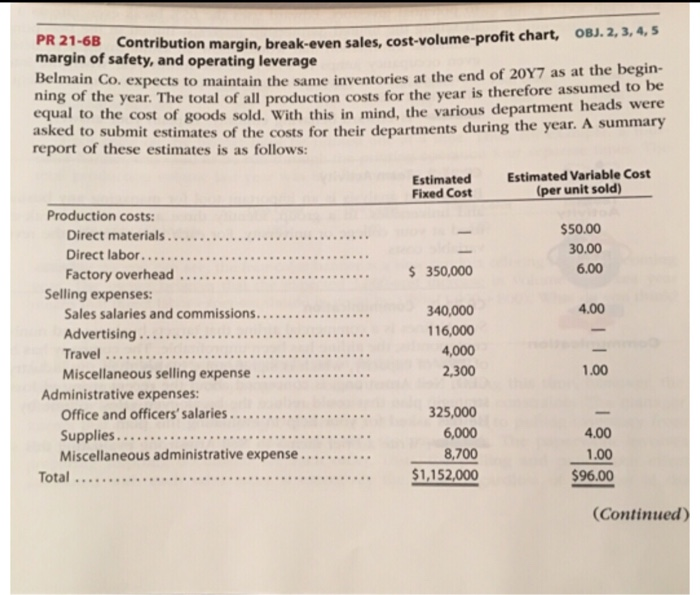

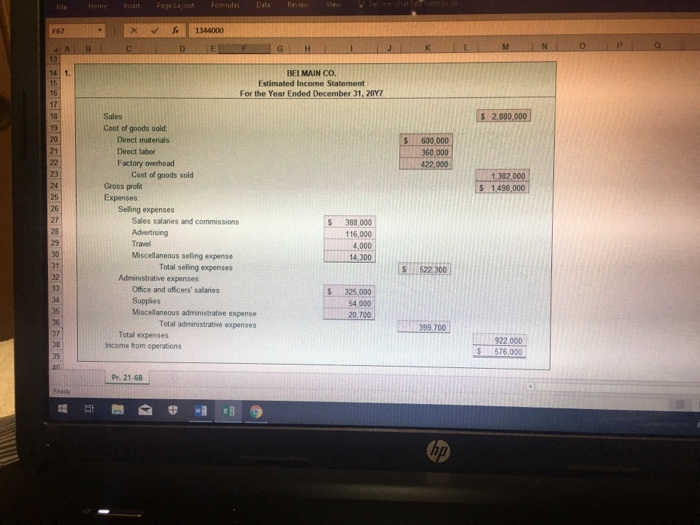

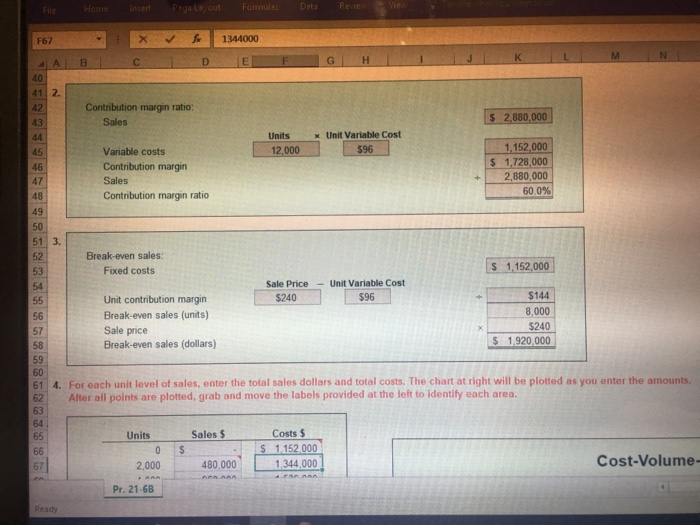

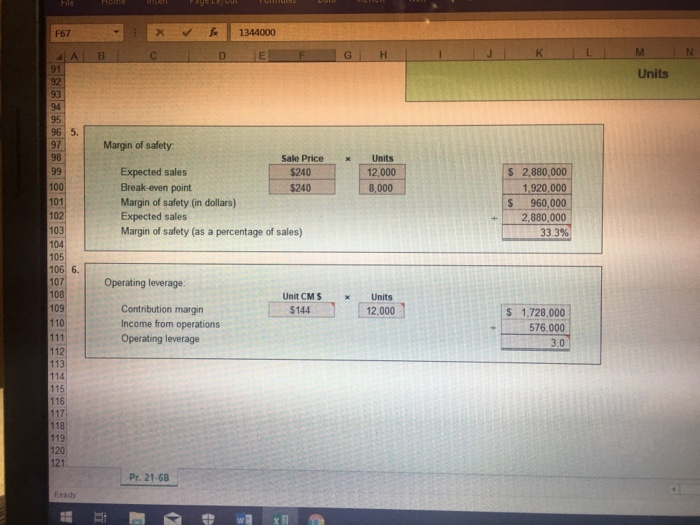

Fle "/ 1344000 61 4. For each unit level of sales, enter the tolal sales dollars and total costs. The chart at right will be plotled as you enter the amounts 6Afler all poinls are ploted, grab and move the labels provided at the left to idestily each area. Units Sales $ Costs Cost-Volume-Profit Chart 480,000 1,344 4,000 6,000 8,000 960,000 1440,000 1,536000c 1,728,000 1,920,000 10,000 2400,0002,112,000 12.000 2,880000 2,304,000 2 496,000 $5,000,000 $4,500,000 $4,000,000 $3,500,000 1,320,000 14,0003,360,000 16.000-3140.0001-2.688 000. 18,000 L4320,000 | | 2.BB0.000] $2.5 Sales $ Break Evern Operating Loss Area $1,500,000 $1,000,000 $500,000 s. Operating Prof Area 0 2000 4,000 6000 8,000 10,000 12,000 14,000 16,000 18,000 Pr-2168 ane done Pleane help me bwita yue x what in onden BJ.2,3, 4, PR21-68 Contribution margin, break-even sales, cost-volume- profit chart, o margin of safety, and operating leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the begin- e total of all production costs for the year is therefore assumed to be he cost of goods sold. With this in mind, the various department heads were equal to t asked to submit estimates of the costs for their departments during the year report of these estimates is as follows mary Estimated Variable Cost (per unit sold) Estimated Fixed Cost Production costs: 50.00 30.00 6.00 350,000 Factory overhead Selling expenses: 340,000 116,000 4,000 2,300 4.00 Advertising Travel Miscellaneous selling expense .00 .. Administrative expenses: 325,000 6,000 8,700 $1,152,000 4.00 1.00 596.00 Continued) Cost-Volume-Profit Analysis It is expected that 12,000 units will be sold at a price of $240 a unit. Maxi within the relevant range are 18,000 units. mum sales NO AL-B BELMAIN CO. Estimated Income Statement For the Year Ended December 31, 20Y7 16 18 Cost of goods sold 20 Direct materials Direct labor Factory overhead 600.000 60,000 Cost of goods sold 382,000 24 25 26 27 Gross proft Expenses: Seling expenses Sales salaries and commissions Advertising Travel Miscellaneous selling expense 388,000 116,000 4,000 522 300 Total seling expenses 32 Administrative expenses Office and officers' salaries Supplies Miscellaneous administrative expense S 325,000 4,000 34 35 Total administrative expenses Total expenses Income from operations 922.000 S 576,000 Pr. 21-6B F67 GI H A B 40 Contribution margin ratio: 2,880,000 43 Sales Units Unit Variable Cost 1.152,000 $ 1,728,000 2,880,000 600% 96 Variable costs Contribution margin Sales Contribution margin ratio 46 47 48 49 51 3. Break-even sales: S 1.152,000 Fixed costs Sale PriceUnit Variable Cost $144 8,000 $240 S 1,920,000 $96 $240 Unit contribution margin Break-even sales (units) Sale price Break-even sales (dollars) 56 57 58 59 60 61 4. For each unit level of sales, enter the total sales dollars and total costs. The chart at right will be plotted as you enter the amounts After all points are plotted, grab and move the labels provided at the left to identify each area. 62 Unis Saless Costs S 65 S 1.152 000 2,000 48000 1344 000 Cost-Volume 67 Pr. 21-68 Ready XV1344000 F67 G| H 91 Units 93 95 96 5. 97 98 Margin of safety Sale Price $240 $240 Units 12,000 8,000 $ 2,880,000 1,920,000 Expected sales Break-even point Margin of safety (in dollars) Expected sales Margin of safety (as a percentage of sales) 101 102 103 104 105 S 960,00 2,880,000 33 3% 6. 107 Operating leverage Unit CMS Units 2,000 109 110 Contribution margin Income from operations Operating leverage $144 S 1,728,000 576,000 3.0 112 113 114 115 116 118 119 120 121 Pr. 21.68