Answered step by step

Verified Expert Solution

Question

1 Approved Answer

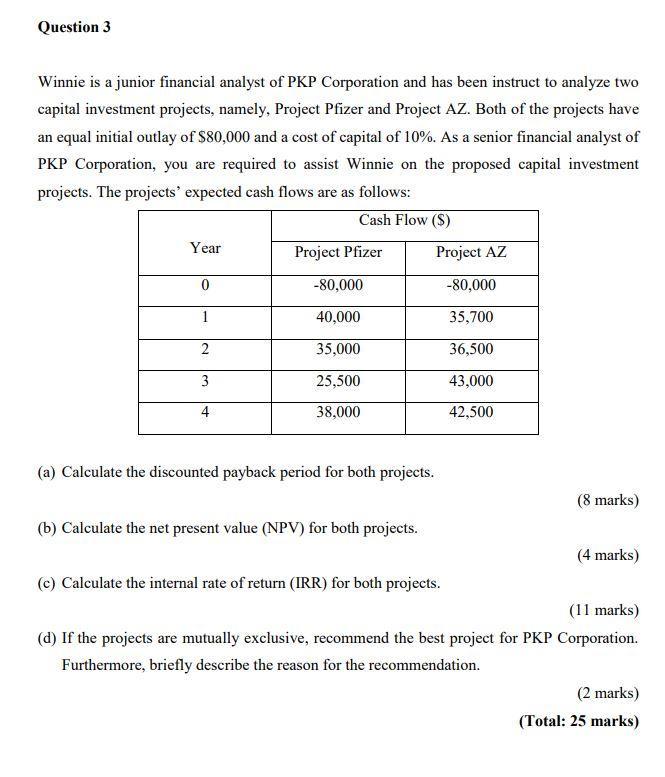

Question 3 Winnie is a junior financial analyst of PKP Corporation and has been instruct to analyze two capital investment projects, namely, Project Pfizer

Question 3 Winnie is a junior financial analyst of PKP Corporation and has been instruct to analyze two capital investment projects, namely, Project Pfizer and Project AZ. Both of the projects have an equal initial outlay of $80,000 and a cost of capital of 10%. As a senior financial analyst of PKP Corporation, you are required to assist Winnie on the proposed capital investment projects. The projects' expected cash flows are as follows: Cash Flow (S) Year 0 1 2 3 4 Project Pfizer -80,000 40,000 35,000 25,500 38,000 Project AZ -80,000 35,700 36,500 43,000 42,500 (a) Calculate the discounted payback period for both projects. (b) Calculate the net present value (NPV) for both projects. (c) Calculate the internal rate of return (IRR) for both projects. (8 marks) (4 marks) (11 marks) (d) If the projects are mutually exclusive, recommend the best project for PKP Corporation. Furthermore, briefly describe the reason for the recommendation. (2 marks) (Total: 25 marks)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Part a Discounted pay back period of project Pfizer 277 years Discounted pay back period of project ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started