Question

Flight Caf prepares in-flight meals for airlines in its kitchen located next to a local airport. The companys planning budget for July appears below: Flight

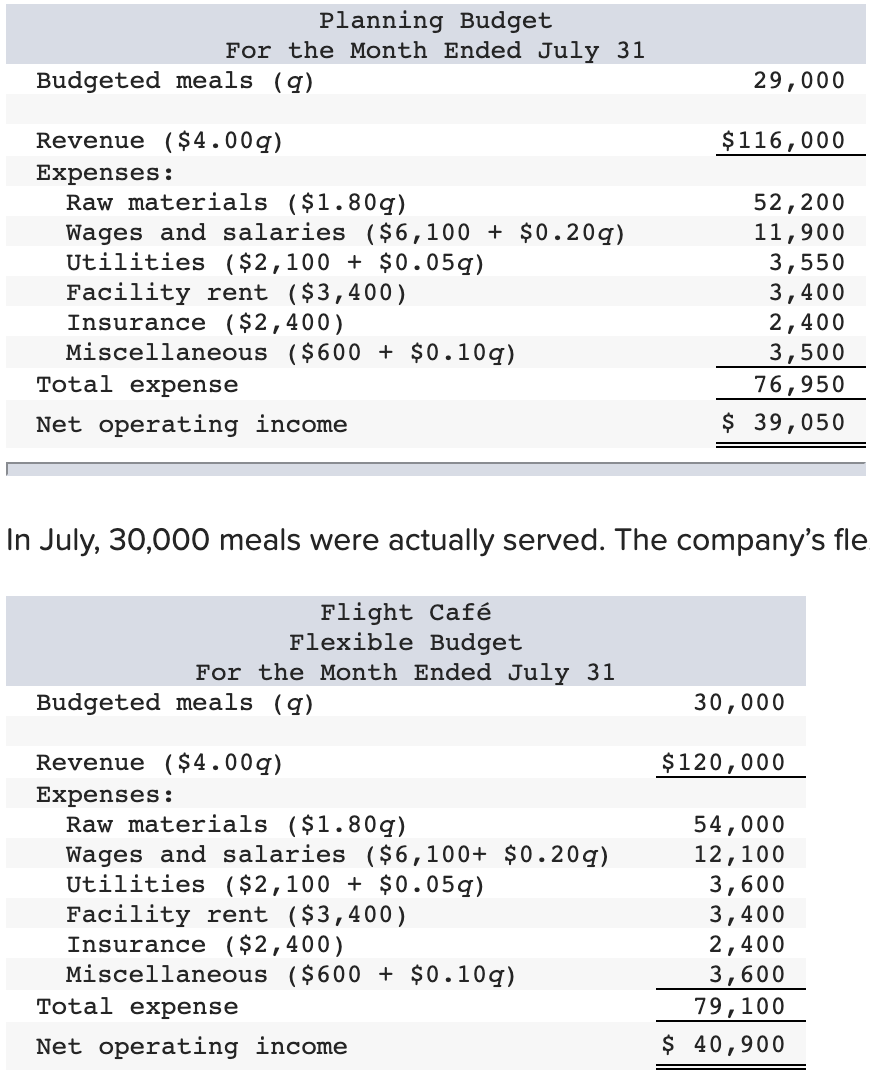

Flight Caf prepares in-flight meals for airlines in its kitchen located next to a local airport. The companys planning budget for July appears below: Flight Caf Planning Budget For the Month Ended July 31 Budgeted meals (q) 29,000 Revenue ($4.00q) $ 116,000 Expenses: Raw materials ($1.80q) 52,200 Wages and salaries ($6,100 + $0.20q) 11,900 Utilities ($2,100 + $0.05q) 3,550 Facility rent ($3,400) 3,400 Insurance ($2,400) 2,400 Miscellaneous ($600 + $0.10q) 3,500 Total expense 76,950 Net operating income $ 39,050 In July, 30,000 meals were actually served. The companys flexible budget for this level of activity appears below: Flight Caf Flexible Budget For the Month Ended July 31 Budgeted meals (q) 30,000 Revenue ($4.00q) $ 120,000 Expenses: Raw materials ($1.80q) 54,000 Wages and salaries ($6,100+ $0.20q) 12,100 Utilities ($2,100 + $0.05q) 3,600 Facility rent ($3,400) 3,400 Insurance ($2,400) 2,400 Miscellaneous ($600 + $0.10q) 3,600 Total expense 79,100 Net operating income $ 40,900 Required: 1. Calculate the companys activity variances for July. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)

Flight Caf prepares in-flight meals for airlines in its kitchen located next to a local airport. The companys planning budget for July appears below: Flight Caf Planning Budget For the Month Ended July 31 Budgeted meals (q) 29,000 Revenue ($4.00q) $ 116,000 Expenses: Raw materials ($1.80q) 52,200 Wages and salaries ($6,100 + $0.20q) 11,900 Utilities ($2,100 + $0.05q) 3,550 Facility rent ($3,400) 3,400 Insurance ($2,400) 2,400 Miscellaneous ($600 + $0.10q) 3,500 Total expense 76,950 Net operating income $ 39,050 In July, 30,000 meals were actually served. The companys flexible budget for this level of activity appears below: Flight Caf Flexible Budget For the Month Ended July 31 Budgeted meals (q) 30,000 Revenue ($4.00q) $ 120,000 Expenses: Raw materials ($1.80q) 54,000 Wages and salaries ($6,100+ $0.20q) 12,100 Utilities ($2,100 + $0.05q) 3,600 Facility rent ($3,400) 3,400 Insurance ($2,400) 2,400 Miscellaneous ($600 + $0.10q) 3,600 Total expense 79,100 Net operating income $ 40,900 Required: 1. Calculate the companys activity variances for July. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started