Question

Flint Company leased equipment to Land Company for a ve-year period. Flint paid $9,393 for the equipment, which equals its current carrying value (with estimated

Flint Company leased equipment to Land Company for a five-year period. Flint paid $9,393 for the equipment, which equals its current carrying value (with estimated useful life of five years). The lease commenced on January 1 of Year 1. Flint uses a target rate of return of 8% in all lease contracts. The first payment was received on January 1 of Year 1, and Flint’s accounting periods end on December 31.

The lease contract contains a purchase option stating that Land Company can purchase the equipment for $800 on January 1 of Year 6, at which time its residual value is estimated to be $1,300. It is reasonably certain that Land Company will exercise the purchase option at the end of the lease term.

Required:

a. Compute the annual payment calculated by the lessor.

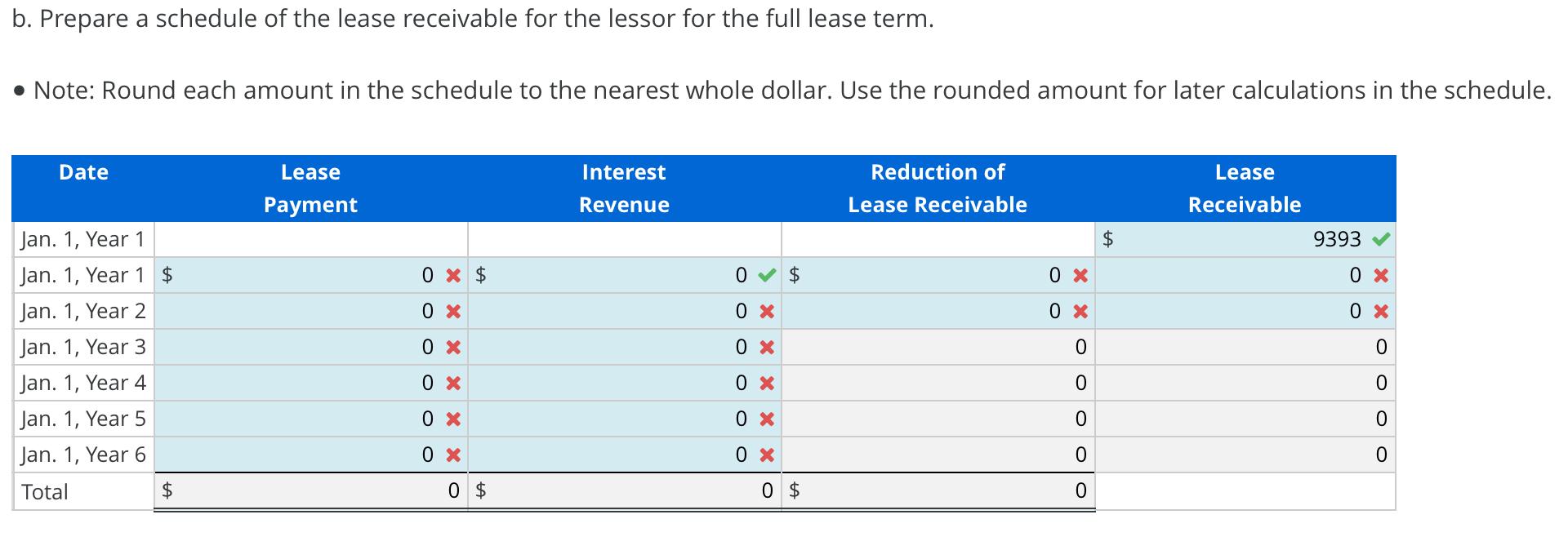

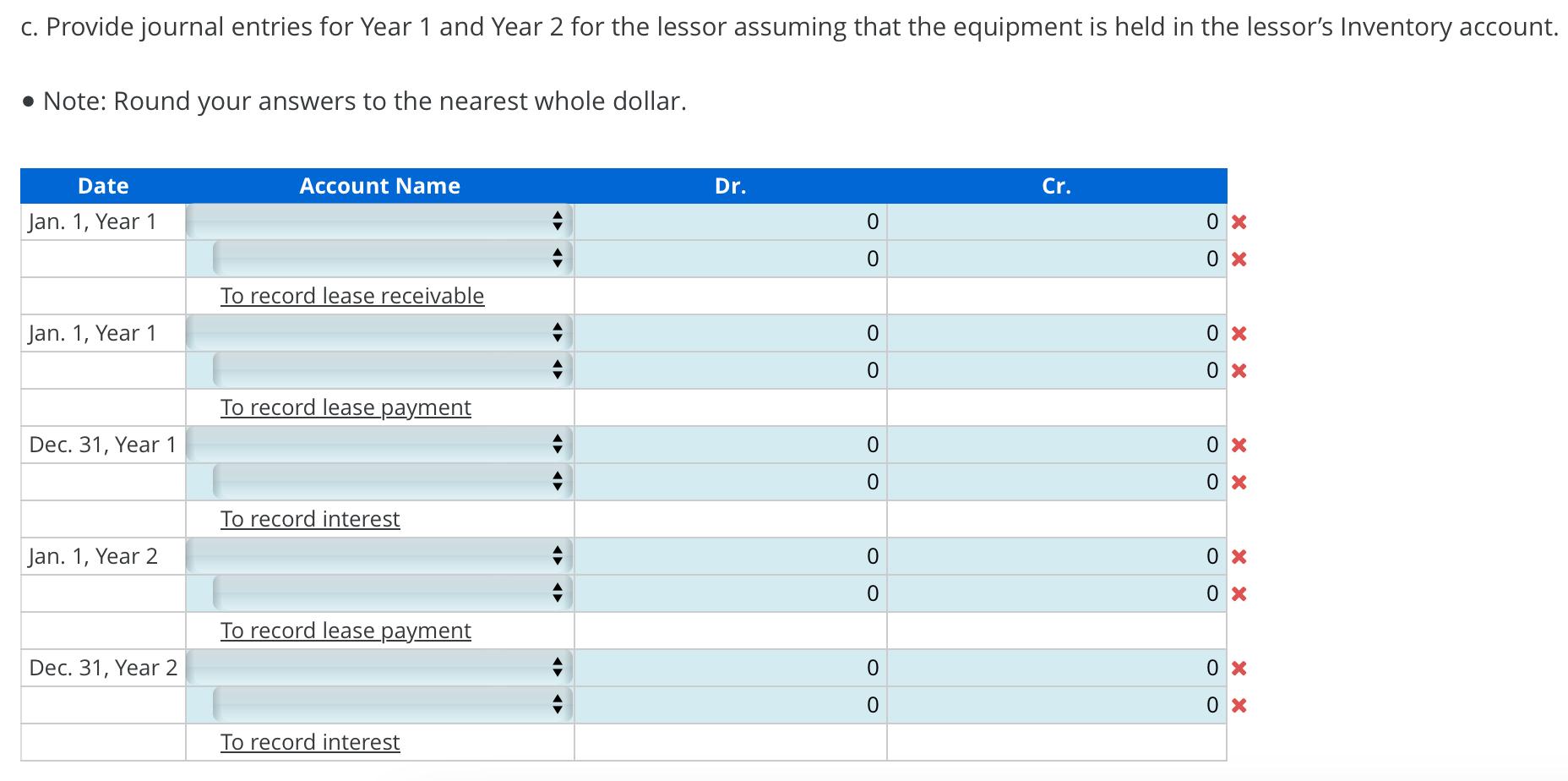

b. Prepare a schedule of the lease receivable for the lessor for the full lease term. Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Date Jan. 1, Year 1 Jan. 1, Year 1 $ Jan. 1, Year 2 Jan. 1, Year 3 Jan. 1, Year 4 Jan. 1, Year 5 Jan. 1, Year 6 Total $ Lease Payment 0 x $ 0 x 0 x 0 x 0 x 0 x 0 $ Interest Revenue 0 $ 0 x 0 x 0 x 0 x 0 x 0 $ Reduction of Lease Receivable tA $ 0 x 0 x 0 0 0 0 0 Lease Receivable 9393 0 x 0 x 0 0 0 0

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the annual payment calculated by the lessor we can use the present value of an annuity formula The formula is as follows Annual Payment E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started