Answered step by step

Verified Expert Solution

Question

1 Approved Answer

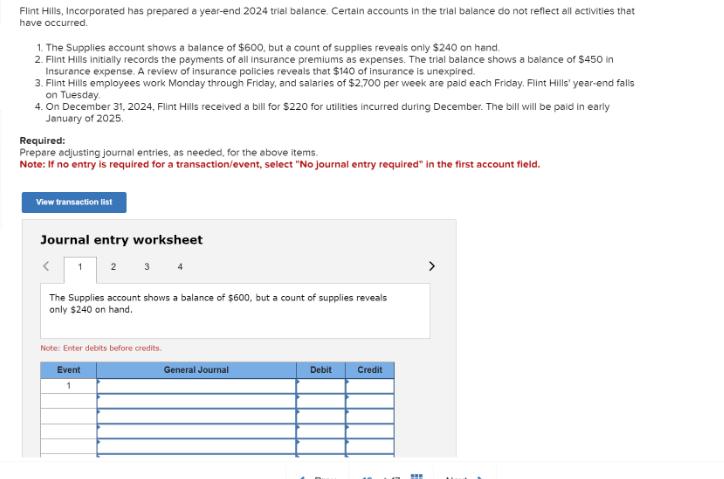

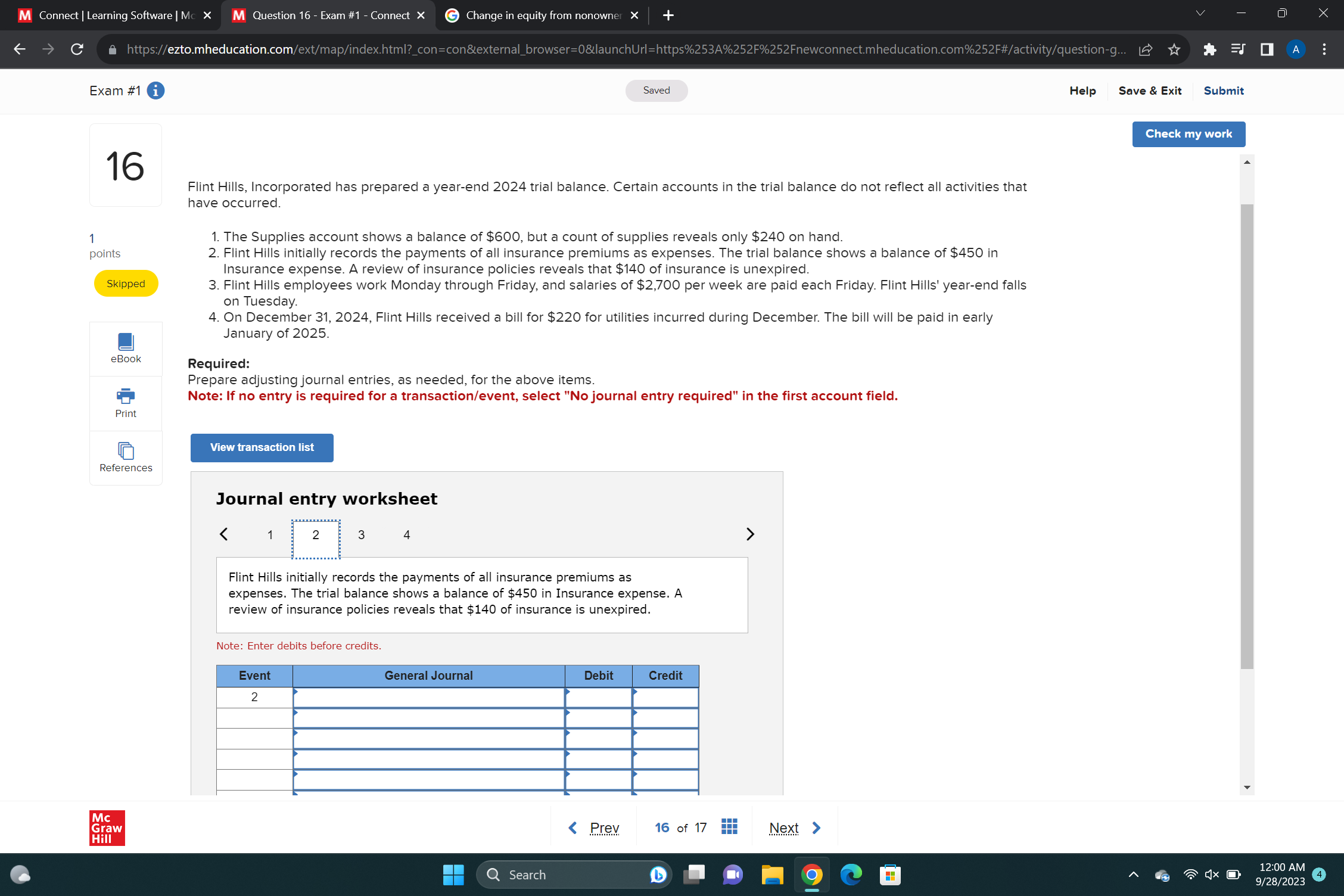

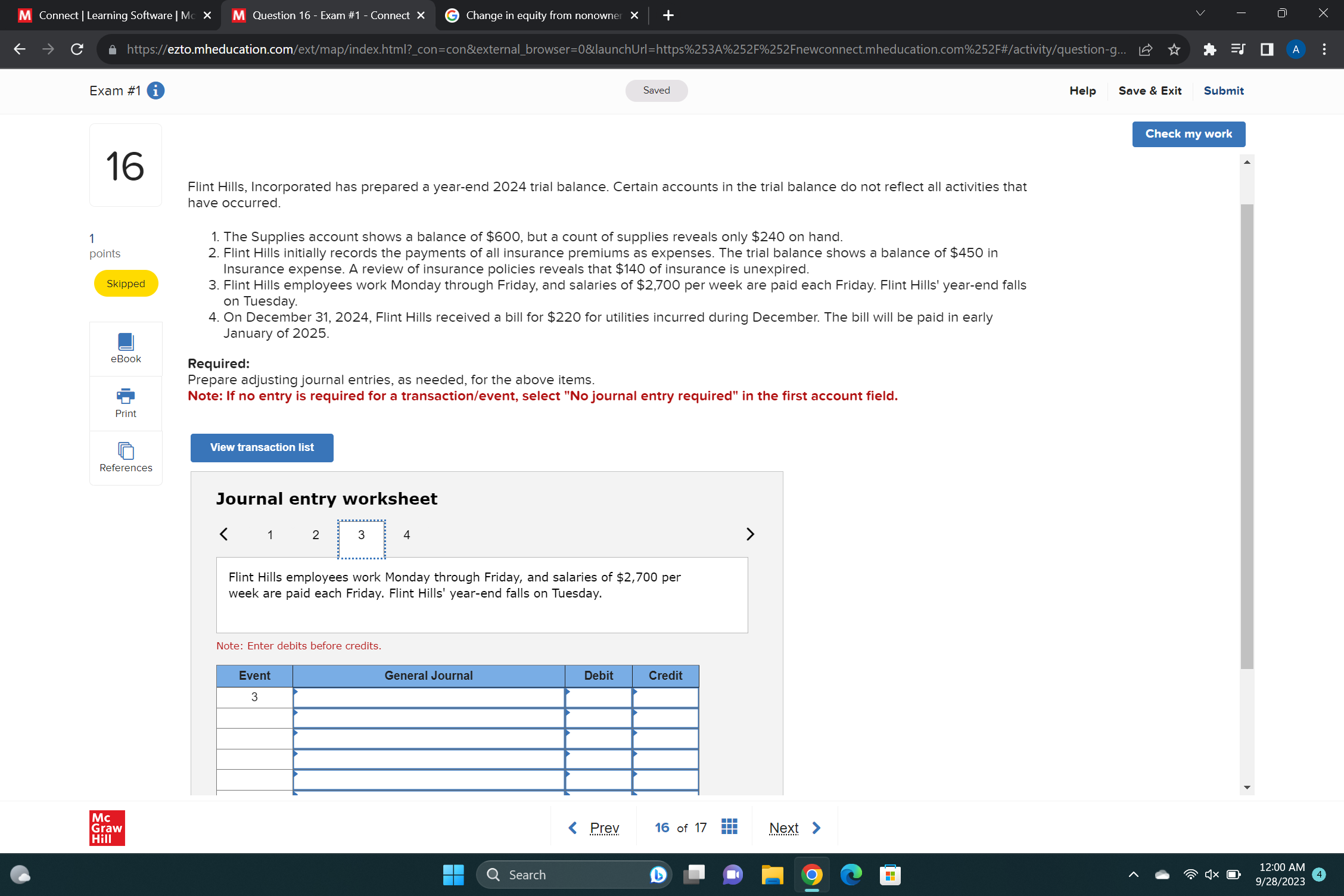

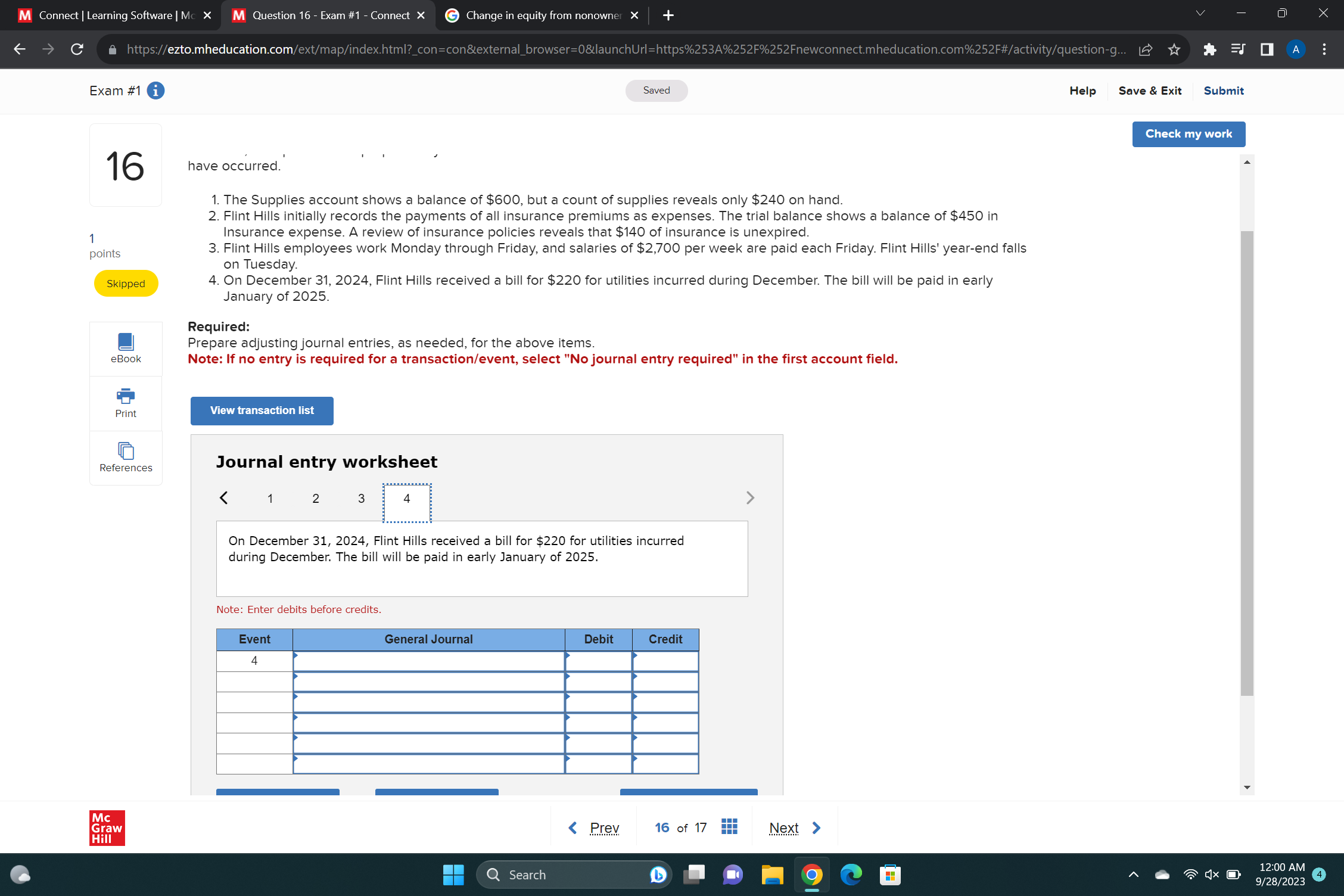

Flint Hills, Incorporated has prepared a year-end 2024 trial balance. Certain accounts in the trial balance do not reflect all activities that have occurred.

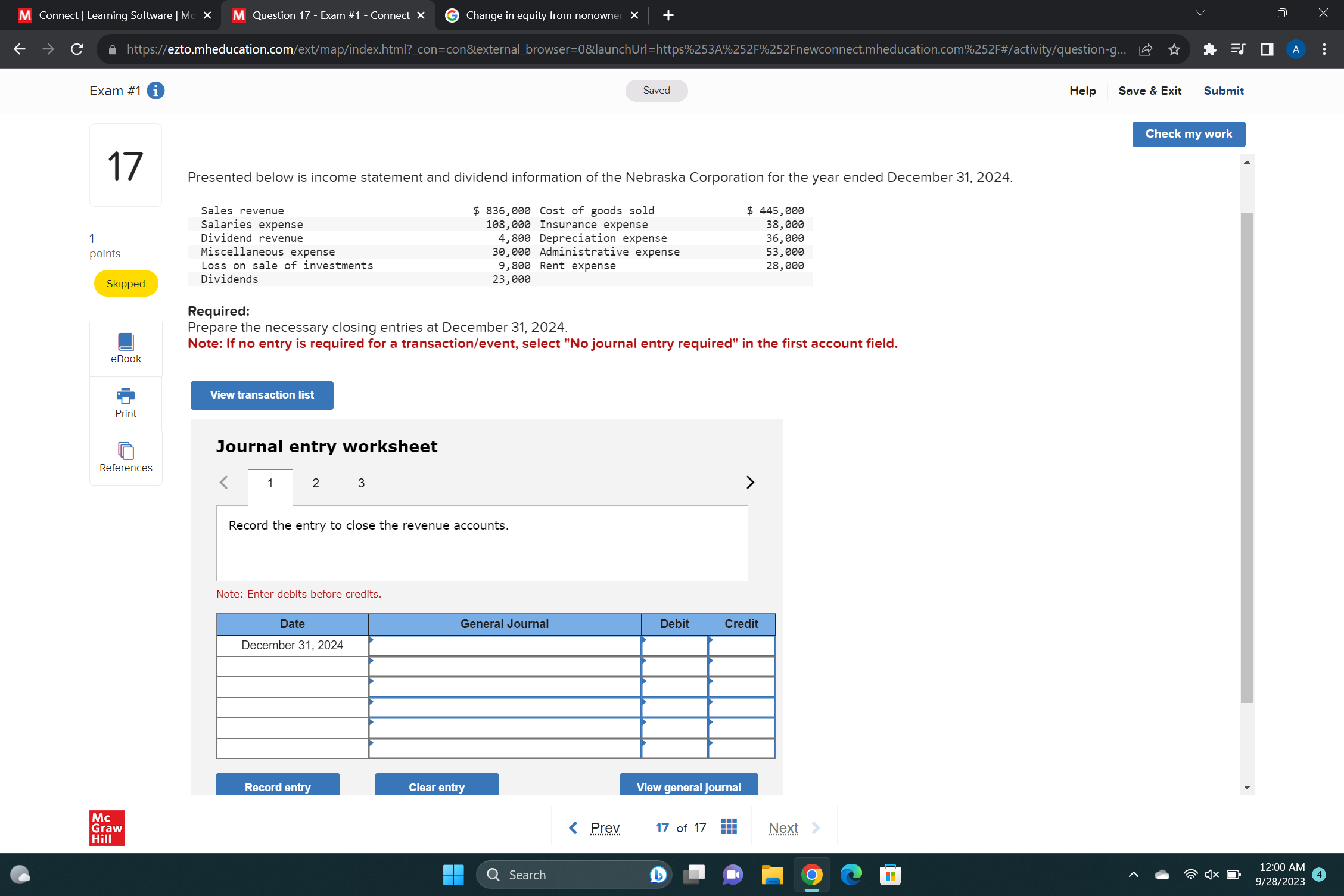

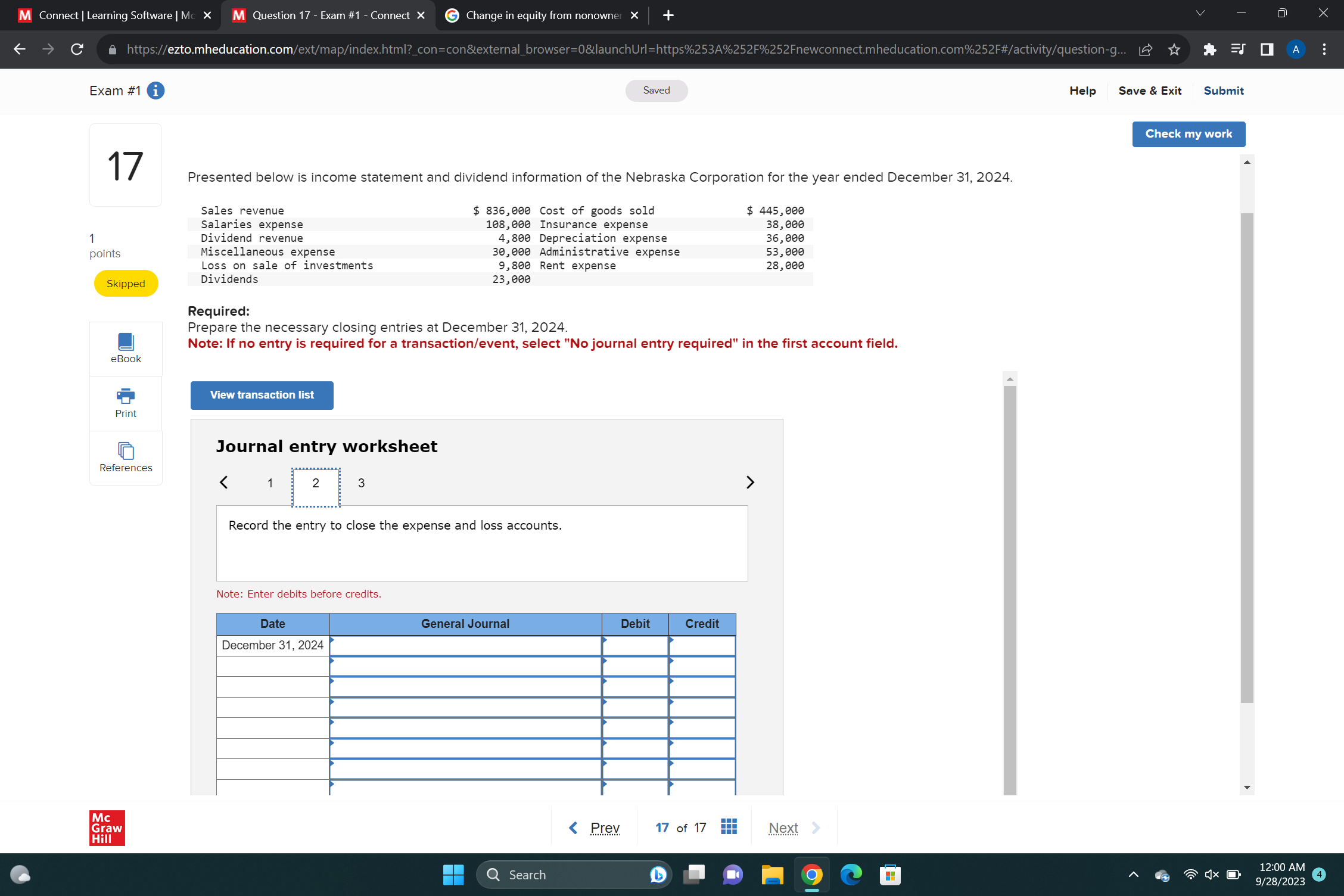

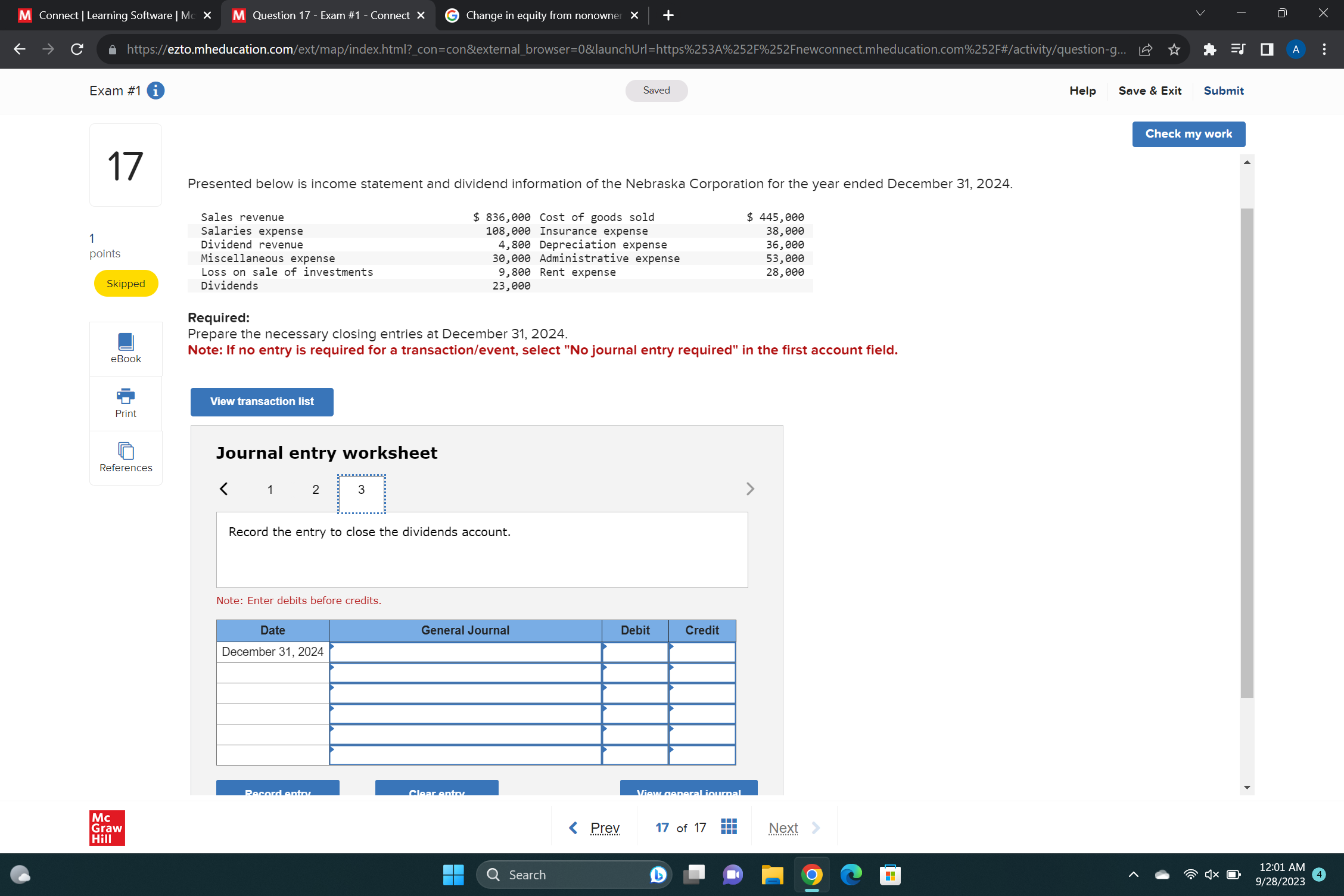

Flint Hills, Incorporated has prepared a year-end 2024 trial balance. Certain accounts in the trial balance do not reflect all activities that have occurred. 1. The Supplies account shows a balance of $600, but a count of supplies reveals only $240 on hand. 2. Flint Hills initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $450 in Insurance expense. A review of insurance policies reveals that $140 of insurance is unexpired. 3. Flint Hills employees work Monday through Friday, and salaries of $2,700 per week are paid each Friday. Flint Hills' year-end falls on Tuesday. 4. On December 31, 2024, Flint Hills received a bill for $220 for utilities incurred during December. The bill will be paid in early January of 2025, Required: Prepare adjusting journal entries, as needed, for the above items. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 2 3 4 The Supplies account shows a balance of $600, but a count of supplies reveals only $240 on hand. Note: Enter debits before credits. Event 1 General Journal Debit Credit E M Connect | Learning Software | Mc X M Question 16 - Exam #1 - Connect X Change in equity from nonowner X + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g... Exam #1 i 16 Saved 1 points Skipped eBook Flint Hills, Incorporated has prepared a year-end 2024 trial balance. Certain accounts in the trial balance do not reflect all activities that have occurred. 1. The Supplies account shows a balance of $600, but a count of supplies reveals only $240 on hand. 2. Flint Hills initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $450 in Insurance expense. A review of insurance policies reveals that $140 of insurance is unexpired. 3. Flint Hills employees work Monday through Friday, and salaries of $2,700 per week are paid each Friday. Flint Hills' year-end falls on Tuesday. 4. On December 31, 2024, Flint Hills received a bill for $220 for utilities incurred during December. The bill will be paid in early January of 2025. Required: Prepare adjusting journal entries, as needed, for the above items. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Print References Mc Graw Hill View transaction list Journal entry worksheet < 1 2 3 4 Flint Hills initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $450 in Insurance expense. A review of insurance policies reveals that $140 of insurance is unexpired. Note: Enter debits before credits. Event General Journal 2 Q Search Debit Credit < Prev 16 of 17 Next > EJ Help Save & Exit Submit Check my work A 12:00 AM 9/28/2023 M Connect | Learning Software | Mc X M Question 16 - Exam #1 - Connect X Change in equity from nonowner X + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g... Exam #1 i 16 Saved 1 points Skipped eBook Flint Hills, Incorporated has prepared a year-end 2024 trial balance. Certain accounts in the trial balance do not reflect all activities that have occurred. 1. The Supplies account shows a balance of $600, but a count of supplies reveals only $240 on hand. 2. Flint Hills initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $450 in Insurance expense. A review of insurance policies reveals that $140 of insurance is unexpired. 3. Flint Hills employees work Monday through Friday, and salaries of $2,700 per week are paid each Friday. Flint Hills' year-end falls on Tuesday. 4. On December 31, 2024, Flint Hills received a bill for $220 for utilities incurred during December. The bill will be paid in early January of 2025. Required: Prepare adjusting journal entries, as needed, for the above items. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Print References Mc Graw Hill View transaction list Journal entry worksheet < 1 2 3 4 Flint Hills employees work Monday through Friday, and salaries of $2,700 per week are paid each Friday. Flint Hills' year-end falls on Tuesday. Note: Enter debits before credits. Event 3 General Journal Debit Credit Q Search < Prev 16 of 17 Next > EJ Help Save & Exit Submit Check my work A 12:00 AM 9/28/2023 M Connect | Learning Software | Mc X M Question 16 - Exam #1 - Connect X Change in equity from nonowner X + 1 https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g... Exam #1 i Saved 16 have occurred. points Skipped eBook 1. The Supplies account shows a balance of $600, but a count of supplies reveals only $240 on hand. 2. Flint Hills initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $450 in Insurance expense. A review of insurance policies reveals that $140 of insurance is unexpired. 3. Flint Hills employees work Monday through Friday, and salaries of $2,700 per week are paid each Friday. Flint Hills' year-end falls on Tuesday. 4. On December 31, 2024, Flint Hills received a bill for $220 for utilities incurred during December. The bill will be paid in early January of 2025. Required: Prepare adjusting journal entries, as needed, for the above items. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Print View transaction list References Journal entry worksheet < 1 2 3 4 Mc Graw Hill On December 31, 2024, Flint Hills received a bill for $220 for utilities incurred during December. The bill will be paid in early January of 2025. Note: Enter debits before credits. Event 4 General Journal Debit Credit Q Search < Prev 16 of 17 Next > Help EJ Save & Exit Submit Check my work 12:00 AM 9/28/2023 A M Connect | Learning Software | Mc X M Question 17 - Exam #1 - Connect X Change in equity from nonowner X + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g... Exam #1 i Saved 17 Presented below is income statement and dividend information of the Nebraska Corporation for the year ended December 31, 2024. Miscellaneous expense Sales revenue Salaries expense 1 Dividend revenue points Loss on sale of investments Dividends Skipped Required: $ 836,000 Cost of goods sold 108,000 Insurance expense 4,800 Depreciation expense 30,000 Administrative expense 9,800 Rent expense 23,000 $ 445,000 38,000 36,000 53,000 28,000 eBook Print References Mc Graw Hill Prepare the necessary closing entries at December 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 3 Record the entry to close the revenue accounts. Note: Enter debits before credits. Date December 31, 2024 General Journal Debit Credit Record entry Clear entry View general journal < Prev 17 of 17 --- Next Q Search EJ Help Save & Exit Submit Check my work A 12:00 AM 9/28/2023 M Connect | Learning Software | Mc X M Question 17 - Exam #1 - Connect X Change in equity from nonowner X + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g... Exam #1 i Saved 17 Presented below is income statement and dividend information of the Nebraska Corporation for the year ended December 31, 2024. Miscellaneous expense Sales revenue Salaries expense 1 Dividend revenue points Loss on sale of investments Dividends Skipped Required: $ 836,000 Cost of goods sold 108,000 Insurance expense 4,800 Depreciation expense 30,000 Administrative expense 9,800 Rent expense 23,000 $ 445,000 38,000 36,000 53,000 28,000 eBook Print References Mc Graw Hill Prepare the necessary closing entries at December 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 3 Record the entry to close the expense and loss accounts. Note: Enter debits before credits. Date December 31, 2024 General Journal Debit Credit Q Search < Prev 17 of 17 Next EJ Help Save & Exit Submit Check my work A 12:00 AM 9/28/2023 M Connect | Learning Software | Mc X M Question 17 - Exam #1 - Connect X Change in equity from nonowner X + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g... Exam #1 i Saved 17 Presented below is income statement and dividend information of the Nebraska Corporation for the year ended December 31, 2024. Miscellaneous expense Sales revenue Salaries expense 1 Dividend revenue points Loss on sale of investments Skipped Dividends Required: $ 836,000 Cost of goods sold 108,000 Insurance expense 4,800 Depreciation expense 30,000 Administrative expense 9,800 Rent expense 23,000 $ 445,000 38,000 36,000 53,000 28,000 eBook Print Prepare the necessary closing entries at December 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet References < 1 2 3 Mc Graw Hill Record the entry to close the dividends account. Note: Enter debits before credits. Date December 31, 2024 General Journal Debit Credit Record entry Clear entry Q Search View general journal < Prev 17 of 17 Next EJ Help Save & Exit Submit Check my work A 12:01 AM 9/28/2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started