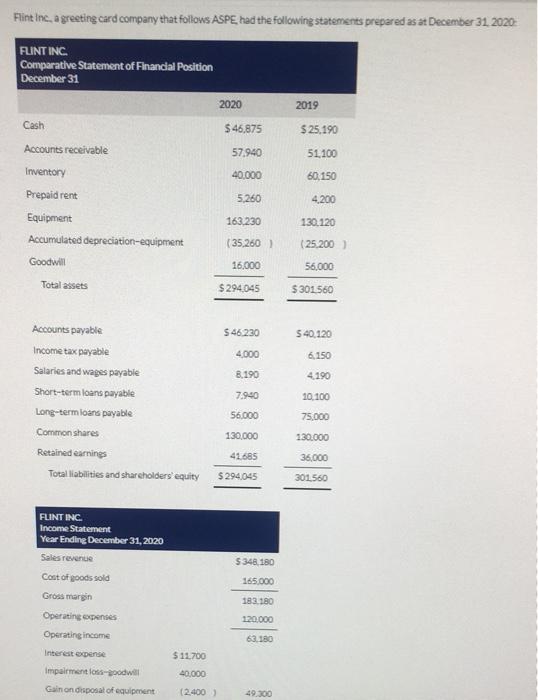

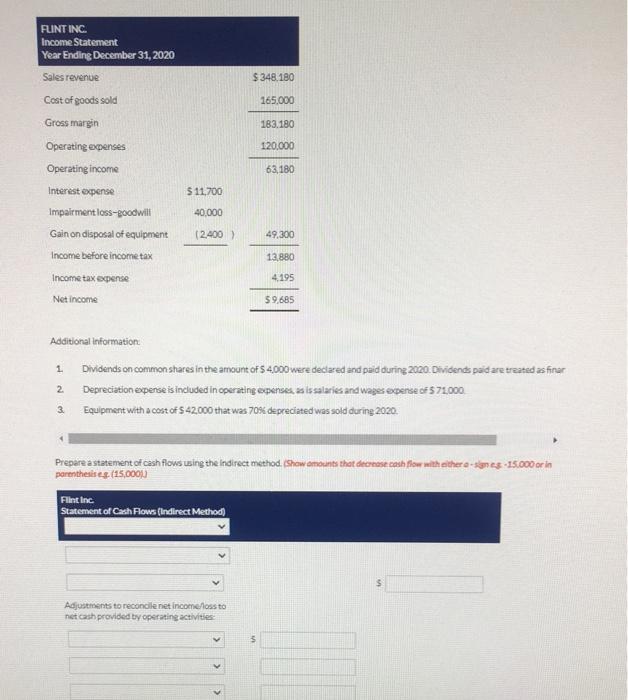

Flint Inc, a greeting card company that follows ASPE had the following statements prepared as at December 31, 2020 FLINT INC. Comparative Statement of Financial Position December 31 2020 2019 Cash $46,875 $25.190 Accounts receivable 57.940 51.100 Inventory 40.000 60,150 Prepaid rent 5.260 4.200 163.230 130.120 (35,260 Equipment Accumulated depreciation-equipment Goodwill Total assets (25.200) 56,000 16.000 $294.045 $301560 546.230 540,120 4.000 6,150 Accounts payable Income tax payable Salaries and wages payable Short-term loans payable Long-term loans payable 8.190 4.190 7.940 10.100 56.000 75,000 Common shares 130,000 130.000 Retained earnings 41685 36,000 Total liabilities and shareholders' equity $ 294,045 301560 S348 180 165.000 FLINT INC. Income Statement Year Ending December 31, 2020 Sales revenue Cost of goods sold Gross margin Operating expenses Operating income Interest Expense Impairments-goodwill Ganon disposal of equipment 183.180 120.000 63.180 $11.700 40.000 (2.400) 49.300 FUNT INC. Income Statement Year Ending December 31, 2020 Sales revenue $ 348.180 Cost of goods sold 165.000 Gross margin 183.180 120.000 Operating expenses Operating income 63,180 Interest Expense $11,700 40,000 (2.400) 49.300 Impairment loss-poodwill Gain on disposal of equipment Income before income tax Income tax expense Net income 13.880 4.195 59685 1 Additional information Dividends on common shares in the amount of $ 4.000 were dedered and paid during 2020. Dividends padare treated as finer Depreciation expense is included in operating expenses, as issalaries and wages expense of $71.000 Equipment with a cost of $ 42.000 that was 70% depreciated was sold during 2020. 2 3. Prepare a statement of cash flows using the Indirect method. Show mounts that decrease cash flow with other as 15.000 or in parenthesises. (15,0001) Flint Inc Statement of Cash Flows (Indirect Method Adjustments to reconcile net income/loss to net cash provided by operating activities S Flintine Statement of Cash Flows indirect Method Austenta reconcile nationelt natash provided by operating activities > v V > V V V V Aamot of tied Nam