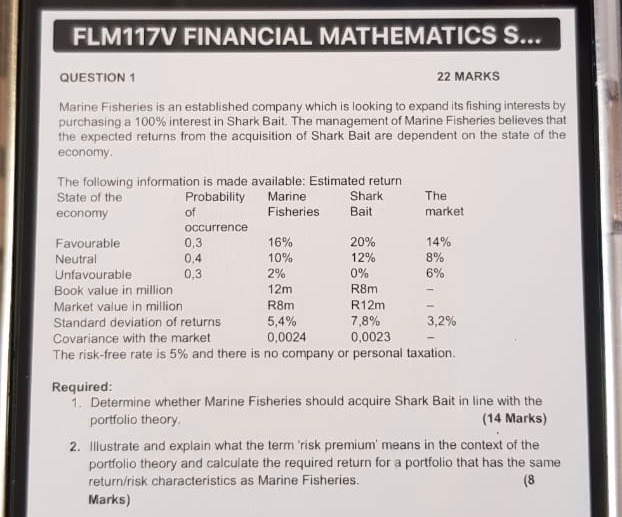

FLM117V FINANCIAL MATHEMATICS S... 14% 0.4 QUESTION 1 22 MARKS Marine Fisheries is an established company which is looking to expand its fishing interests by purchasing a 100% interest in Shark Bait. The management of Marine Fisheries believes that the expected returns from the acquisition of Shark Bait are dependent on the state of the economy The following information is made available: Estimated return State of the Probability Marine Shark The economy of Fisheries Bait market occurrence Favourable 0,3 16% 20% Neutral 10% 12% 8% Unfavourable 0,3 2% 0% 6% Book value in million 12m R8m Market value in million R8m R12m Standard deviation of returns 5,4% 7,8% 3,2% Covariance with the market 0,0024 0.0023 The risk-free rate is 5% and there is no company or personal taxation. Required: 1. Determine whether Marine Fisheries should acquire Shark Bait in line with the portfolio theory (14 Marks) 2. Illustrate and explain what the term 'risk premium' means in the context of the portfolio theory and calculate the required return for a portfolio that has the same return/risk characteristics as Marine Fisheries. (8 Marks) FLM117V FINANCIAL MATHEMATICS S... 14% 0.4 QUESTION 1 22 MARKS Marine Fisheries is an established company which is looking to expand its fishing interests by purchasing a 100% interest in Shark Bait. The management of Marine Fisheries believes that the expected returns from the acquisition of Shark Bait are dependent on the state of the economy The following information is made available: Estimated return State of the Probability Marine Shark The economy of Fisheries Bait market occurrence Favourable 0,3 16% 20% Neutral 10% 12% 8% Unfavourable 0,3 2% 0% 6% Book value in million 12m R8m Market value in million R8m R12m Standard deviation of returns 5,4% 7,8% 3,2% Covariance with the market 0,0024 0.0023 The risk-free rate is 5% and there is no company or personal taxation. Required: 1. Determine whether Marine Fisheries should acquire Shark Bait in line with the portfolio theory (14 Marks) 2. Illustrate and explain what the term 'risk premium' means in the context of the portfolio theory and calculate the required return for a portfolio that has the same return/risk characteristics as Marine Fisheries. (8 Marks)