Question

Flores Inc. acquired all of the outstanding common stock of Wilde Company on January 1, 2020. Annual amortization of $32,000 resulted from this transaction.

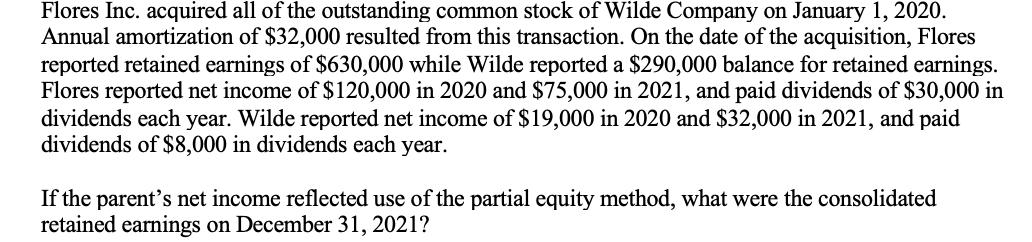

Flores Inc. acquired all of the outstanding common stock of Wilde Company on January 1, 2020. Annual amortization of $32,000 resulted from this transaction. On the date of the acquisition, Flores reported retained earnings of $630,000 while Wilde reported a $290,000 balance for retained earnings. Flores reported net income of $120,000 in 2020 and $75,000 in 2021, and paid dividends of $30,000 in dividends each year. Wilde reported net income of $19,000 in 2020 and $32,000 in 2021, and paid dividends of $8,000 in dividends each year. If the parent's net income reflected use of the partial equity method, what were the consolidated retained earnings on December 31, 2021?

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Retained earning of Flores on Jan12020 Add Net Income of 2020 Less D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra C. Jeter, Paul Chaney

5th Edition

1118022297, 9781118214169, 9781118022290, 1118214161, 978-1118098615

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App