Question

Florida Key, Inc. is the company without any debt. The firm generates $494,000 every year in pretax cash flows and the cash flow is

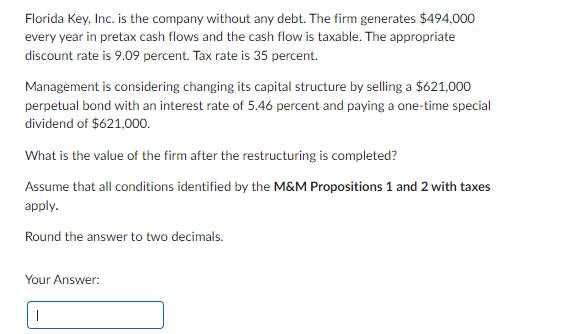

Florida Key, Inc. is the company without any debt. The firm generates $494,000 every year in pretax cash flows and the cash flow is taxable. The appropriate discount rate is 9.09 percent. Tax rate is 35 percent. Management is considering changing its capital structure by selling a $621,000 perpetual bond with an interest rate of 5.46 percent and paying a one-time special dividend of $621,000. What is the value of the firm after the restructuring is completed? Assume that all conditions identified by the M&M Propositions 1 and 2 with taxes apply. Round the answer to two decimals. Your Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to find the value of the firm after restructuring Calculate the aftertax perpetuity cash f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2019 Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

22nd Edition

9781259917097, 1259917096, 978-1260161472

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App