Question

Flounder Limited owns 90% of Pharoah Inc. During 2020, Flounder acquired a machine from Pharoah in exchange for its own used machine. Both companies are

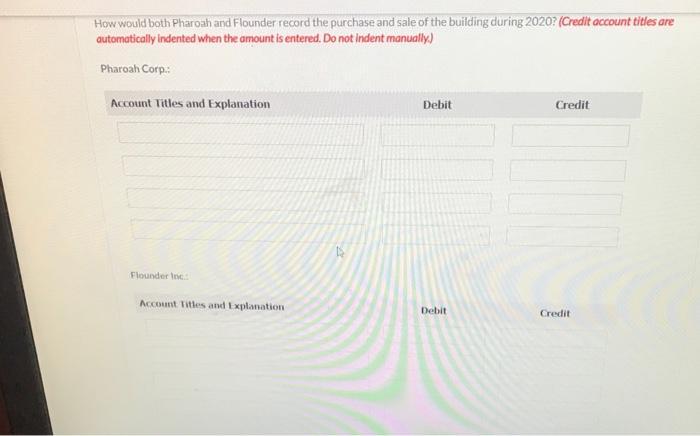

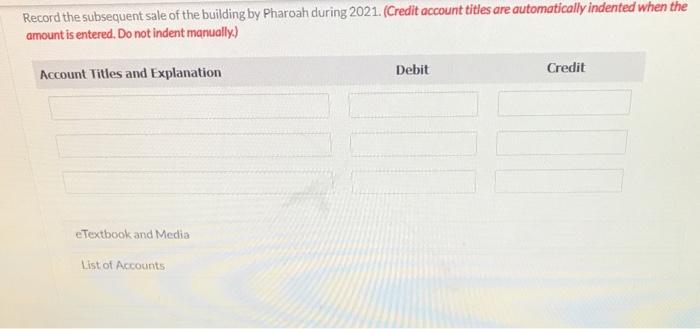

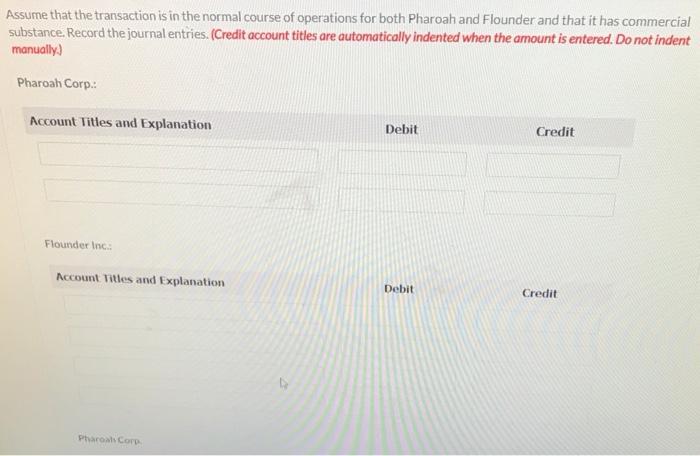

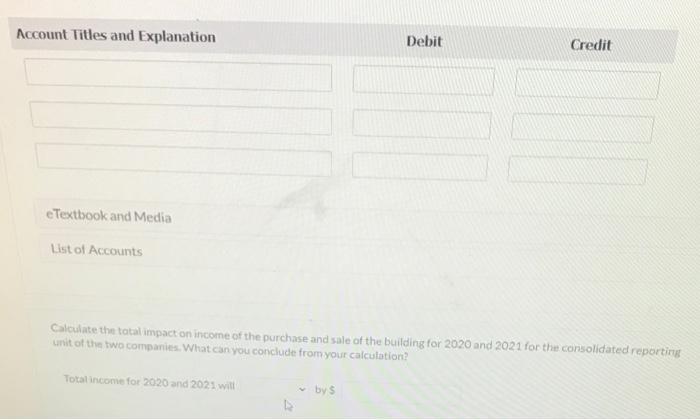

Flounder Limited owns 90% of Pharoah Inc. During 2020, Flounder acquired a machine from Pharoah in exchange for its own used machine. Both companies are in the tool-making business. The agreed exchange amount is $2,050, although the transaction is nonmonetary. Pharoah has an original cost of $6,000 and carries its machine on its books at a carrying amount of $1,640, whereas Flounder has an original cost of $7,000 and carries its machine on its books at a carrying amount of $1,910. Neither company has a balance in the Contributed Surplus account relating to previous related-party transactions. Both Flounder and Pharoah follow ASPE.

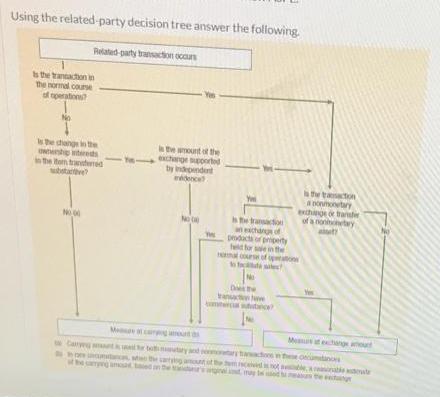

Using the related-party decision tree answer the following. is the transaction in the normal course of operations? No Related-party bransaction occurs is the change in the ownership tereds in the tem tranded NO N is the amount of the exchange supported by independent dece NO ng ati is the transaction exchange of products of property the al course of options to foc No Det w is the transaction anonmonetary exchange or transf of a nonintary tawactions in the is not per Mess the change amount

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer and Explanation It looks like youve provided a scenario involving a nonmonetary exchange of m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started