Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Flounder Shoe Sales has a January 31 fiscal year-end. At the start of the year, Flounder had 235 pairs of shoes in its Inventory

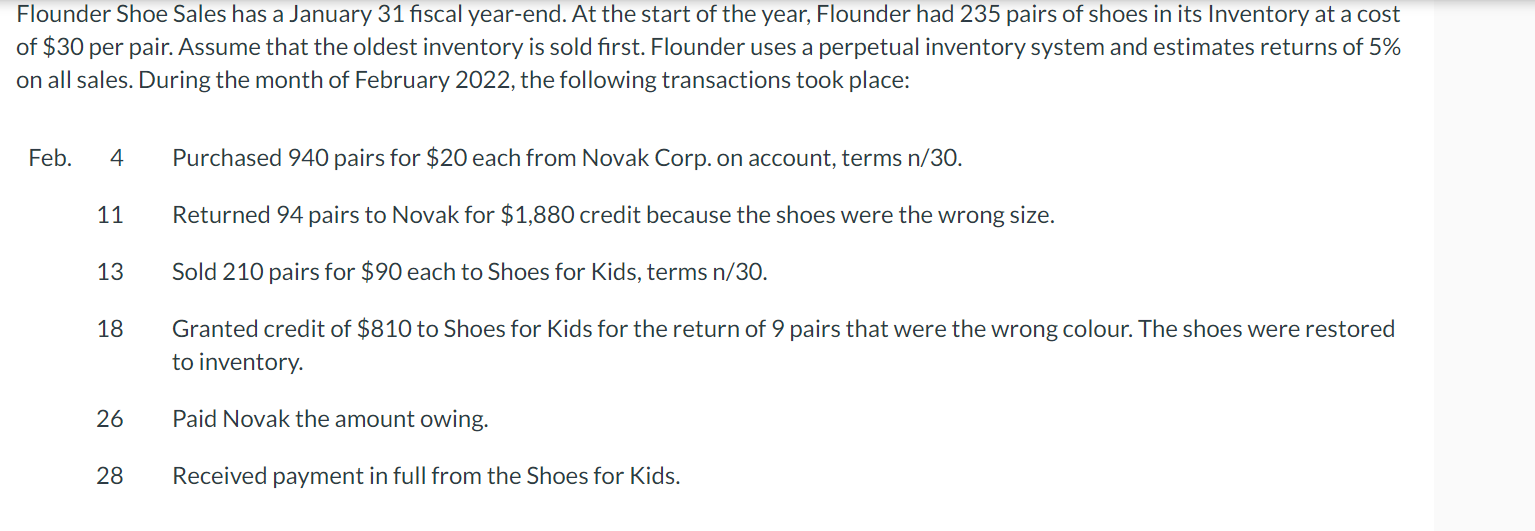

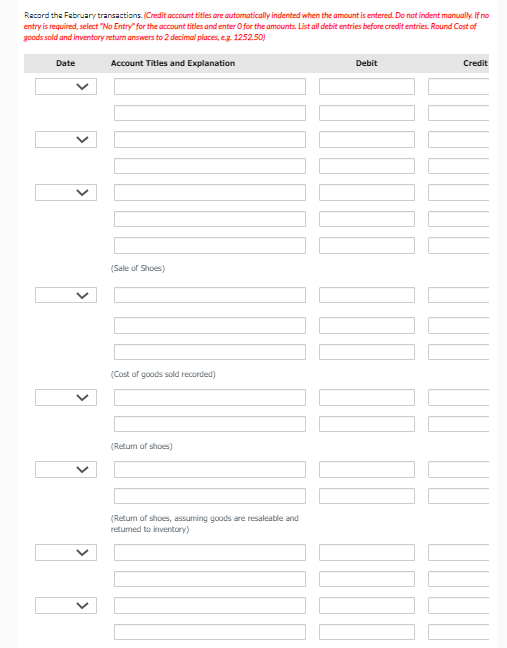

Flounder Shoe Sales has a January 31 fiscal year-end. At the start of the year, Flounder had 235 pairs of shoes in its Inventory at a cost of $30 per pair. Assume that the oldest inventory is sold first. Flounder uses a perpetual inventory system and estimates returns of 5% on all sales. During the month of February 2022, the following transactions took place: Feb. 4 Purchased 940 pairs for $20 each from Novak Corp. on account, terms n/30. 11 Returned 94 pairs to Novak for $1,880 credit because the shoes were the wrong size. 13 Sold 210 pairs for $90 each to Shoes for Kids, terms n/30. 18 Granted credit of $810 to Shoes for Kids for the return of 9 pairs that were the wrong colour. The shoes were restored to inventory. 26 Paid Novak the amount owing. 28 Received payment in full from the Shoes for Kids. Record the Fabruary transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Round Cost of goods sold and inventory return answers to 2 decimal places, eg 1252.50) Date Account Titles and Explanation Debit Credit (Sale of Shoes) (Cost of goods sold recorded) (Retum of shoes) (Retum of shoes, assuming goods are resaleable and returned to inventory)

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Date Account title Debit Credit Feb 4 Inventory 20940 18800 Account payable Novak ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started