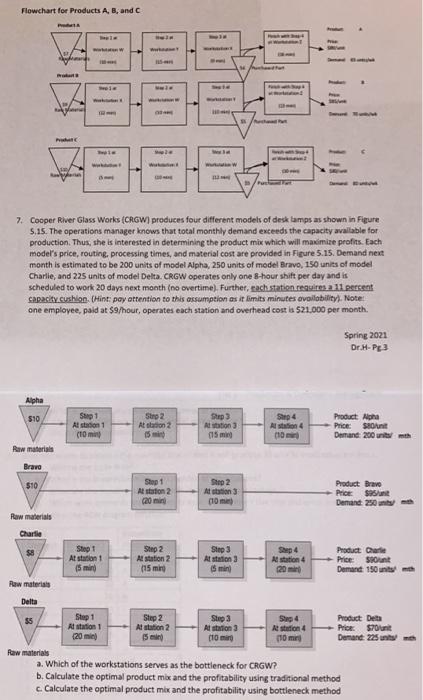

Flowchart for Products A, B, and C www tul 7. Cooper River Glass Works (CRGW) produces four different models of desk Lamps as shown in Figure 5.15. The operations manager knows that total monthly demand exceeds the capacity available for production. Thus, she is interested in determining the product mix which will maximize profits. Each model's price, routing processing times, and material cost are provided in Figure 5.15. Demand next month is estimated to be 200 units of model Alpha, 250 units of model Bravo, 150 units of model Charlie, and 225 units of model Delta CRGW operates only one 8-hour shift per day and is scheduled to work 20 days next month (no overtime). Further, each station requires a 11 percent capacity.cushion. (Hint: pay attention to this assumption as it limits minutes availability). Note one employee, paid at $9/hour, operates each station and overhead cost is $21.000 per month. Spring 2021 Dr.H.P3 Alpha 510 Shp4 Sep 1 Alstadion 1 (10 min Step 2 At station 2 Sain) Step Alation 3 (15 min Product Alpha Price: $ Demand 200 smith 110 Raw materials Bravo $10 Step 1 Step 2 Product Bravo Alstation 2 Atsion 3 Prict: 95 20 min (10 m) Demant 250 Raw materials Charlie Step 1 Step 2 Step 3 Product Care At station 1 Atstation 2 Atstation 3 Atstation 4 Price: Sunt 15 min 15 min Smin 20 min Demand 150 mth Raw materials Delta 55 Step 1 Step 2 Step 3 Step 4 Product Delta Atstation 1 Atstation 2 Alstation 3 Atstation 4 Prior. Sunt 15 min (10 min 110 mm Demand: 225 Raw materials a. Which of the workstations serves as the bottleneck for CRGW? b. Calculate the optimal product mix and the profitability using traditional method c. Calculate the optimal product mix and the profitability using bottleneck method Flowchart for Products A, B, and C www tul 7. Cooper River Glass Works (CRGW) produces four different models of desk Lamps as shown in Figure 5.15. The operations manager knows that total monthly demand exceeds the capacity available for production. Thus, she is interested in determining the product mix which will maximize profits. Each model's price, routing processing times, and material cost are provided in Figure 5.15. Demand next month is estimated to be 200 units of model Alpha, 250 units of model Bravo, 150 units of model Charlie, and 225 units of model Delta CRGW operates only one 8-hour shift per day and is scheduled to work 20 days next month (no overtime). Further, each station requires a 11 percent capacity.cushion. (Hint: pay attention to this assumption as it limits minutes availability). Note one employee, paid at $9/hour, operates each station and overhead cost is $21.000 per month. Spring 2021 Dr.H.P3 Alpha 510 Shp4 Sep 1 Alstadion 1 (10 min Step 2 At station 2 Sain) Step Alation 3 (15 min Product Alpha Price: $ Demand 200 smith 110 Raw materials Bravo $10 Step 1 Step 2 Product Bravo Alstation 2 Atsion 3 Prict: 95 20 min (10 m) Demant 250 Raw materials Charlie Step 1 Step 2 Step 3 Product Care At station 1 Atstation 2 Atstation 3 Atstation 4 Price: Sunt 15 min 15 min Smin 20 min Demand 150 mth Raw materials Delta 55 Step 1 Step 2 Step 3 Step 4 Product Delta Atstation 1 Atstation 2 Alstation 3 Atstation 4 Prior. Sunt 15 min (10 min 110 mm Demand: 225 Raw materials a. Which of the workstations serves as the bottleneck for CRGW? b. Calculate the optimal product mix and the profitability using traditional method c. Calculate the optimal product mix and the profitability using bottleneck method