Answered step by step

Verified Expert Solution

Question

1 Approved Answer

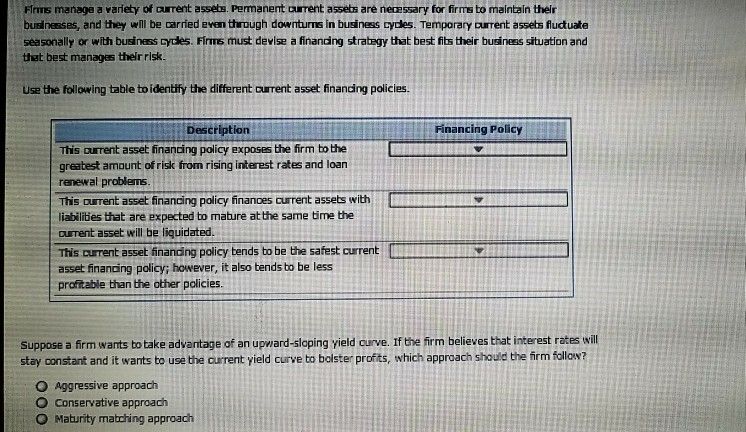

Flrms manage a variety of aurrent assets. Permanent ourrent assets are necessary for firms to maintain their businesses, and they wll be carried even through

Flrms manage a variety of aurrent assets. Permanent ourrent assets are necessary for firms to maintain their businesses, and they wll be carried even through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Firms must devise a financing stratagy that best fits their business situation and thet best manages their risk. Use the following table to identitfy the different current asset finanding policies. Description Financing Policy This ourrent asset financing policy exposes the firm bo the greatest amount of risk from rising interest rates and loan renewal problems. This ourent asset financing policy finanoes current assets with liabilities that are expected to mature at the same time the ourrent asset will be liquidated This current asset finanding policy bends to be the safest current asset financing policy; however, it also tends to be less profitable than the other policies. Suppose a firm wants bo take advantage of an upward-sloping yield curve. If the firm believes that interest rates will stay constant and it wants to use the current yield curve to bolster profits, which approach should the firm fallow? O Aggressive approach O Conservative approach O Maturity matching approach Flrms manage a variety of aurrent assets. Permanent ourrent assets are necessary for firms to maintain their businesses, and they wll be carried even through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Firms must devise a financing stratagy that best fits their business situation and thet best manages their risk. Use the following table to identitfy the different current asset finanding policies. Description Financing Policy This ourrent asset financing policy exposes the firm bo the greatest amount of risk from rising interest rates and loan renewal problems. This ourent asset financing policy finanoes current assets with liabilities that are expected to mature at the same time the ourrent asset will be liquidated This current asset finanding policy bends to be the safest current asset financing policy; however, it also tends to be less profitable than the other policies. Suppose a firm wants bo take advantage of an upward-sloping yield curve. If the firm believes that interest rates will stay constant and it wants to use the current yield curve to bolster profits, which approach should the firm fallow? O Aggressive approach O Conservative approach O Maturity matching approach

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started