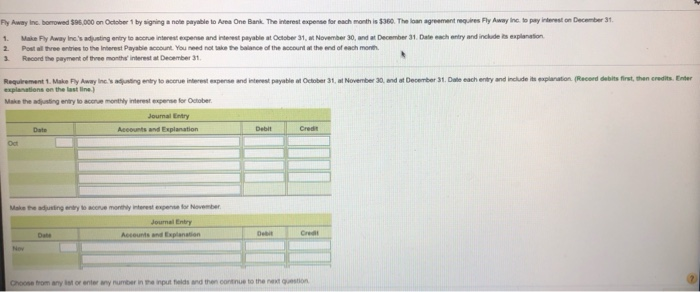

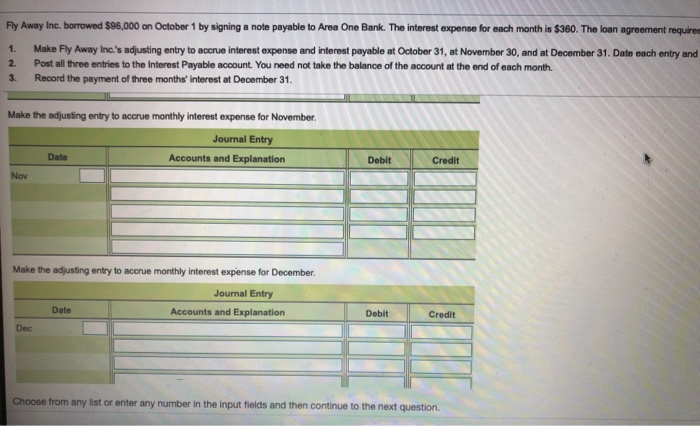

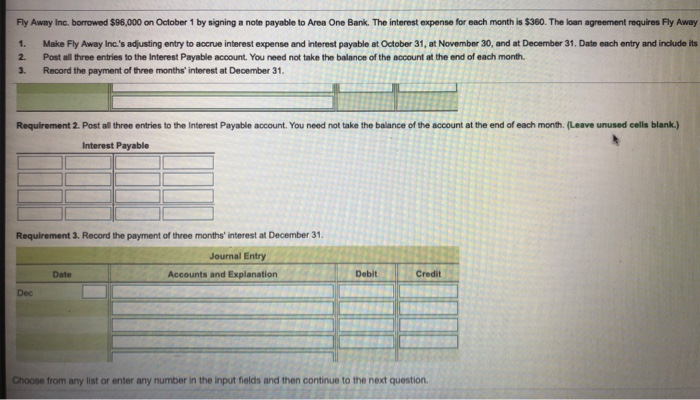

Fly Away Inc. borrowed 500.000 on October 1 by signing a note payable to rea One Bank. The interest expense for each month is $360. The loan agreement requires Fly Away no to pay interest on December 31 1 Make Fly Away Inc.'s adjusting entry to wore interest expense and interest payable at October 31, November 30, and at December 31, Date each entry and include a planation 2. Postal tree entries to the Interest Payable account. You need not take the balance of the count at the end of each month Record the payment of three month interest December 31 Requirement 1. Make Away inc.'s dusting entry to score interest pense and interest payable at October 31, at November 30, and at December 31, Date each entry and include the explanation Record debits first, then credits. Enter explanations on the basiline) Make the adjusting entry to remonty interest expense for October Journal Entry Accounts and Explanation Debit Credit O Make the dingen om motstepeno November Journal Entry Accounts and Explanation Cred Nov Choose from any store any number in the input felds and then continue to the next to Fly Away Inc. borrowed $96,000 on October 1 by signing a note payable to Area One Bank. The interest expense for each month is $360. The loan agreement requirem Make Fly Away Inc.'s adjusting entry to accrue interest expense and interest payable at October 31, at November 30, and at December 31. Date each entry and 2. Post all three entries to the Interest Payable account. You need not take the balance of the account at the end of each month. Record the payment of three months' interest at December 31. 1. 3. Make the adjusting entry to accrue monthly interest expense for November Journal Entry Date Accounts and Explanation Nov Debit Credit Make the adjusting entry to accrue monthly interest expense for December Journal Entry Accounts and Explanation Date Debit Credit Dec Choose from any list or enter any number in the input fields and then continue to the next question. Fly Away Inc. borrowed $96,000 on October 1 by signing a note payable to Area One Bank. The interest expense for each month is $360. The loan agreement requires Fly Away 1. Make Fly Away Inc.'s adjusting entry to accrue interest expense and interest payable at October 31, at November 30, and at December 31. Date each entry and include its 2. Post all three entries to the Interest Payable account. You need not take the balance of the account at the end of each month. 3. Record the payment of three months' interest at December 31. Requirement 2. Post all three entries to the Interest Payable account. You need not take the balance of the account at the end of each month. (Leave unused cells blank.) Interest Payable Requirement 3. Record the payment of three months' interest at December 31 Journal Entry Accounts and Explanation Date Dobit Credit Dec Choose from any list or enter any number in the input fields and then continue to the next