Answered step by step

Verified Expert Solution

Question

1 Approved Answer

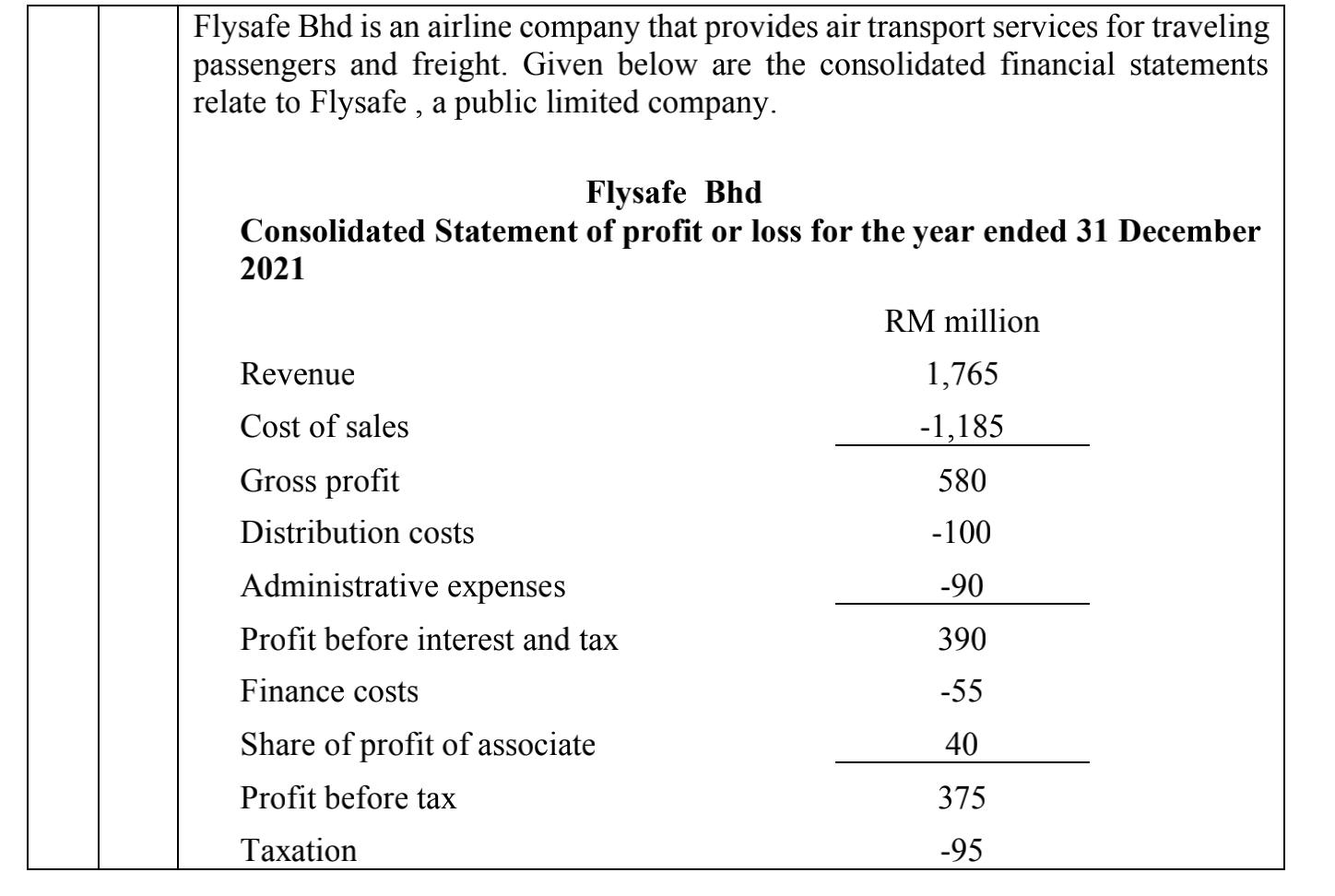

Flysafe Bhd is an airline company that provides air transport services for traveling passengers and freight. Given below are the consolidated financial statements relate

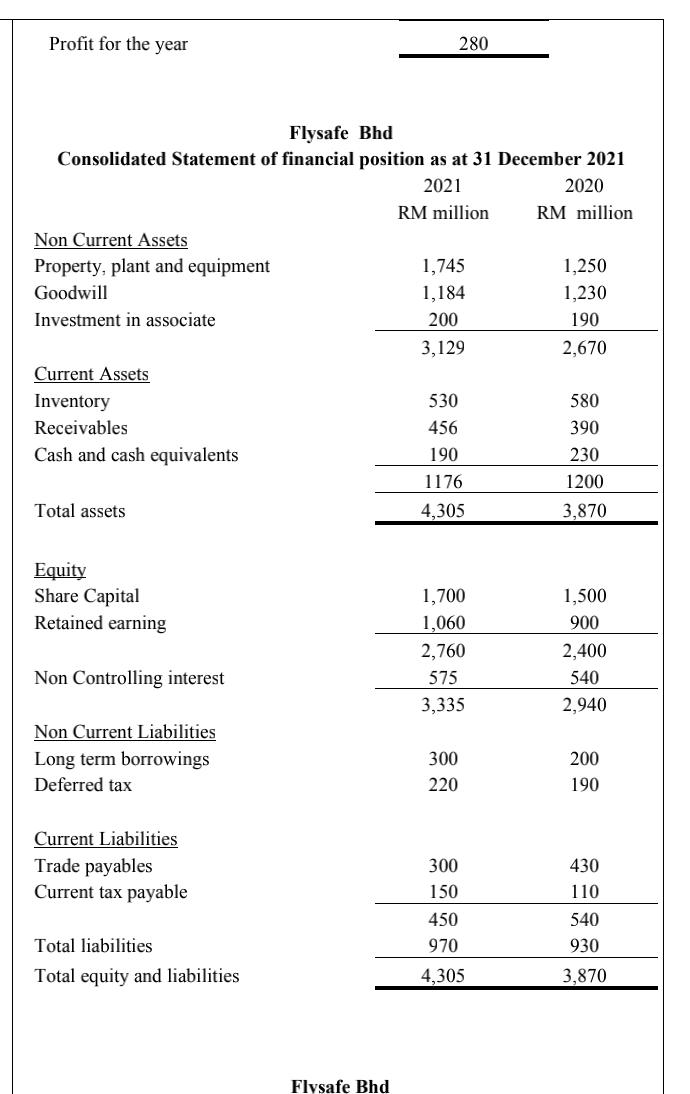

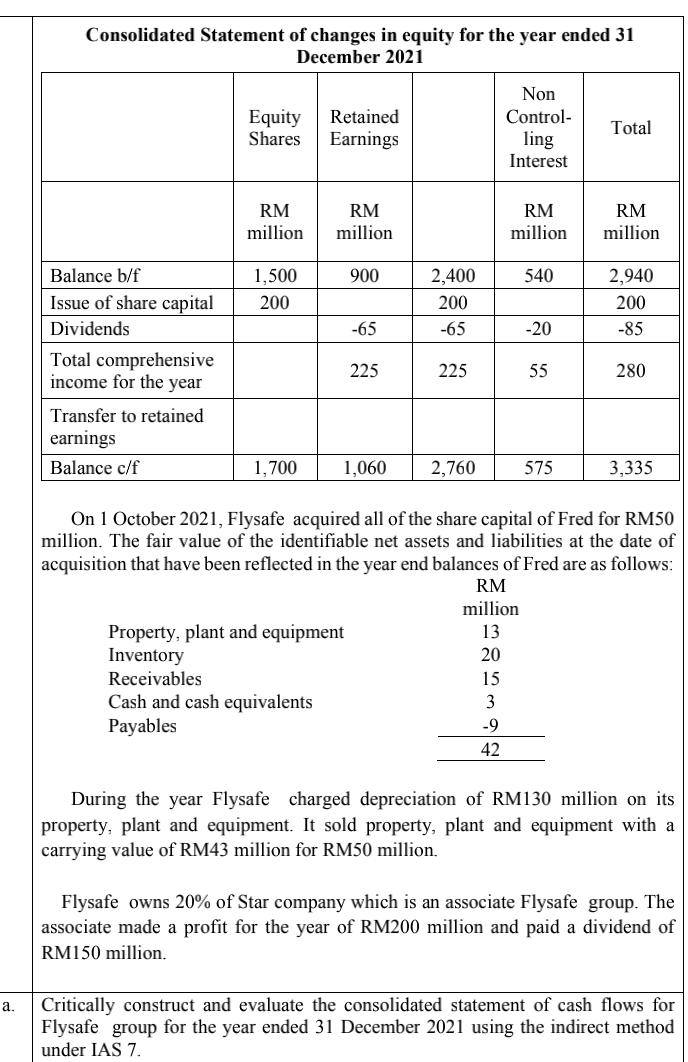

Flysafe Bhd is an airline company that provides air transport services for traveling passengers and freight. Given below are the consolidated financial statements relate to Flysafe, a public limited company. Flysafe Bhd Consolidated Statement of profit or loss for the year ended 31 December 2021 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Profit before interest and tax Finance costs Share of profit of associate Profit before tax Taxation RM million 1,765 -1,185 580 -100 -90 390 -55 40 375 -95 Profit for the year Flysafe Bhd Consolidated Statement of financial position as at 31 December 2021 2021 2020 RM million RM million Non Current Assets Property, plant and equipment Goodwill Investment in associate Current Assets Inventory Receivables Cash and cash equivalents Total assets Equity Share Capital Retained earning Non Controlling interest Non Current Liabilities Long term borrowings Deferred tax Current Liabilities Trade payables Current tax payable Total liabilities Total equity and liabilities 280 Flysafe Bhd 1,745 1,184 200 3,129 530 456 190 1176 4,305 1,700 1,060 2,760 575 3,335 300 220 300 150 450 970 4,305 1,250 1,230 190 2,670 580 390 230 1200 3,870 1,500 900 2,400 540 2,940 200 190 430 110 540 930 3,870 a. Consolidated Statement of changes in equity for the year ended 31 December 2021 Balance b/f Issue of share capital Dividends Total comprehensive income for the year Transfer to retained earnings Balance c/f Equity Shares RM million 1,500 200 1,700 Retained Earnings RM million 900 -65 Property, plant and equipment Inventory Receivables Cash and cash equivalents Payables 225 1,060 2,400 200 -65 225 2,760 Non Control- ling Interest RM million 540 RM million 13 20 15 3 -9 42 -20 55 575 Total RM million 2,940 200 -85 280 On 1 October 2021, Flysafe acquired all of the share capital of Fred for RM50 million. The fair value of the identifiable net assets and liabilities at the date of acquisition that have been reflected in the year end balances of Fred are as follows: 3,335 During the year Flysafe charged depreciation of RM130 million on its property, plant and equipment. It sold property, plant and equipment with a carrying value of RM43 million for RM50 million. Flysafe owns 20% of Star company which is an associate Flysafe group. The associate made a profit for the year of RM200 million and paid a dividend of RM150 million. Critically construct and evaluate the consolidated statement of cash flows for Flysafe group for the year ended 31 December 2021 using the indirect method under IAS 7.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Cashflows of fly safe group as on 31st December 2021 Indirect metho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started