Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Flysafe Bhd issues 2,000 convertible bonds at 1 January 2019. The bonds have a 3 years term, and are issued at par with a

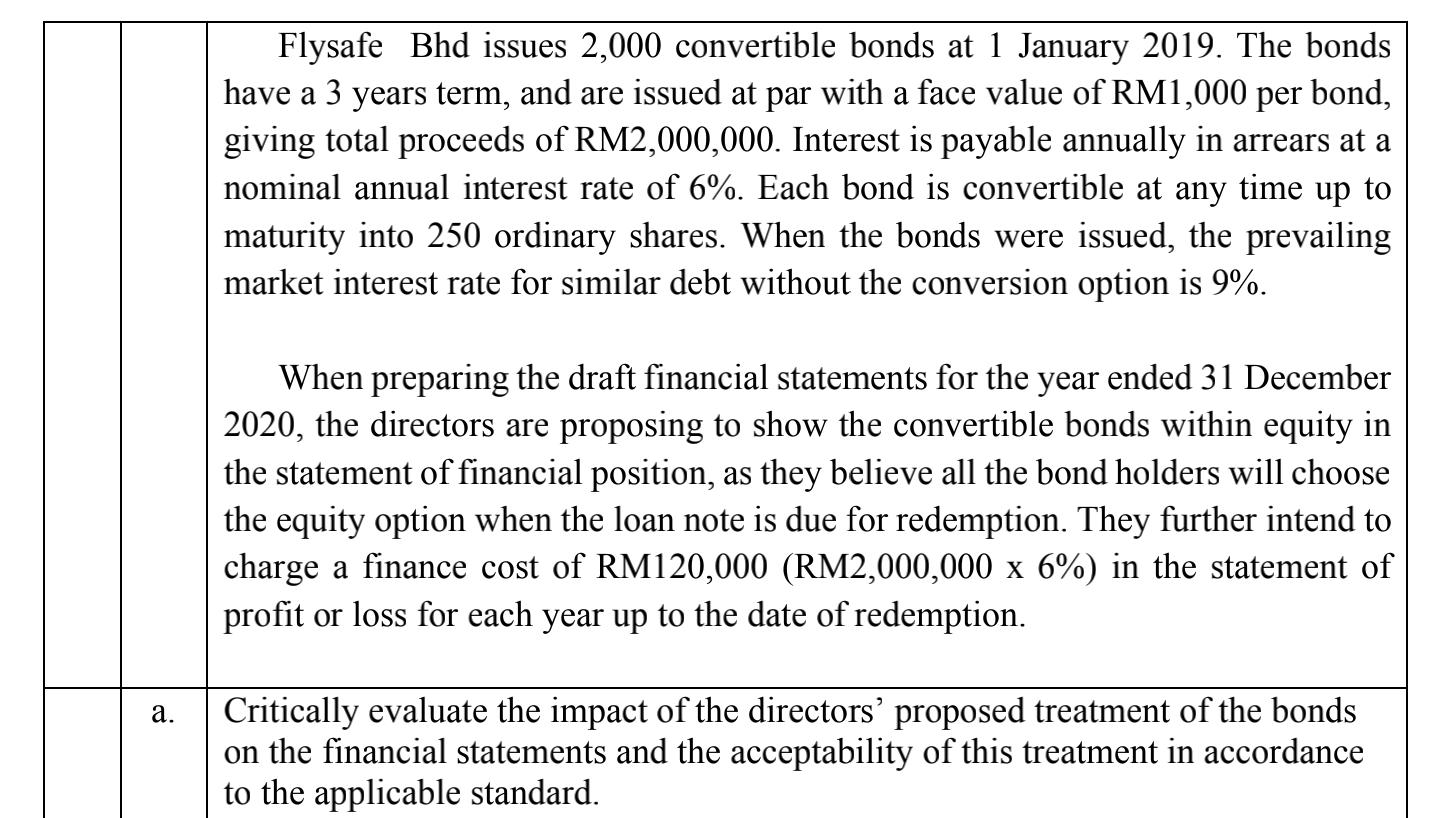

Flysafe Bhd issues 2,000 convertible bonds at 1 January 2019. The bonds have a 3 years term, and are issued at par with a face value of RM1,000 per bond, giving total proceeds of RM2,000,000. Interest is payable annually in arrears at a nominal annual interest rate of 6%. Each bond is convertible at any time up to maturity into 250 ordinary shares. When the bonds were issued, the prevailing market interest rate for similar debt without the conversion option is 9%. When preparing the draft financial statements for the year ended 31 December 2020, the directors are proposing to show the convertible bonds within equity in the statement of financial position, as they believe all the bond holders will choose the equity option when the loan note is due for redemption. They further intend to charge a finance cost of RM120,000 (RM2,000,000 x 6%) in the statement of profit or loss for each year up to the date of redemption. a. Critically evaluate the impact of the directors' proposed treatment of the bonds on the financial statements and the acceptability of this treatment in accordance to the applicable standard.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS The directors proposed treatment of the bonds would result in the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started