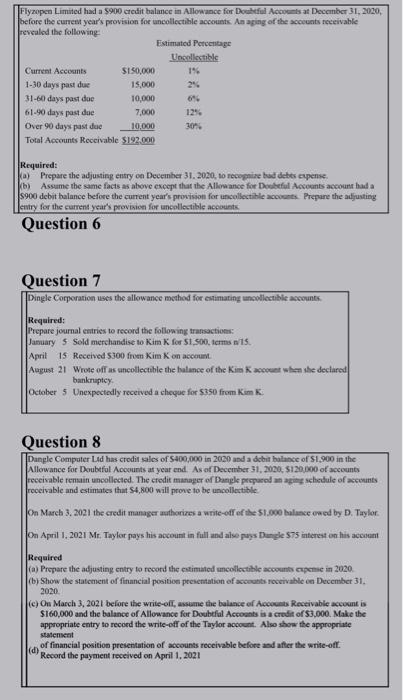

Flyzopen Limited had a $900 credit balance in Allowance for Doubtful Accounts at December 31, 2020, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following Estimated Percentage Uncollectible Current Accounts $150,000 1-30 days past due 15.000 31-60 days past doe 10,000 61-90 days past due 7.000 Over 90 days past due 10.000 30% Total Accounts Receivable $19.000 Required: KO) Prepare the adjusting entry on December 31, 2020, to recognize bad debts expense. b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a 5900 debit balance before the current year's provision for collectible accounts Prepare the adjusting entry for the current year's provision for uncollectible accounts Question 6 Question 7 Dingle Corporation uses the allowance method for estimating uncollectible accounts. Required: Prepare journal entries to record the following transactions January 5 Sold merchandise to Kim K for S1.500 terms 15. April 15 Received 5300 from Kim K on account August 21 Wrote off as uncollectible the balance of the Kim K account when she declared bankruptcy October 5 Unexpectedly received a cheque for 5350 from Kim K Question 8 Dangle Computer Ltd has credit sales of $400,000 in 2020 and a debit balance of S1.900 in the Allowance for Doubtful Accounts at your end. As of December 31, 2020, $120,000 of accounts receivable remain uncollected. The credit manager of Dangle prepared an aging schedule of accounts receivable and estimates that 54,800 will prove to be uncollectible on March 3, 2021 the credit manager authorizes a write-off of the 51.000 balance owed by D. Taylor on April 1, 2021 Mt. Taylot pays his account in full and also pays Dangle 875 interest on his account Required Prepare the adjusting entry to record the estimuated uncollectible accounts cepemic in 2020. Show the statement of financial position presentation of accounts receivable on December 31. 2020 (c) On March 3, 2021 before the write-off, assume the balance of Accounts Receivable account is $160,000 and the balance of Allowance for Doubtfal Account is a credit of $3.000. Make the appropriate entry to record the write-off of the Taylor account. Also show the appropriate statement (d) of financial position presentation of accounts receivable before and after the write-oft. Record the payment received on April 1, 2021