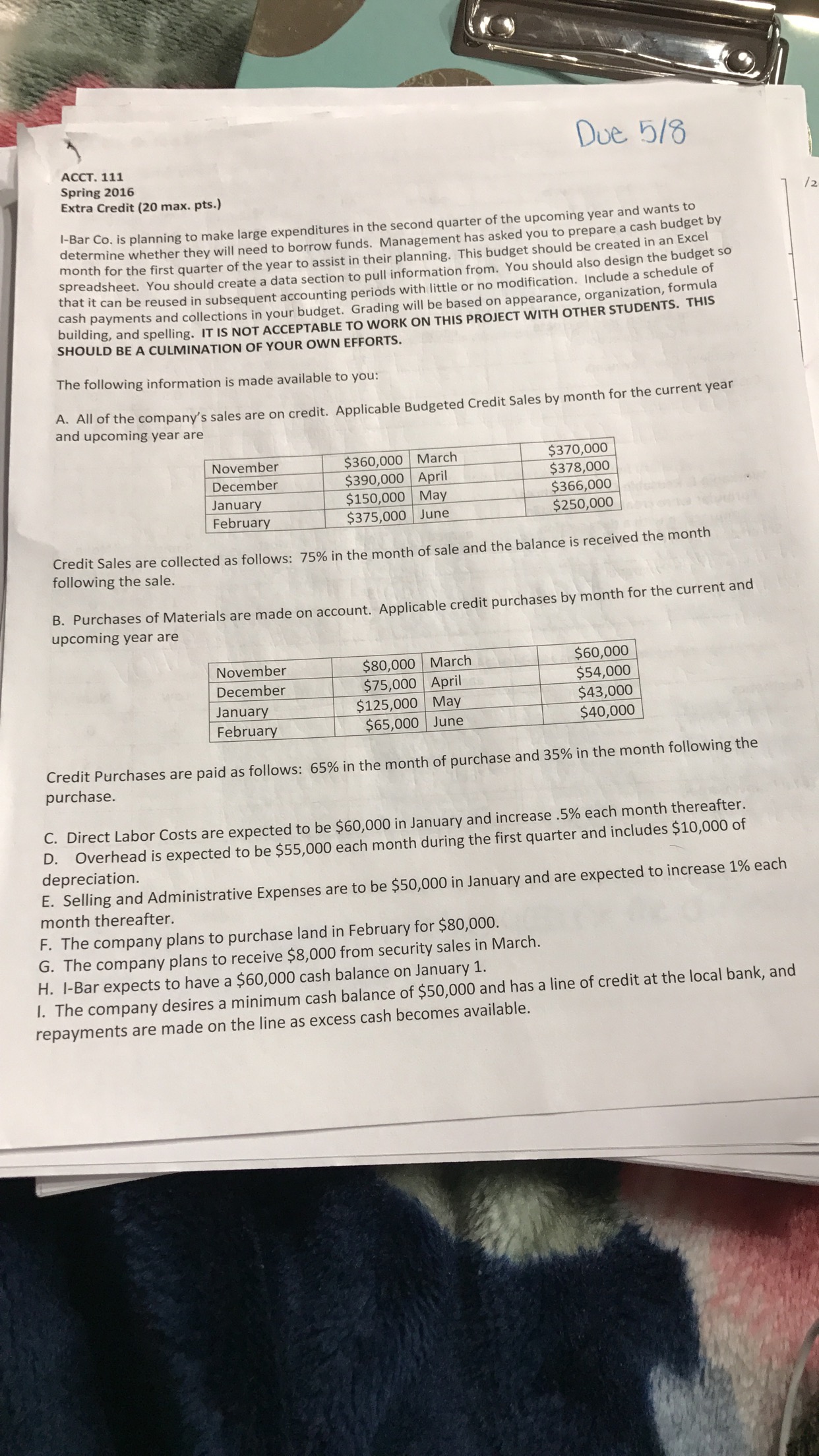

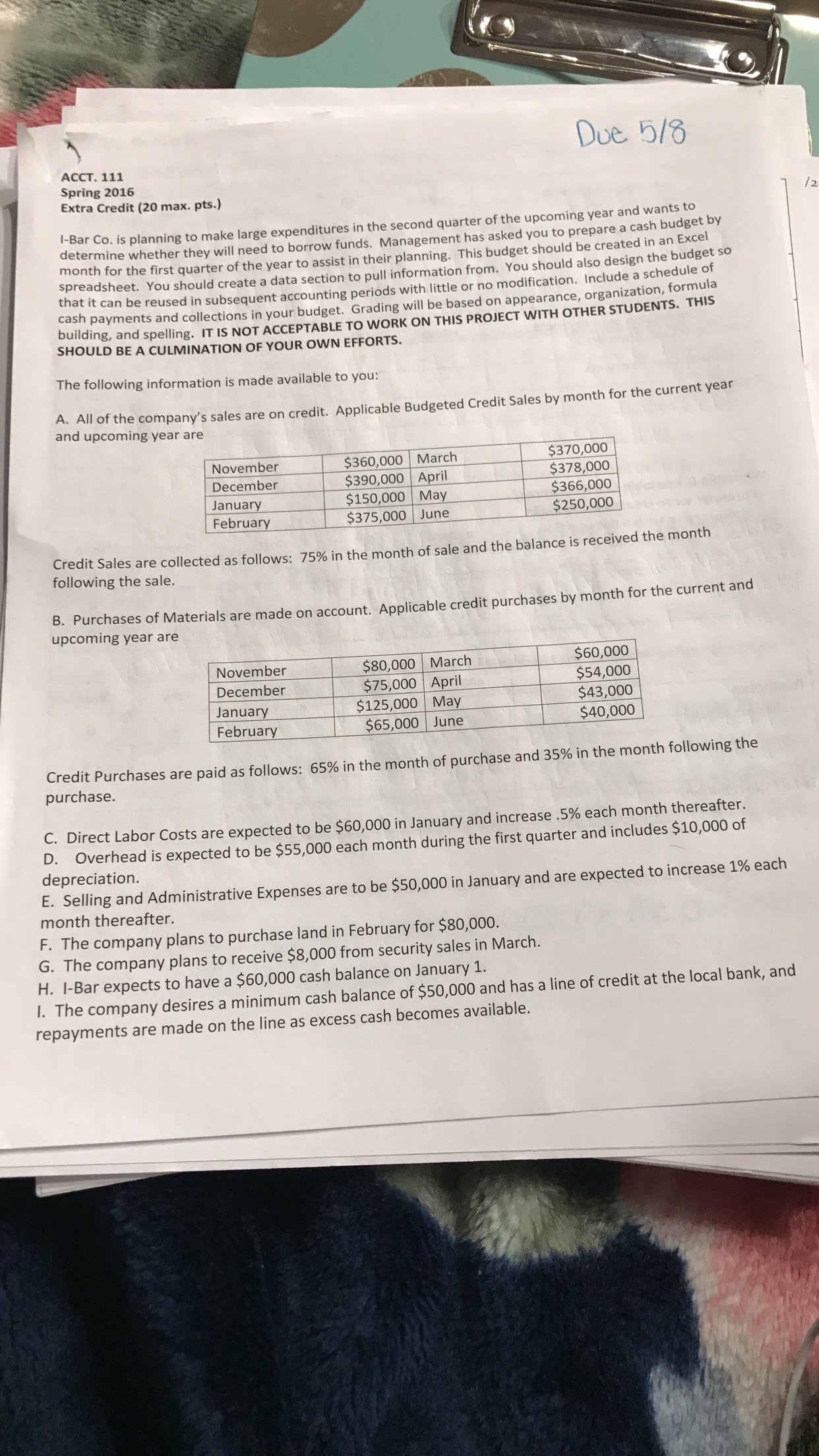

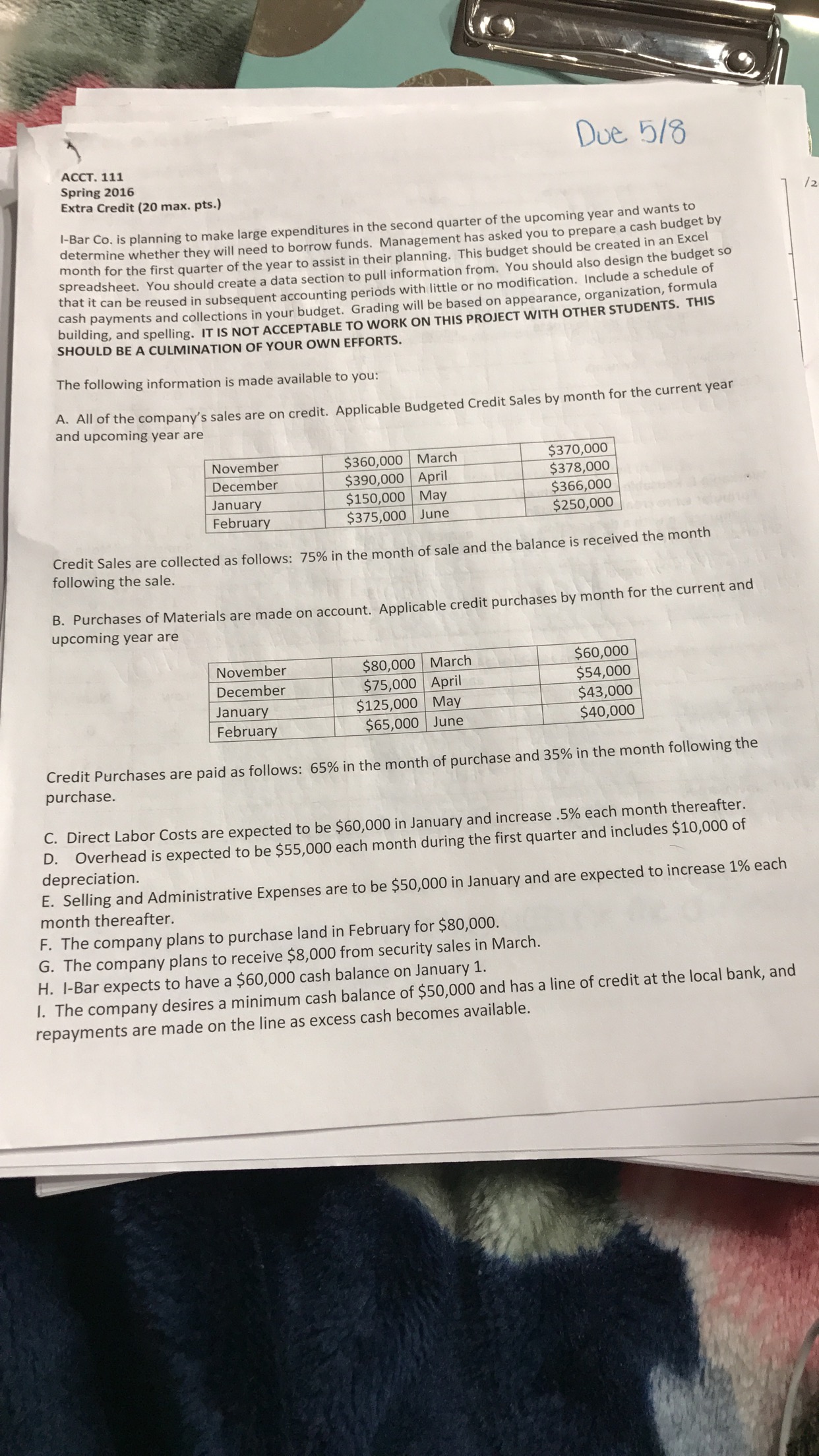

\f-m,.. ~_ OAIW'W ' ' Doe, 6/6 AR '- 'ACC'I'. 111 Spring 2016 Extra Credit (20 max. piS-l arter of the upcoming year and wants tot bv u to prepare a cash budge ated in an Excel he budget 5 rge expenditures in the second qu d to borrow funds. Management has asked yo ssist in their planning. This budget should be are to pull information from. You should also design t l-B-'ar Co. is planning to make la determine whether they will nee month for the rst quarter of the year to a Spreadsheet. YOu should create a data section that it can be reused in subsequent accounting per cash payments and collections in your bUdEEt- Gra building, and spelling. IT IS NOT ACCEPTABLE TO W0 SHOULD BE A CULMINATION OF YOUR OWN EFFORTS. ding will be based on appearance, organization, RK ON THIS PROJECT WITH OTHER STUDENTS. THIS The following information is made available to you: dit. Applicable Budgeted Credit Sales by month for the current year W __ma_ mM lemming eived the month A. All of the company's sales are on cre and upcoming year are Credit Sales are collected as follows: 75% in the month of sale and the balance 'IS rec following the sale. B. Purchases of Materials are made on account. Applicable credit purchases by month for the current and upcoming year are $75,000 5125.000 m_ $43,000 $65900. $40,000 Credit Purchases are paid as follows: 65% in the month of purchase and 35% in the month following the purchase. . r C. Direct Labor Costs are expected to be $60,000 in January and increase 5% each month thereafter. D. Overhead is expected to be $55,000 each month during the first quarter and includes $10,000 of depreciation. T E. Selling and Administrative Expenses are to be $50,000 in January and are expected to increase 1% ea; month thereafter. F. The company plans to purchase land in February for $80,000. G. The company plans to receive $8,000 from security sales in March. H. l-Bar expects to have a $60,000 cash balance on January 1. l. The company desires a minimum cash balance of $50,000 and has a line of cred-i __ repayments are made on the line as excess cash becomes available. \\ Doc. 5/?) ACCT. 111 Spring 2015 Extra Credit (20 max. ptS-l year and wants to tures in the second quarter of the upc0ming pare a cash budget. by w funds. Management has asked you to pre _ 1 ist in their planning. This budget should be created In an Exce to pull information from. You should also design the budse: 5 periods with little or no modification. include a schedule 0 s will be based on appearance, organization, formula ROJECT WITH OTHER STUDENTS. THIS .' "Bar Co. is planning to make large expendi El determine whether they will need to borro mOnth for the rst quarter of the year to ass SpreadSheet. You should create a data section that it can be reused in subsequent accounting A. 53?\" payments and collections In your budget. Gradin ' bu'ming: and Spelling. IT IS nor ACCEPTABLE To WORK ON THIS P SHOULD BE A CULMINATION OF YOUR OWN EFFORTS. The following information Is made available to yon: A. All of the company's sales are on credit. Applicable Budgeted Credit Sales by month for the current Veal and \"Naming year are $360,000 m $390,000 m $150,000 [m Credit Sales are collected as follows: 75% in the month of sale and the balance is received the month following the sale. B. Purchases of Materials are made on account. Applicable Credit purchases by month for the current and \"PCDMing year are November December Credit Purchases are paid as follows: 65% in the month of purchase and 35% in the month following the purchase. C. Direct Labor Costs are expected to be $60,000 in January and increase 5% each month thereafter. 0- Overhead is expected to be $55,000 each month during the first quarter and includes $10,000 of depreciation. E. Selling and Administrative Expenses are to be $50,000 in January an month thereafter. F. The company plans to purchase land in Februa G. The company plans to receive $8,000 from securi H. l-Bar expects to have a $60,000 cash balance on January 1. l. The company desires a minimum cash balance of $50,000 and has a line of credit at the local bank, an repayments are made on the line as excess cash becomes available. 0 are expected to increase 1% each ry for $80,000. ty sales in March.