Answered step by step

Verified Expert Solution

Question

1 Approved Answer

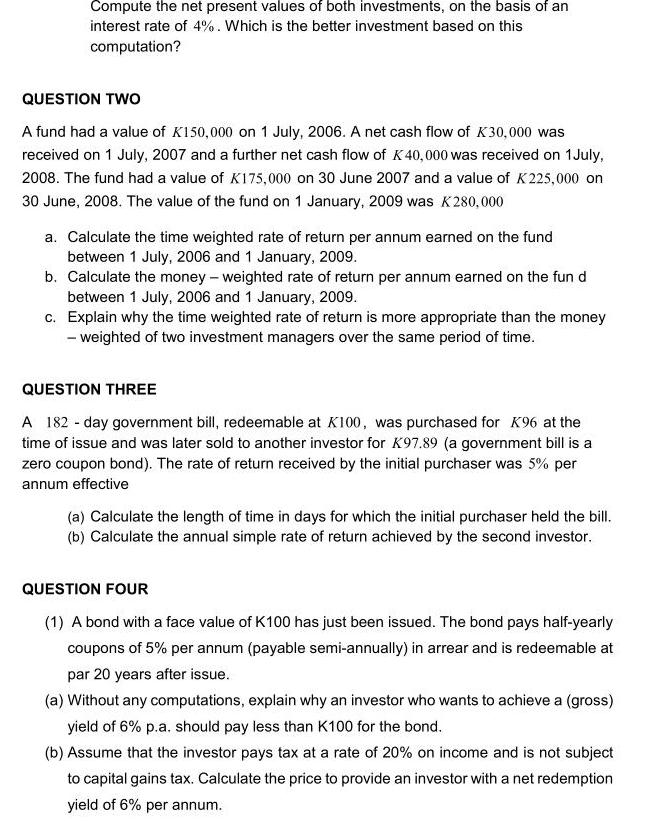

Compute the net present values of both investments, on the basis of an interest rate of 4%. Which is the better investment based on

Compute the net present values of both investments, on the basis of an interest rate of 4%. Which is the better investment based on this computation? QUESTION TWO A fund had a value of K150,000 on 1 July, 2006. A net cash flow of K30,000 was received on 1 July, 2007 and a further net cash flow of K40,000 was received on 1 July, 2008. The fund had a value of K175,000 on 30 June 2007 and a value of K225,000 on 30 June, 2008. The value of the fund on 1 January, 2009 was K280,000 a. Calculate the time weighted rate of return per annum earned on the fund between 1 July, 2006 and 1 January, 2009. b. Calculate the money - weighted rate of return per annum earned on the fun d between 1 July, 2006 and 1 January, 2009. c. Explain why the time weighted rate of return is more appropriate than the money - weighted of two investment managers over the same period of time. QUESTION THREE A 182 - day government bill, redeemable at K100, was purchased for K96 at the time of issue and was later sold to another investor for K97.89 (a government bill is a zero coupon bond). The rate of return received by the initial purchaser was 5% per annum effective (a) Calculate the length of time in days for which the initial purchaser held the bill. (b) Calculate the annual simple rate of return achieved by the second investor. QUESTION FOUR (1) A bond with a face value of K100 has just been issued. The bond pays half-yearly coupons of 5% per annum (payable semi-annually) in arrear and is redeemable at par 20 years after issue. (a) Without any computations, explain why an investor who wants to achieve a (gross) yield of 6% p.a. should pay less than K100 for the bond. (b) Assume that the investor pays tax at a rate of 20% on income and is not subject to capital gains tax. Calculate the price to provide an investor with a net redemption yield of 6% per annum.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Question Two a Time Weighted Return Value at end of period Value at beginning of period Value at beg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started