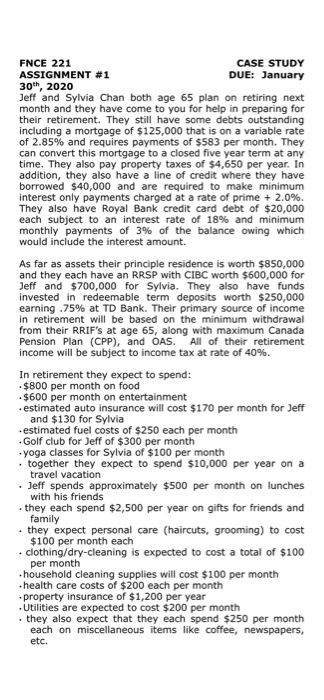

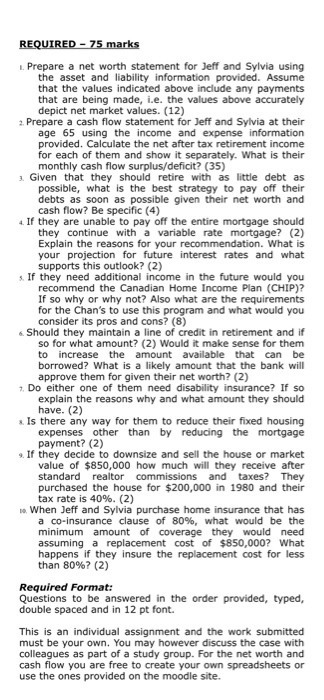

FNCE 221 CASE STUDY ASSIGNMENT #1 DUE: January 30th, 2020 Jeff and Sylvia Chan both age 65 plan on retiring next month and they have come to you for help in preparing for their retirement. They still have some debts outstanding including a mortgage of $125,000 that is on a variable rate of 2.85% and requires payments of $583 per month. They can convert this mortgage to a closed five year term at any time. They also pay property taxes of $4,650 per year. In addition, they also have a line of credit where they have borrowed $40,000 and are required to make minimum interest only payments charged at a rate of prime + 2.0%. They also have Royal Bank credit card debt of $20,000 each subject to an interest rate of 18% and minimum monthly payments of 3% of the balance owing which would include the interest amount. As far as assets their principle residence is worth $850,000 and they each have an RRSP with CIBC worth $600,000 for Jeff and $700,000 for Sylvia. They also have funds invested in redeemable term deposits worth $250,000 earning -75% at TD Bank. Their primary source of income in retirement will be based on the minimum withdrawal from their RRIF's at age 65, along with maximum Canada Pension Plan (CPP), and OAS. All of their retirement income will be subject to income tax at rate of 40%. In retirement they expect to spend: $800 per month on food $600 per month on entertainment . estimated auto insurance will cost $170 per month for Jeff and $130 for Sylvia estimated fuel costs of $250 each per month .Golf club for Jeff of $300 per month -yoga classes for Sylvia of $100 per month together they expect to spend $10,000 per year on a travel vacation Jeff spends approximately $500 per month on lunches with his friends - they each spend $2,500 per year on gifts for friends and family . they expect personal care (haircuts, grooming) to cost $100 per month each . clothing/dry-cleaning is expected to cost a total of $100 per month household cleaning supplies will cost $100 per month .health care costs of $200 each per month .property insurance of $1,200 per year . Utilities are expected to cost $200 per month . they also expect that they each spend $250 per month each on miscellaneous items like coffee, newspapers, etc. REQUIRED - 75 marks 1. Prepare a net worth statement for Jeff and Sylvia using the asset and liability information provided. Assume that the values indicated above include any payments that are being made, i.e. the values above accurately depict net market values. (12) 2. Prepare a cash flow statement for Jeff and Sylvia at their age 65 using the income and expense information provided. Calculate the net after tax retirement income for each of them and show it separately. What is their monthly cash flow surplus/deficit? (35) Given that they should retire with as little debt as possible, what is the best strategy to pay off their debts as soon as possible given their net worth and cash flow? Be specific (4) If they are unable to pay off the entire mortgage should they continue with a variable rate mortgage? (2) Explain the reasons for your recommendation. What is your projection for future interest rates and what supports this outlook? (2) If they need additional income in the future would you recommend the Canadian Home Income Plan (CHIP)? If so why or why not? Also what are the requirements for the Chan's to use this program and what would you consider its pros and cons? (8) Should they maintain a line of credit in retirement and if so for what amount? (2) Would it make sense for them to increase the amount available that can be borrowed? What is a likely amount that the bank will approve them for given their net worth? (2) Do either one of them need disability insurance? If so explain the reasons why and what amount they should have. (2) Is there any way for them to reduce their fixed housing expenses other than by reducing the mortgage payment? (2) If they decide to downsize and sell the house or market value of $850,000 how much will they receive after standard realtor commissions and taxes? They purchased the house for $200,000 in 1980 and their tax rate is 40%. (2) When Jeff and Sylvia purchase home insurance that has a co-insurance clause of 80%, what would be the minimum amount of coverage they would need assuming a replacement cost of $850,000? What happens if they insure the replacement cost for less than 80%? (2) Required Format: Questions to be answered in the order provided, typed, double spaced and in 12 pt font. This is an individual assignment and the work submitted must be your own. You may however discuss the case with colleagues as part of a study group. For the net worth and cash flow you are free to create your own spreadsheets or use the ones provided on the moodle site