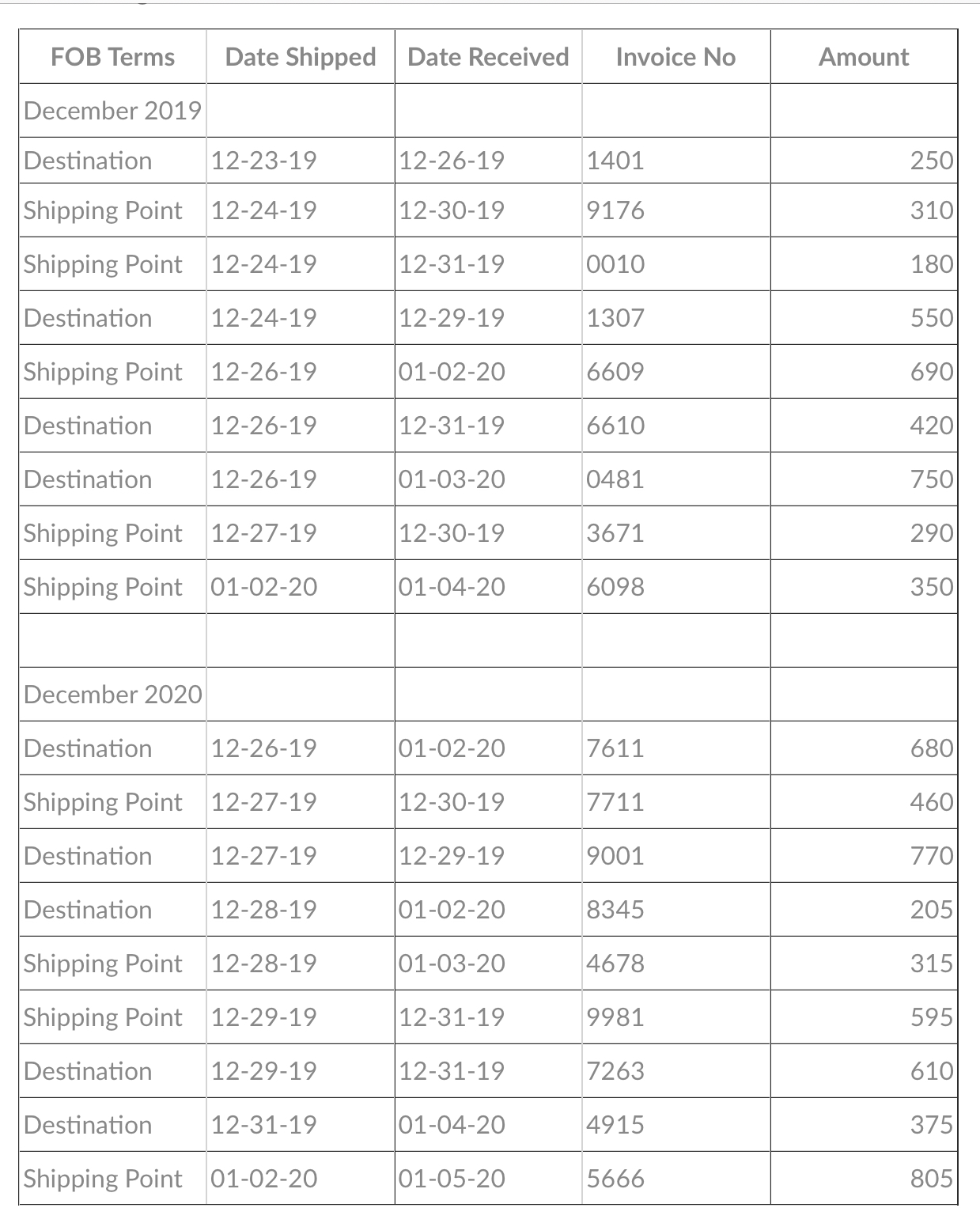

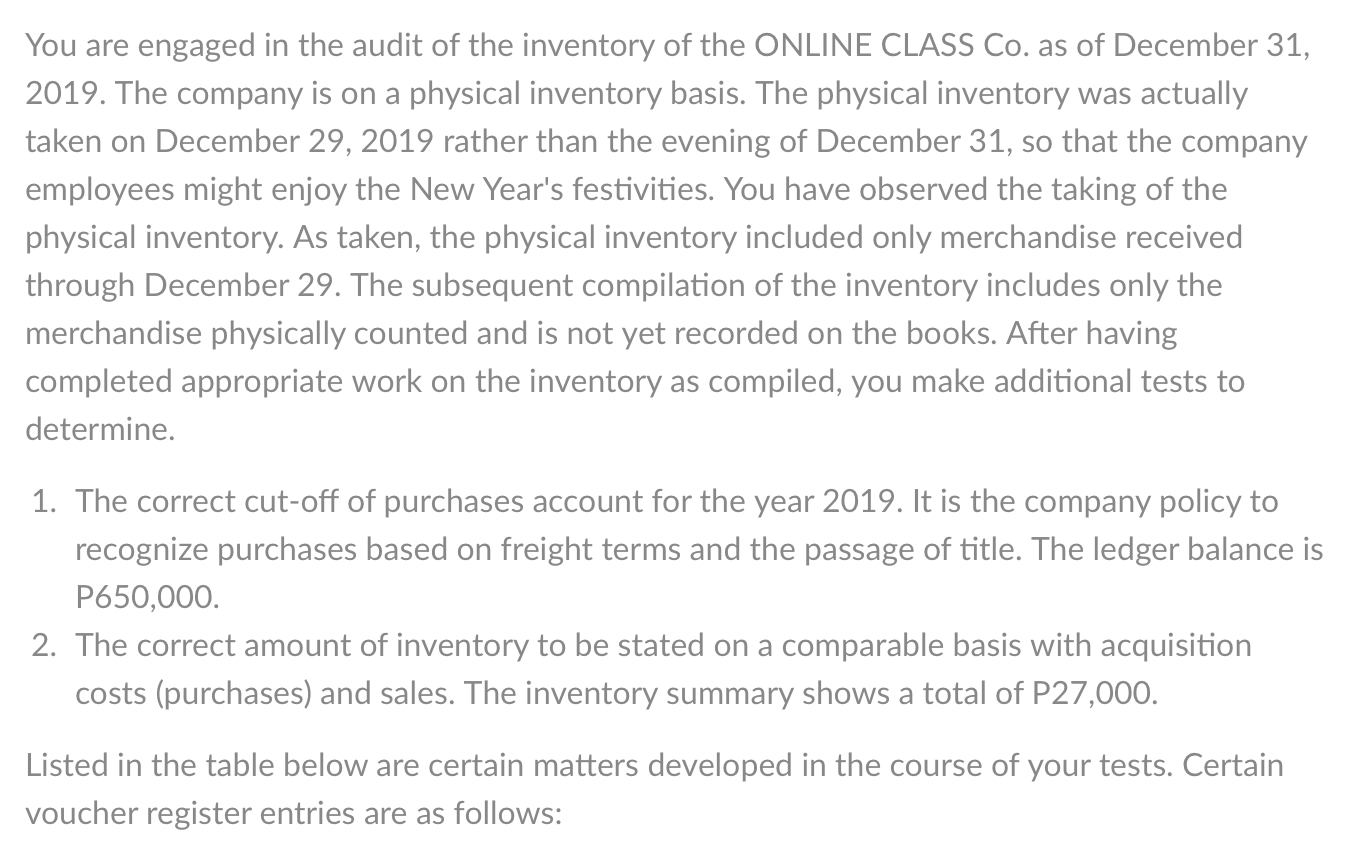

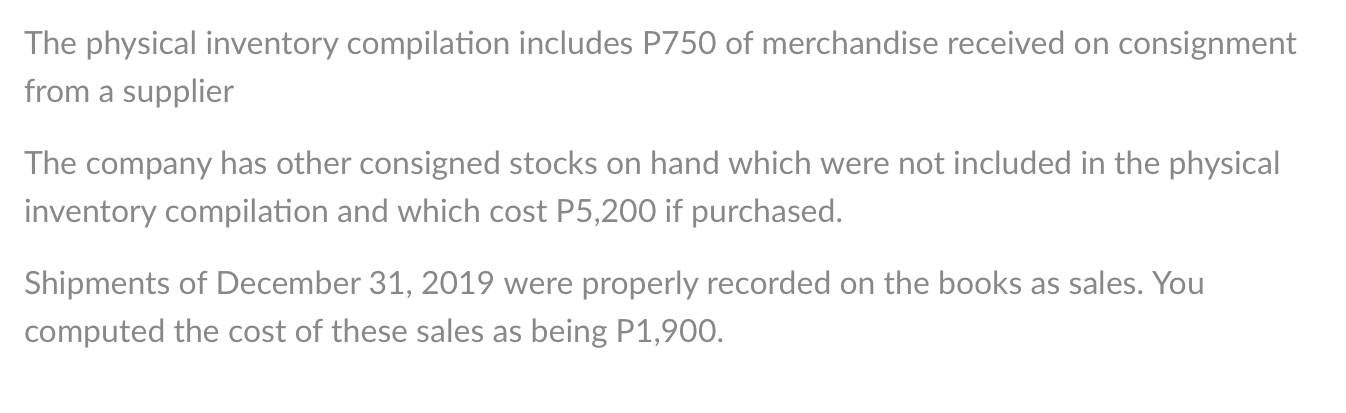

FOB Terms Date Shipped Date Received Invoice No Amount December 2019 Destination 12-23-19 12-26-19 1401 250 Shipping Point 12-24-19 12-30-19 9176 310 Shipping Point 12-24-19 12-31-19 0010 180 Destination 12-24-19 12-29-19 1307 550 Shipping Point 12-26-19 01-02-20 6609 690 Destination 12-26-19 12-31-19 6610 420 Destination 12-26-19 01-03-20 0481 750 Shipping Point 12-27-19 12-30-19 3671 290 Shipping Point 01-02-20 01-04-20 6098 350 December 2020 Destination 12-26-19 01-02-20 7611 680 Shipping Point 12-27-19 12-30-19 7711 460 Destination 12-27-19 12-29-19 9001 770 Destination 12-28-19 01-02-20 8345 205 Shipping Point 12-28-19 01-03-20 4678 315 Shipping Point 12-29-19 12-31-19 9981 595 Destination 12-29-19 12-31-19 7263 610 Destination 12-31-19 01-04-20 4915 375 Shipping Point 01-02-20 01-05-20 5666 805 You are engaged in the audit of the inventory of the ONLINE CLASS Co. as of December 31, 2019. The company is on a physical inventory basis. The physical inventory was actually taken on December 29, 2019 rather than the evening of December 31, so that the company employees might enjoy the New Year's festivities. You have observed the taking of the physical inventory. As taken, the physical inventory included only merchandise received through December 29. The subsequent compilation of the inventory includes only the merchandise physically counted and is not yet recorded on the books. After having completed appropriate work on the inventory as compiled, you make additional tests to determine. 1. The correct cut-off of purchases account for the year 2019. It is the company policy to recognize purchases based on freight terms and the passage of title. The ledger balance is P650000. 2. The correct amount of inventory to be stated on a comparable basis with acquisition costs (purchases) and sales. The inventory summary shows a total of P27,000. Listed in the table below are certain matters developed in the course of your tests. Certain voucher register entries are as follows: The physical inventory compilation includes P750 of merchandise received on consignment from a supplier The company has other consigned stocks on hand which were not included in the physical inventory compilation and which cost P5200 if purchased. Shipments of December 31, 2019 were properly recorded on the books as sales. You computed the cost of these sales as being P1,900