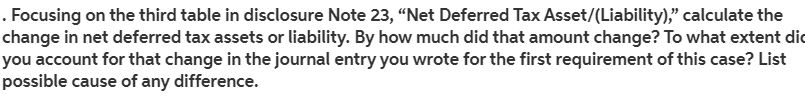

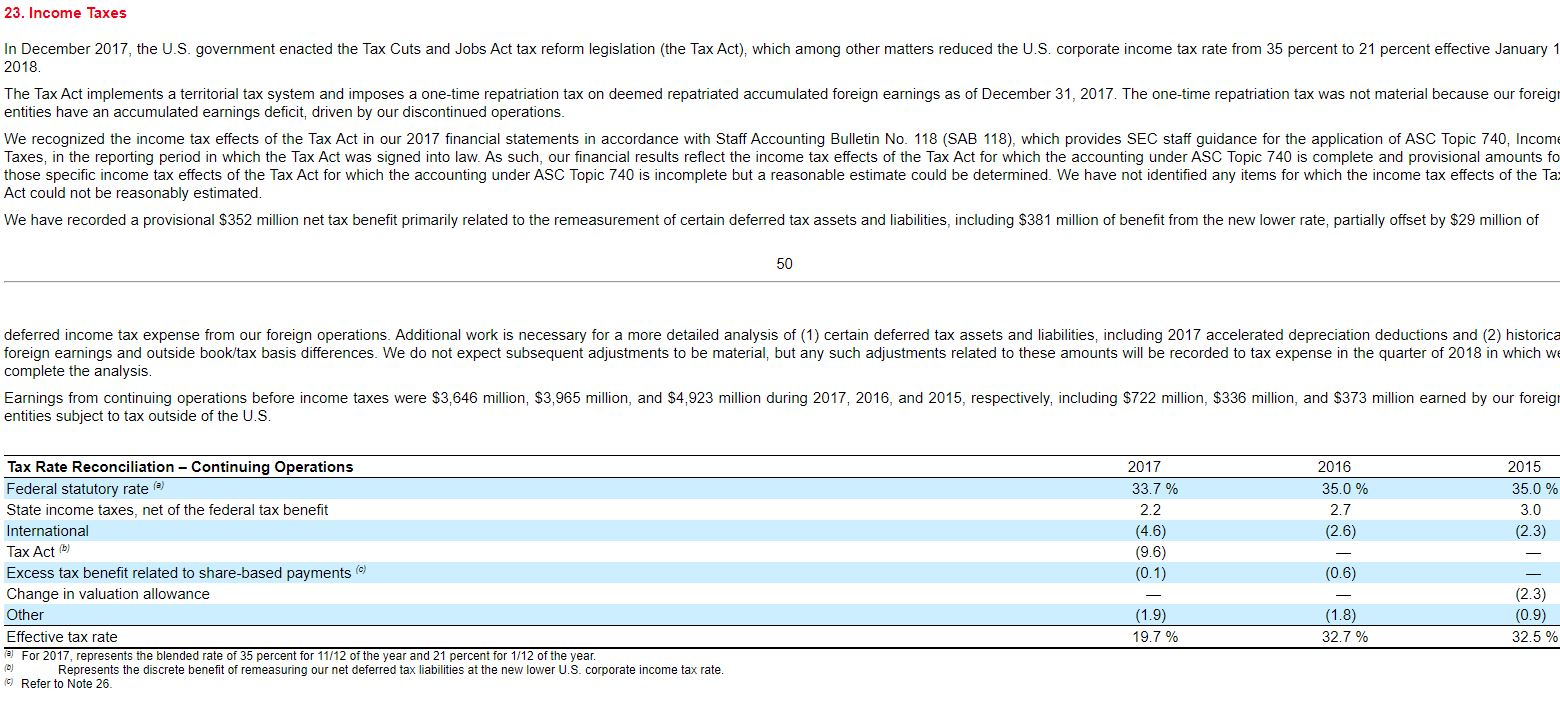

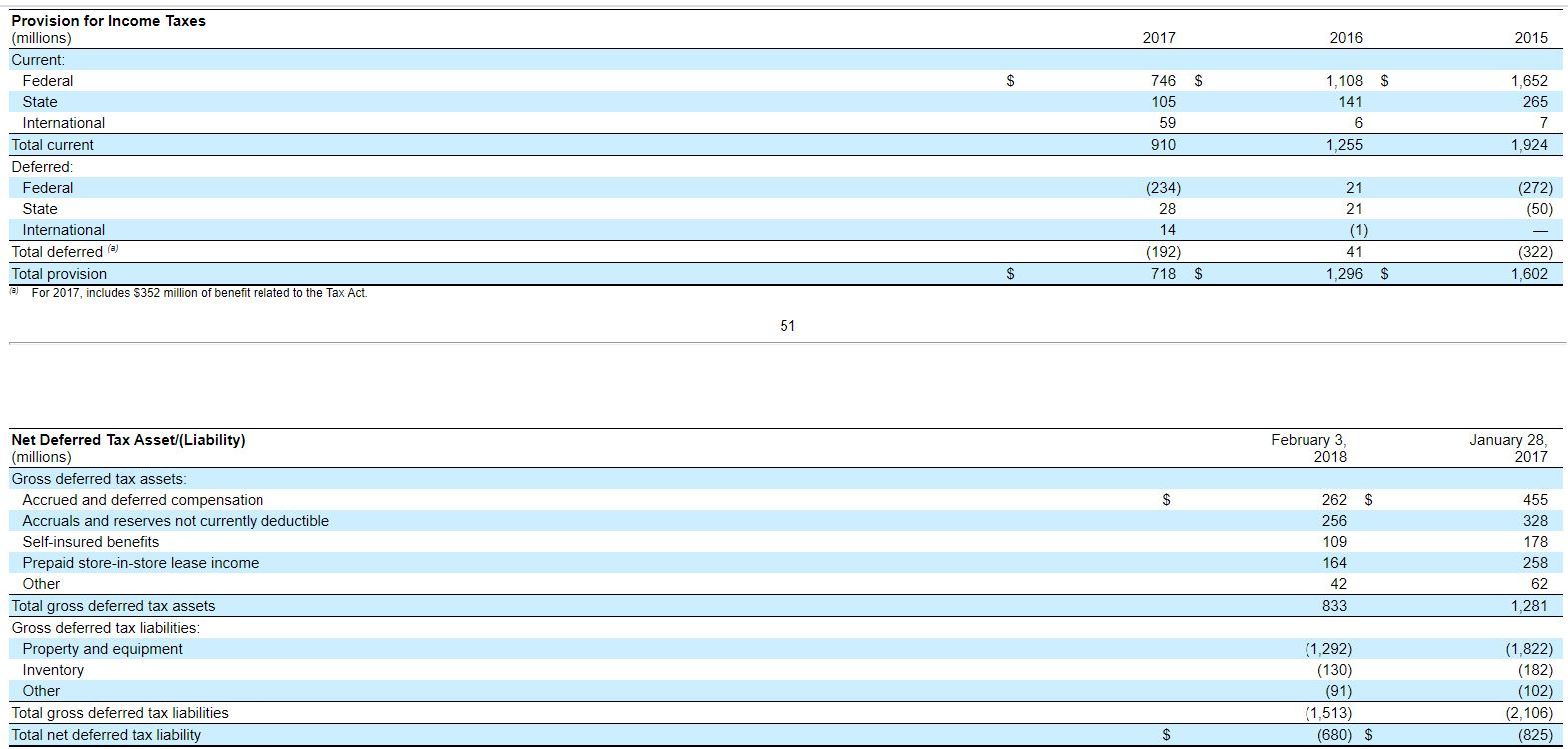

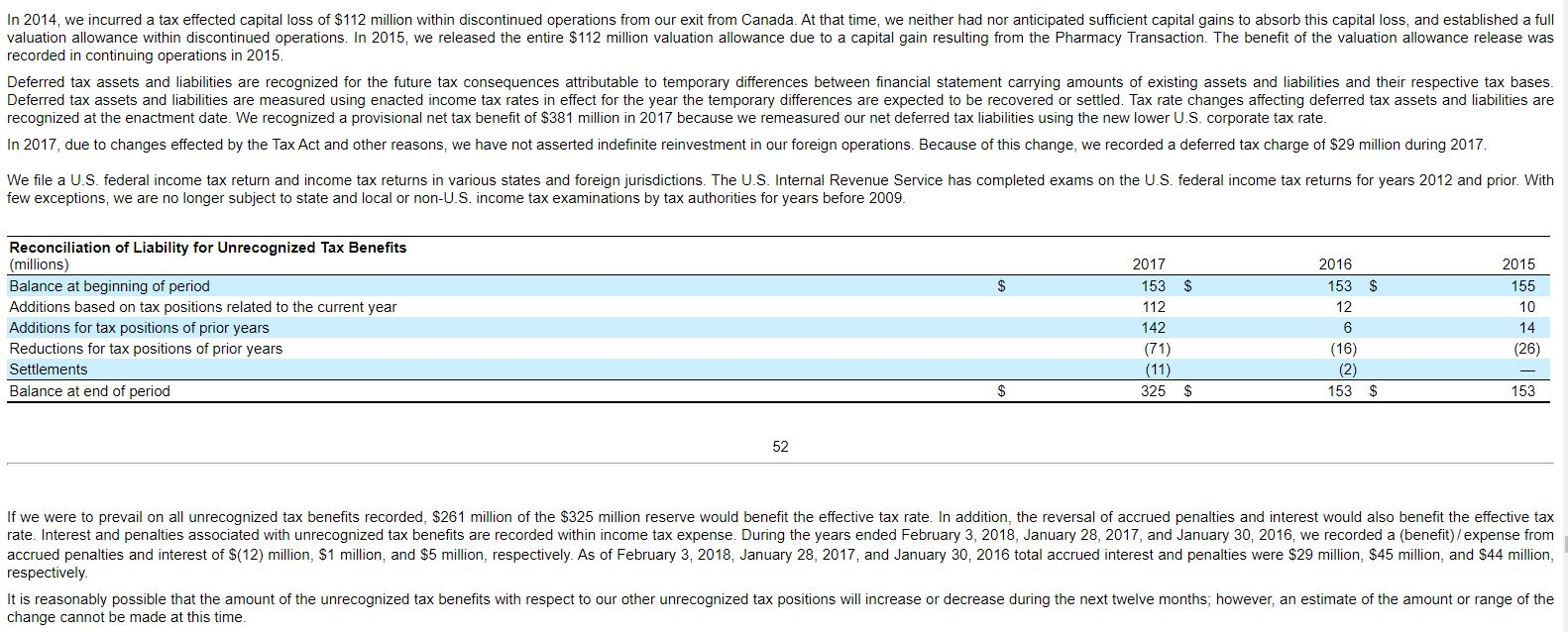

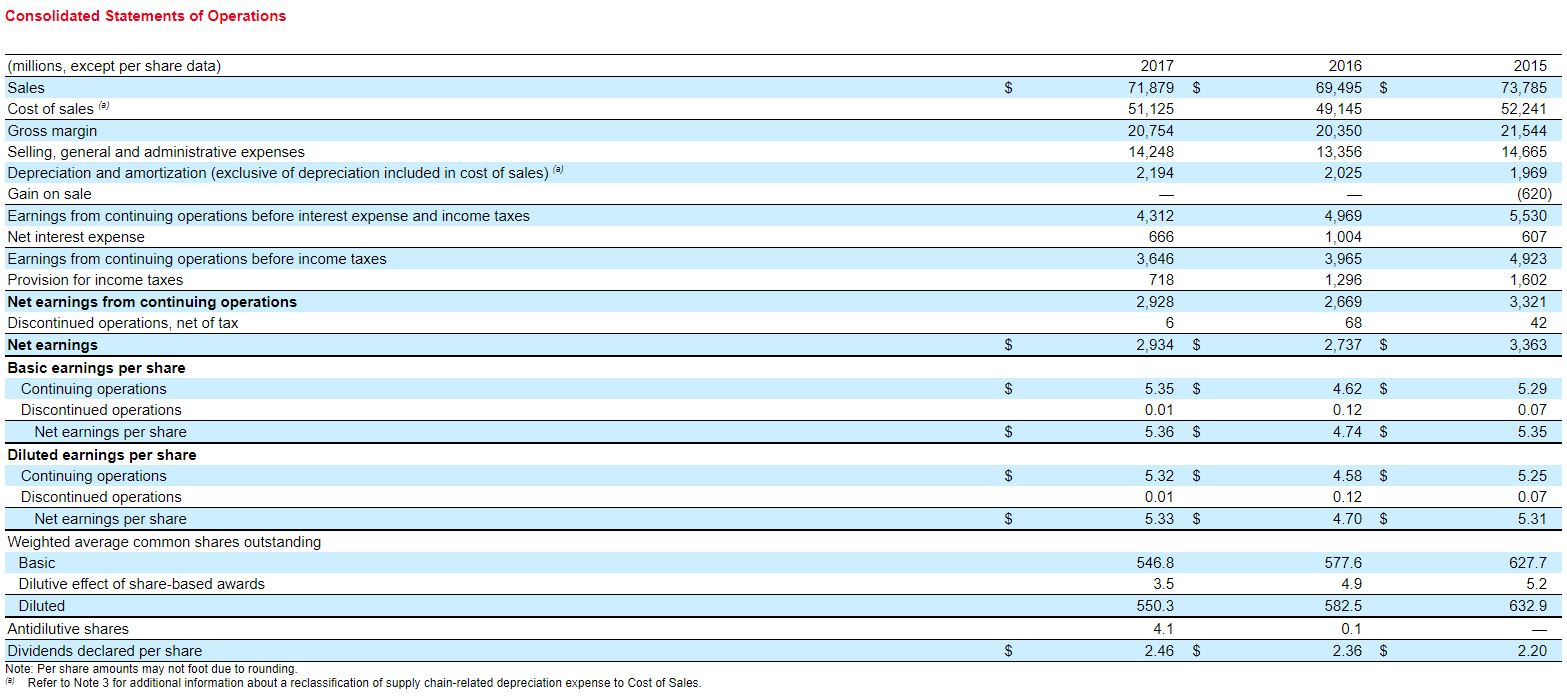

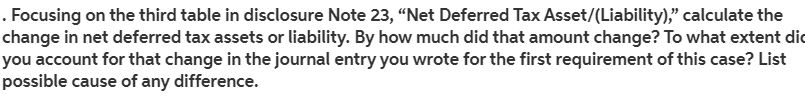

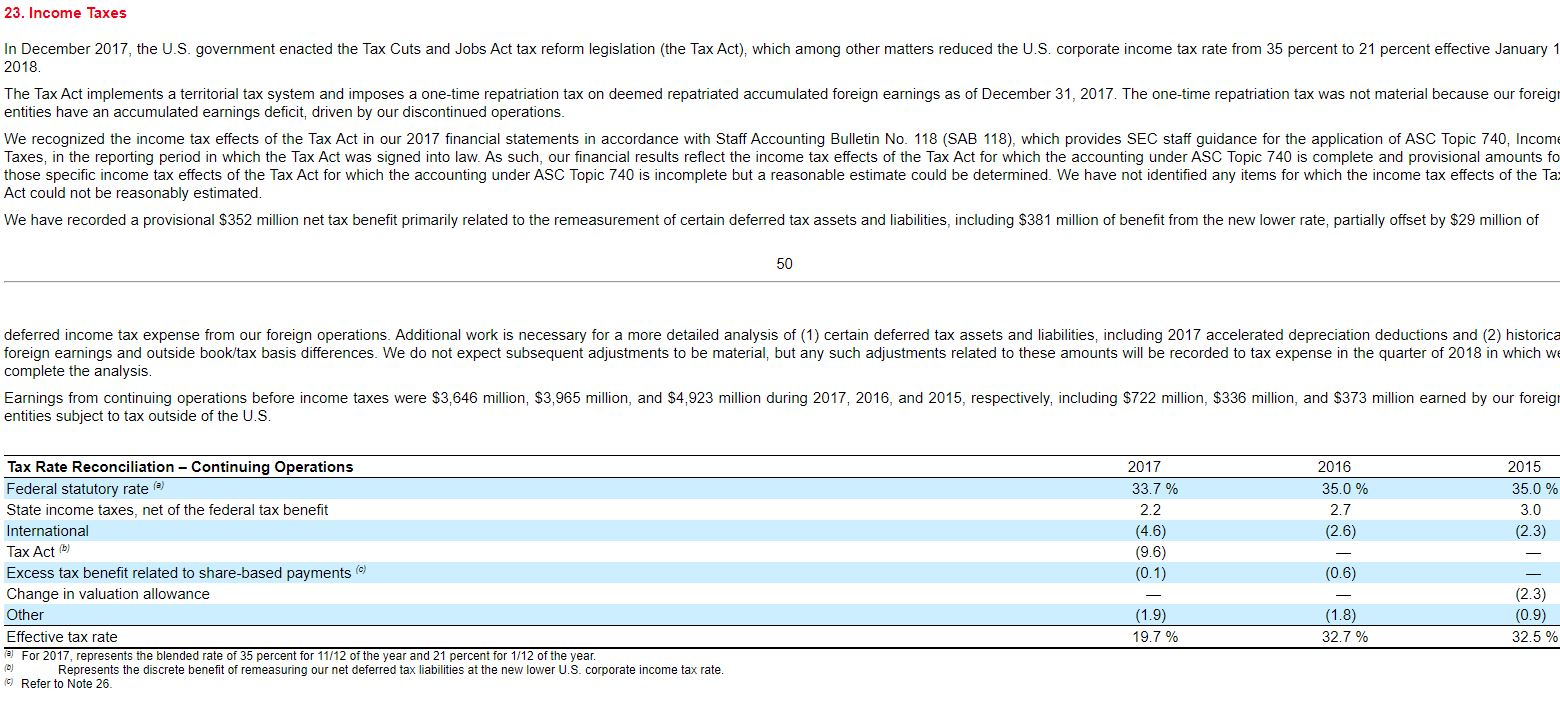

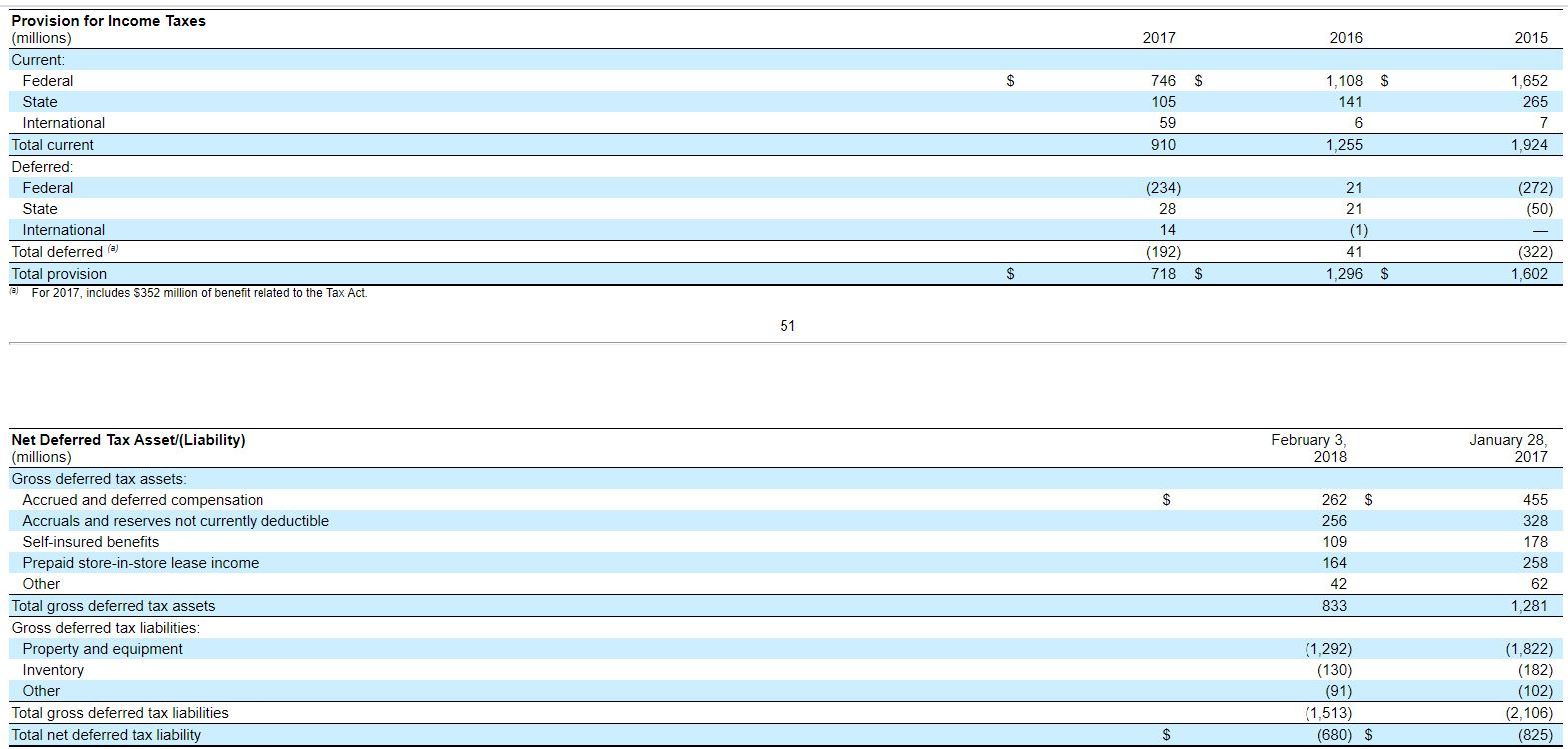

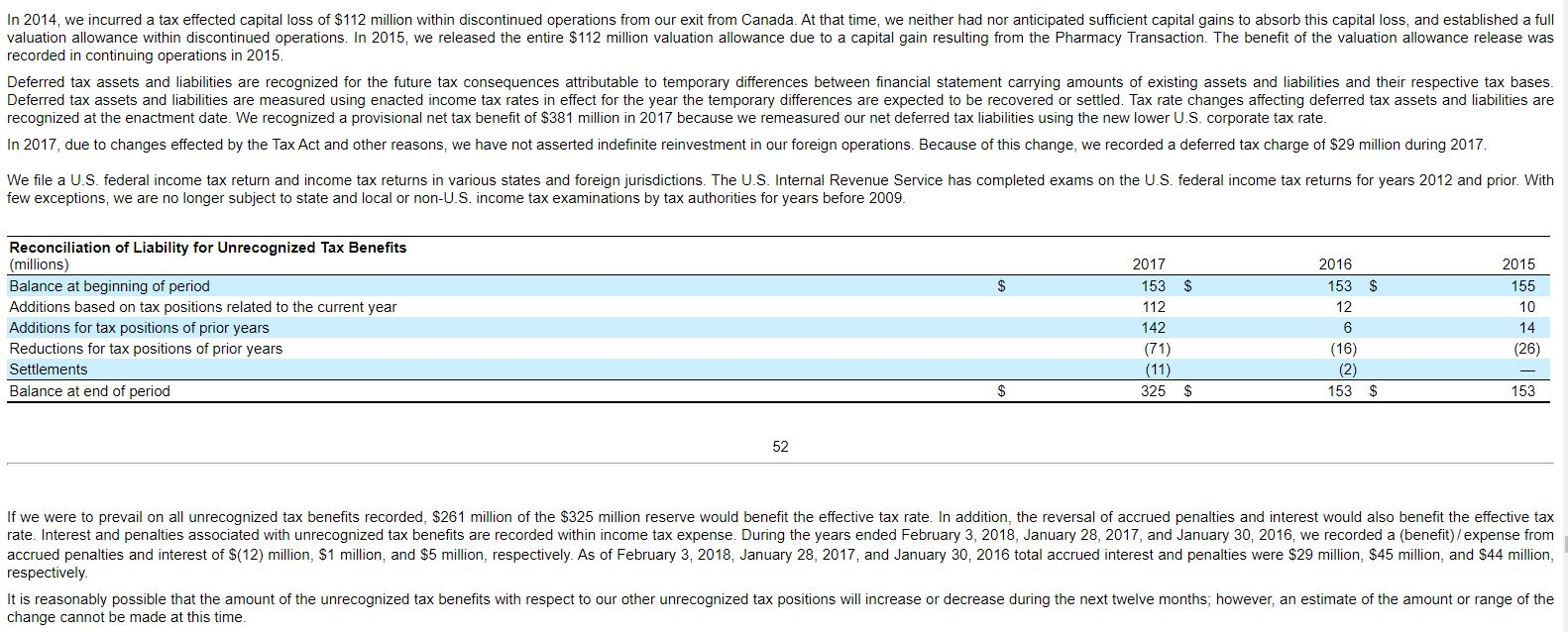

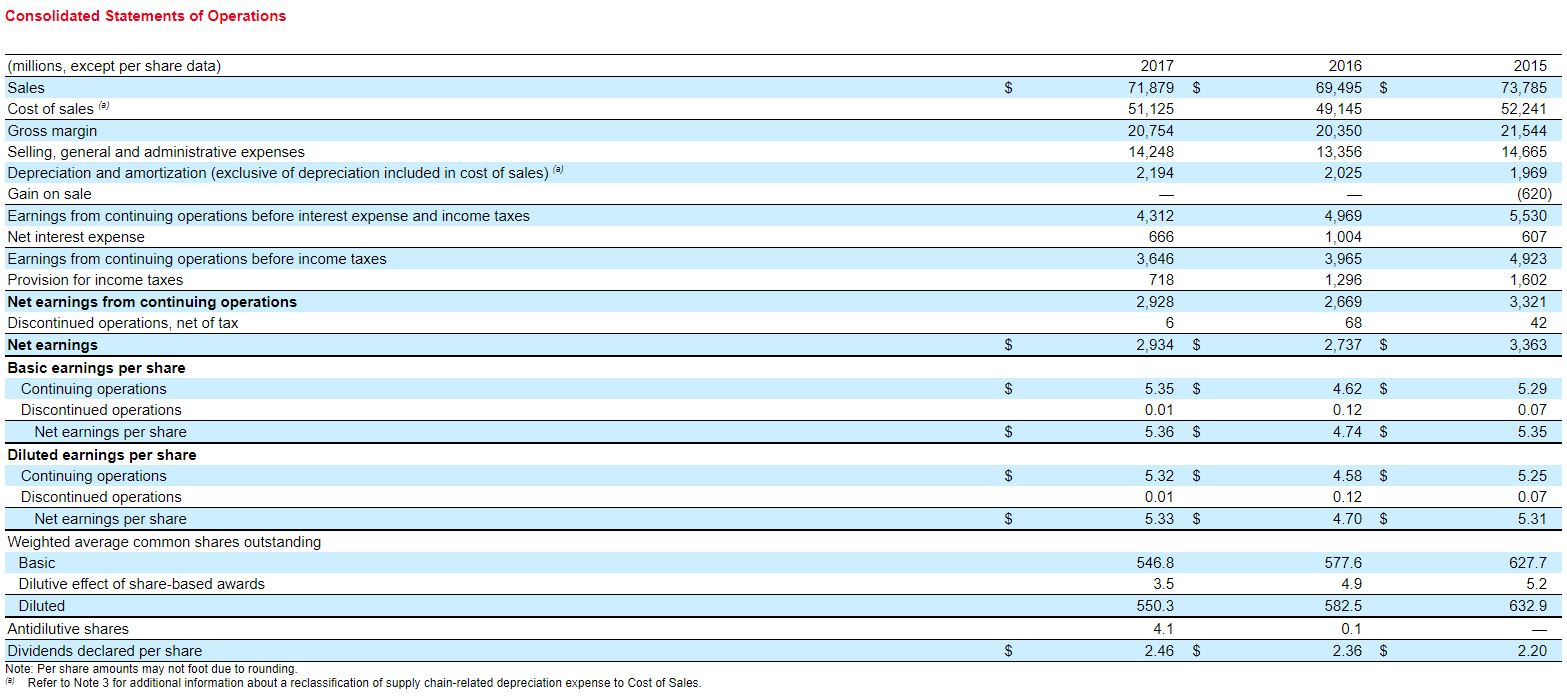

. Focusing on the third table in disclosure Note 23, "Net Deferred Tax Asset/(Liability)," calculate the change in net deferred tax assets or liability. By how much did that amount change? To what extent di you account for that change in the journal entry you wrote for the first requirement of this case? List possible cause of any difference. 23. Income Taxes In December 2017, the U.S. government enacted the Tax Cuts and Jobs Act tax reform legislation (the Tax Act), which among other matters reduced the U.S. corporate income tax rate from 35 percent to 21 percent effective January 1 2018. The Tax Act implements a territorial tax system and imposes a one-time repatriation tax on deemed repatriated accumulated foreign earnings as of December 31, 2017. The one-time repatriation tax was not material because our foreign entities have an accumulated earnings deficit, driven by our discontinued operations. We recognized the income tax effects of the Tax Act in our 2017 financial statements in accordance with Staff Accounting Bulletin No. 118 (SAB 118), which provides SEC staff guidance for the application of ASC Topic 740, Income Taxes, in the reporting period in which the Tax Act was signed into law. As such, our financial results reflect the income tax effects of the Tax Act for which the accounting under ASC Topic 740 is complete and provisional amounts fo those specific income tax effects of the Tax Act for which the accounting under ASC Topic 740 is incomplete but a reasonable estimate could be determined. We have not identified any items for which the income tax effects of the Ta Act could not be reasonably estimated. We have recorded a provisional $352 million net tax benefit primarily related to the remeasurement of certain deferred tax assets and liabilities, including $381 million of benefit from the new lower rate, partially offset by $29 million of 50 deferred income tax expense from our foreign operations. Additional work is necessary for a more detailed analysis of (1) certain deferred tax assets and liabilities, including 2017 accelerated depreciation deductions and (2) historica foreign earnings and outside book/tax basis differences. We do not expect subsequent adjustments to be material, but any such adjustments related to these amounts will be recorded to tax expense in the quarter of 2018 in which we complete the analysis. Earnings from continuing operations before income taxes were $3,646 million, $3,965 million, and $4,923 million during 2017, 2016, and 2015, respectively, including $722 million, $336 million, and $373 million earned by our foreign entities subject to tax outside of the U.S. 2017 33.7 % 22 (4.6) (9.6) (0.1) 2016 35.0 % 2.7 (2.6) Tax Rate Reconciliation - Continuing Operations Federal statutory rate) State income taxes, net of the federal tax benefit International Tax Actb) Excess tax benefit related to share-based payments Change in valuation allowance Other Effective tax rate For 2017, represents the blended rate of 35 percent for 11/12 of the year and 21 percent for 1/12 of the year. Represents the discrete benefit of remeasuring our net deferred tax liabilities at the new lower U.S. corporate income tax rate. Refer to Note 26. 2015 35.0 % 3.0 (2.3) (0.6) (1.9) 19.7 % (1.8) 32.7 % (2.3) (0.9) 32.5% 2017 2016 2015 $ $ 1,652 265 746 105 59 910 910 1,108 141 6 1,255 1,924 Provision for Income Taxes (millions) Current: Federal State International Total current Deferred: Federal State International Total deferred Total provision For 2017, includes $352 million of benefit related to the Tax Act. (272) (50) (234) 28 - 14 (192) 718 21 21 (1) 41 1,296 (322) 1.602 $ $ February 3, 2018 January 28, 2017 262 $ 256 109 164 Net Deferred Tax Asset/(Liability) (millions) Gross deferred tax assets: Accrued and deferred compensation Accruals and reserves not currently deductible Self-insured benefits Prepaid store-in-store lease income Other Total gross deferred tax assets Gross deferred tax liabilities: Property and equipment Inventory Other Total gross deferred tax liabilities Total net deferred tax liability 455 328 178 258 62 1,281 42 833 (1,292) (130) (91) (1,513) (680) $ (1,822) (182) (102) (2,106) (825) In 2014, we incurred a tax effected capital loss of $112 million within discontinued operations from our exit from Canada. At that time, we neither had nor anticipated sufficient capital gains to absorb this capital loss, and established a full valuation allowance within discontinued operations. In 2015, we released the entire $112 million valuation allowance due to a capital gain resulting from the Pharmacy Transaction. The benefit of the valuation allowance release was recorded in continuing operations in 2015. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted income tax rates in effect for the year the temporary differences are expected to be recovered or settled. Tax rate changes affecting deferred tax assets and liabilities are recognized at the enactment date. We recognized a provisional net tax benefit of $381 million in 2017 because we remeasured our net deferred tax liabilities using the new lower U.S. corporate tax rate. In 2017, due to changes effected by the Tax Act and other reasons, we have not asserted indefinite reinvestment in our foreign operations. Because of this change, we recorded a deferred tax charge of $29 million during 2017 We file a U.S. federal income tax return and income tax returns in various states and foreign jurisdictions. The U.S. Internal Revenue Service has completed exams on the U.S. federal income tax returns for years 2012 and prior. With few exceptions, we are no longer subject to state and local or non-U.S. income tax examinations by tax authorities for years before 2009. $ Reconciliation of Liability for Unrecognized Tax Benefits (millions) Balance at beginning of period Additions based on tax positions related to the current year Additions for tax positions of prior years Reductions for tax positions of prior years Settlements Balance at end of period 2015 155 10 2017 153 112 142 (71) (11) 325 2016 153 $ 12 6 (16) 14 (26) (2) $ 153 $ 153 If we were to prevail on all unrecognized tax benefits recorded, $261 million of the $325 million reserve would benefit the effective tax rate. In addition, the reversal of accrued penalties and interest would also benefit the effective tax rate. Interest and penalties associated with unrecognized tax benefits are recorded within income tax expense. During the years ended February 3, 2018, January 28, 2017, and January 30, 2016, we recorded a (benefit) / expense from accrued penalties and interest of $(12) million, $1 million, and $5 million, respectively. As of February 3, 2018, January 28, 2017, and January 30, 2016 total accrued interest and penalties were $29 million, $45 million, and $44 million, respectively. It is reasonably possible that the amount of the unrecognized tax benefits with respect to our other unrecognized tax positions will increase or decrease during the next twelve months, however, an estimate of the amount or range of the change cannot be made at this time. Consolidated Statements of Operations $ 2017 71,879 $ 51,125 20.754 14,248 2,194 2016 69,495 $ 49,145 20,350 13,356 2,025 2015 73,785 52,241 21,544 14,665 1,969 (620) 5,530 607 4,923 1,602 3,321 42 3,363 4,312 666 3,646 718 2,928 6 2.934 4,969 1,004 3,965 1.296 2,669 68 2,737 $ $ (millions, except per share data) Sales Cost of sales) Gross margin Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) () Gain on sale Earnings from continuing operations before interest expense and income taxes Net interest expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earnings Basic earnings per share Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations Discontinued operations Net earnings per share Weighted average common shares outstanding Basic Dilutive effect of share-based awards Diluted Antidilutive shares Dividends declared per share Note: Per share amounts may not foot due to rounding a) Refer to Note 3 for additional information about a reclassification of supply chain-related depreciation expense to Cost of Sales $ 5.35 0.01 5.36 4.62 $ 0.12 4.74 $ 5.29 0.07 5.35 $ $ $ 5.32 0.01 5.33 4.58 $ 0.12 4.70 $ 5.25 0.07 5.31 $ 546.8 3.5 550.3 4.1 2.46 577.6 4.9 582.5 0.1 2.36 627.7 5.2 632.9 $ $ 2.20