Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Foleo Accessories has 2 manufacturing processes required to produce the car cradles, undertaken by the Electronics and Plastics departments. These departments are both currently

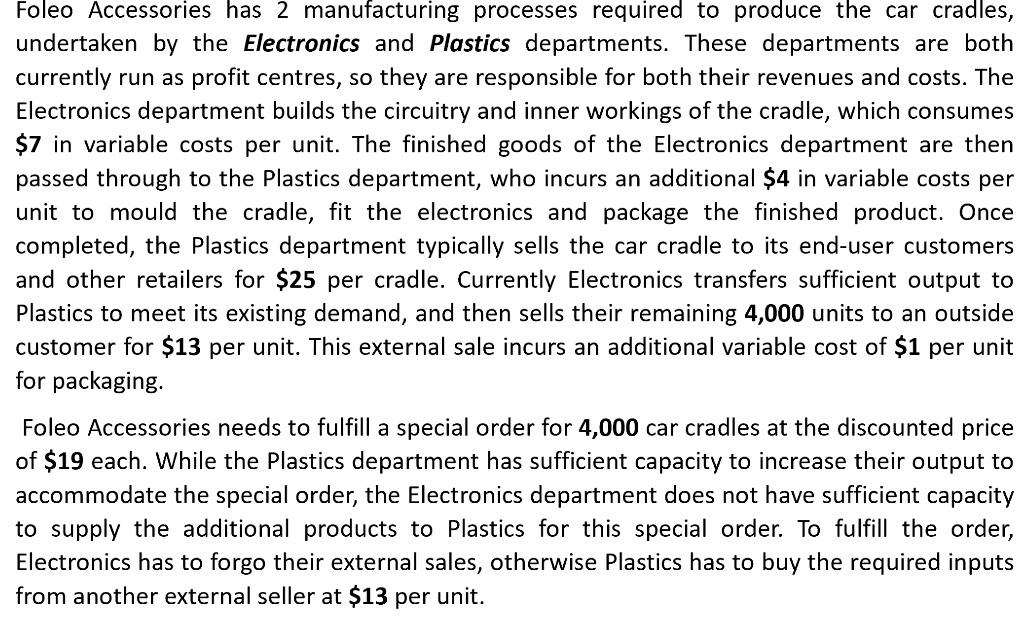

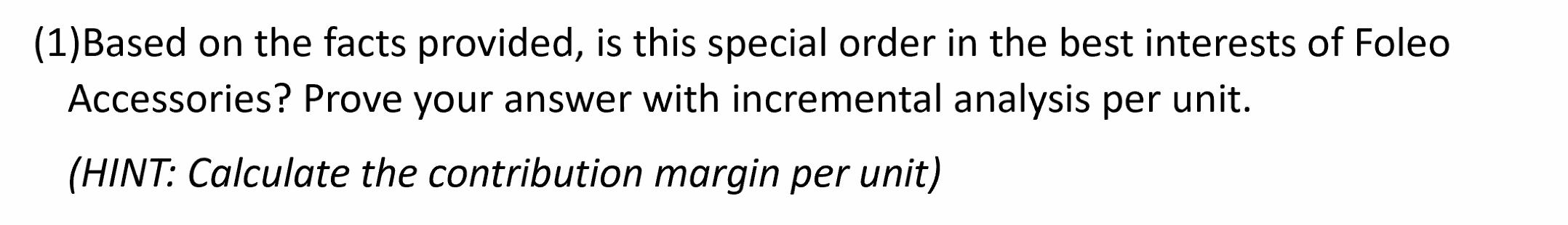

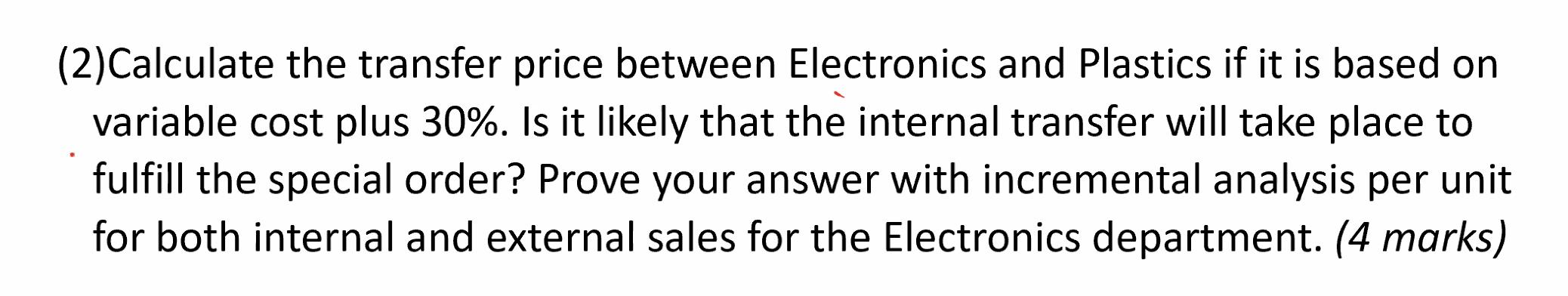

Foleo Accessories has 2 manufacturing processes required to produce the car cradles, undertaken by the Electronics and Plastics departments. These departments are both currently run as profit centres, so they are responsible for both their revenues and costs. The Electronics department builds the circuitry and inner workings of the cradle, which consumes $7 in variable costs per unit. The finished goods of the Electronics department are then passed through to the Plastics department, who incurs an additional $4 in variable costs per unit to mould the cradle, fit the electronics and package the finished product. Once completed, the Plastics department typically sells the car cradle to its end-user customers and other retailers for $25 per cradle. Currently Electronics transfers sufficient output to Plastics to meet its existing demand, and then sells their remaining 4,000 units to an outside customer for $13 per unit. This external sale incurs an additional variable cost of $1 per unit for packaging. Foleo Accessories needs to fulfill a special order for 4,000 car cradles at the discounted price of $19 each. While the Plastics department has sufficient capacity to increase their output to accommodate the special order, the Electronics department does not have sufficient capacity to supply the additional products to Plastics for this special order. To fulfill the order, Electronics has to forgo their external sales, otherwise Plastics has to buy the required inputs from another external seller at $13 per unit. (1)Based on the facts provided, is this special order in the best interests of Foleo Accessories? Prove your answer with incremental analysis per unit. (HINT: Calculate the contribution margin per unit) (2)Calculate the transfer price between Electronics and Plastics if it is based on variable cost plus 30%. Is it likely that the internal transfer will take place to fulfill the special order? Prove your answer with incremental analysis per unit for both internal and external sales for the Electronics department. (4 marks) Foleo Accessories has 2 manufacturing processes required to produce the car cradles, undertaken by the Electronics and Plastics departments. These departments are both currently run as profit centres, so they are responsible for both their revenues and costs. The Electronics department builds the circuitry and inner workings of the cradle, which consumes $7 in variable costs per unit. The finished goods of the Electronics department are then passed through to the Plastics department, who incurs an additional $4 in variable costs per unit to mould the cradle, fit the electronics and package the finished product. Once completed, the Plastics department typically sells the car cradle to its end-user customers and other retailers for $25 per cradle. Currently Electronics transfers sufficient output to Plastics to meet its existing demand, and then sells their remaining 4,000 units to an outside customer for $13 per unit. This external sale incurs an additional variable cost of $1 per unit for packaging. Foleo Accessories needs to fulfill a special order for 4,000 car cradles at the discounted price of $19 each. While the Plastics department has sufficient capacity to increase their output to accommodate the special order, the Electronics department does not have sufficient capacity to supply the additional products to Plastics for this special order. To fulfill the order, Electronics has to forgo their external sales, otherwise Plastics has to buy the required inputs from another external seller at $13 per unit. (1)Based on the facts provided, is this special order in the best interests of Foleo Accessories? Prove your answer with incremental analysis per unit. (HINT: Calculate the contribution margin per unit) (2)Calculate the transfer price between Electronics and Plastics if it is based on variable cost plus 30%. Is it likely that the internal transfer will take place to fulfill the special order? Prove your answer with incremental analysis per unit for both internal and external sales for the Electronics department. (4 marks) Foleo Accessories has 2 manufacturing processes required to produce the car cradles, undertaken by the Electronics and Plastics departments. These departments are both currently run as profit centres, so they are responsible for both their revenues and costs. The Electronics department builds the circuitry and inner workings of the cradle, which consumes $7 in variable costs per unit. The finished goods of the Electronics department are then passed through to the Plastics department, who incurs an additional $4 in variable costs per unit to mould the cradle, fit the electronics and package the finished product. Once completed, the Plastics department typically sells the car cradle to its end-user customers and other retailers for $25 per cradle. Currently Electronics transfers sufficient output to Plastics to meet its existing demand, and then sells their remaining 4,000 units to an outside customer for $13 per unit. This external sale incurs an additional variable cost of $1 per unit for packaging. Foleo Accessories needs to fulfill a special order for 4,000 car cradles at the discounted price of $19 each. While the Plastics department has sufficient capacity to increase their output to accommodate the special order, the Electronics department does not have sufficient capacity to supply the additional products to Plastics for this special order. To fulfill the order, Electronics has to forgo their external sales, otherwise Plastics has to buy the required inputs from another external seller at $13 per unit. (1)Based on the facts provided, is this special order in the best interests of Foleo Accessories? Prove your answer with incremental analysis per unit. (HINT: Calculate the contribution margin per unit) (2)Calculate the transfer price between Electronics and Plastics if it is based on variable cost plus 30%. Is it likely that the internal transfer will take place to fulfill the special order? Prove your answer with incremental analysis per unit for both internal and external sales for the Electronics department. (4 marks)

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Yes the special order is in the best interests of Foleo Accessories Working Incremental analysis per unit is shown in the following table Per unit S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started