Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Foley Systems is considering a new QUESTiems is consideran Straight line additional controverte Foley a bedelle, ancojects the P salvage value, and would requin SETA

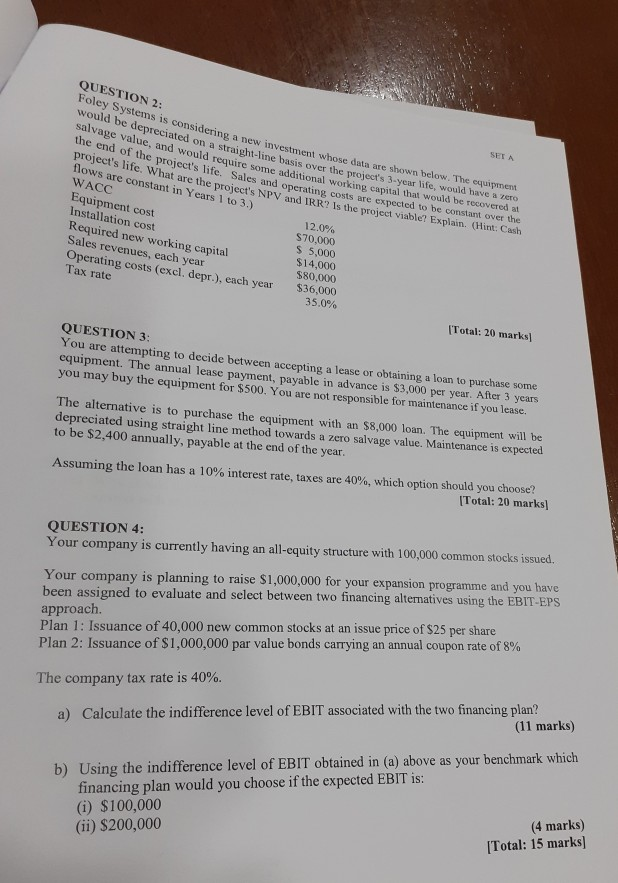

Foley Systems is considering a new QUESTiems is consideran Straight line additional controverte Foley a bedelle, ancojects the P salvage value, and would requin SETA Considering a new investment whose dates are shown below. The equipment would be depreciated on a straight-line basis yet the project's 3-year te, e value, and would require some additional working capital that would be basis over the project's 3-year life, would have a zero end of the project's life. Sales and operating costs are expected to be constant project's life. What are the project's NPV and IRR? 15 What are the project's NPV and IRR? Is the project viable? Explain. (Hint: Cash flows are constant in Years 1 to 3.) WACC 12.0% Equipment cost Installation cost Required new working capital Sales revenues, each year Operating costs (excl. depr.), each year Tax rate working capital that would be TOOVTed at 3 ) istant over the hues, cache capital S70,000 $ 5,000 $14,000 $80,000 $36,000 35.0% (Total: 20 marks] QUESTION 3: You are attempting to decide between accepting a lease or obtaining a loan to purchase some equipment. The annual lease payment, payable in advance is $3,000 per year. After 3 years you may buy the equipment for $500. You are not responsible for maintenance if you lease. The alternative is to purchase the equipment with an $8,000 loan. The equipment will be depreciated using straight line method towards a zero salvage value. Maintenance is expected to be $2,400 annually, payable at the end of the year. Assuming the loan has a 10% interest rate, taxes are 40%, which option should you choose? [Total: 20 marks] QUESTION 4: Your company is currently having an all-equity structure with 100,000 common stocks issued. Your company is planning to raise $1,000,000 for your expansion programme and you have been assigned to evaluate and select between two financing alternatives using the EBIT-EPS approach Plan 1: Issuance of 40,000 new common stocks at an issue price of $25 per share Plan 2: Issuance of $1,000,000 par value bonds carrying an annual coupon rate of 8% The company tax rate is 40%. a) Calculate the indifference level of EBIT associated with the two financing plan? (11 marks) b) Using the indifference level of EBIT obtained in (a) above as your benchmark which financing plan would you choose if the expected EBIT is: (i) $100,000 (ii) $200,000 (4 marks) [Total: 15 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started