Follow spreadsheet layout

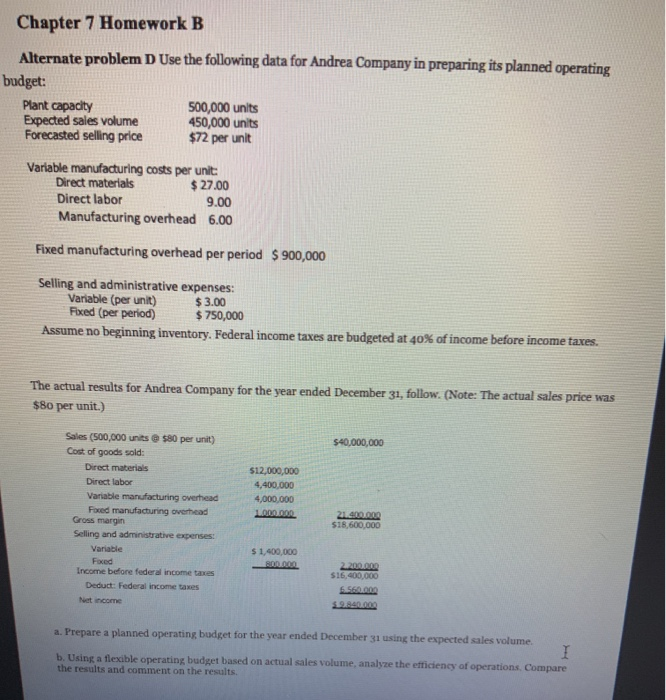

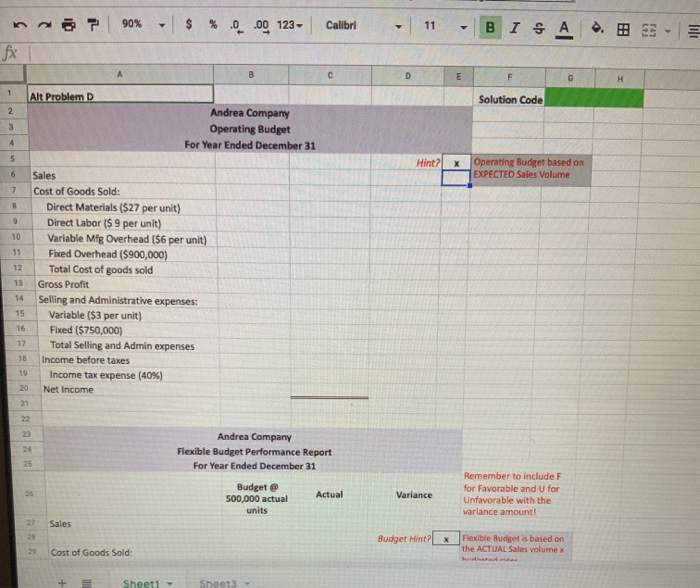

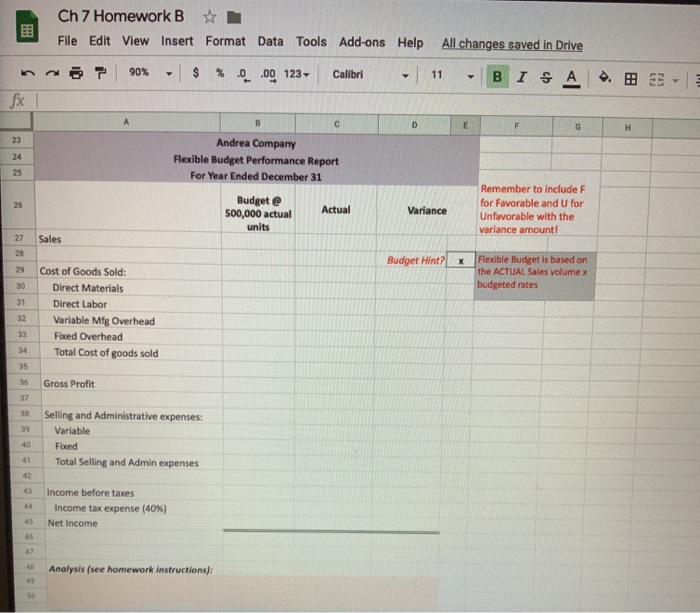

Chapter 7 Homework B Alternate problemD Use the following data for Andrea Company in preparing its planned operating budget: Plant capacity Expected sales volume Forecasted selling price 500,000 units 450,000 units $72 per unit Variable manufacturing costs per unit: Direct materials Direct labor $27.00 9.00 Manufacturing overhead 6.00 Fixed manufacturing overhead per period $900,000 Selling and administrative expenses: $3.00 $750,000 Variable (per unit) Fixed (per period) Assume no beginning inventory. Federal income taxes are budgeted at 40% of income before income taxes. The actual results for Andrea Company for the year ended December 31, follow. (Note: The actual sales price was $80 per unit.) Sales (500,000 units@$80 per unit) $40,000,000 Cost of goods sold: Direct materials $12,000,000 Direct labor 4,400,000 Variable manufacturing overhead 4,000,000 Foxed manufacturing overhead Gross margin 1000.000 21.400.000 $18.600.000 Selling and administrative expenses Variable $1,400,000 Foxed Income before federal income taxes 800.000 2.200.000 $16.400.000 Deduct: Federal income taxes 6.560.000 Net income $9.840 000 a. Prepare a planned operating budget for the year ended December 31 using the expected sales volume. b. Using a flexible operating budget based on actual sales volume, analyze the efficiency of operations. Compare the results and comment on the results. ISA B 90% .0 00 123- Calibri 11 B fx A C E G Alt Problem D Solution Code 2 Andrea Company Operating Budget 3 4 For Year Ended December 31 5 Hint? Operating Budget based on EXPECTED Sales Volume Sales 7 Cost of Goods Sold: Direct Materials ($27 per unit) Direct Labor ($ 9 per unit) Variable Mfg Overhead ($6 per unit) Fixed Overhead ($900,000) Total Cost of goods sold Gross Profit Selling and Administrative expenses: 9 10 11 12 13 14 15 Variable ($3 per unit) 16 Fixed ($750,000) 17 Total Selling and Admin expenses Income before taxes 18 19 Income tax expense (40 %) 20 Net Income 21 22 23 Andrea Company 24 Flexible Budget Performance Report 25 For Year Ended December 31 Remember to include F Budget@ 500,000 actual units for Favorable and U for 26 Actual Variance Unfavorable with the variance amount! 27 Sales 28 Flexible Budget is based on the ACTUAL Sales volume x Budget Hint? 29 Cost of Goods Sold: hednnted se Sheet1 Sheet3 Ch 7 Homework B File Edit View Insert Format Data Tools Add-ons Help All changes saved in Drive % 0 90% .00 123 - BISA. Calibri 11 fx E H 23 Andrea Company 24 Flexible Budget Performance Report 25 For Year Ended December 31 Remember to include F Budgete 500,000 actual for Favorable and U for 26 Actual Variance Unfavorable with the variance amount! units 27 Sales 28 Flexible Budget is based on the ACTUAL Sales volume x Budget Hint? Cost of Goods Sold: 29 budgeted rates 30 Direct Materials 31 Direct Labor 32 Variable Mfg Overhead 33 Fixed Overhead 34 Total Cost of goods sold 35 36 Gross Profit 37 38 Selling and Administrative expenses: 39 Variable 40 Fixed 41 Total Selling and Admin expenses 42 Income before taxes 43 Income tax expense (40 %) 45 Net Income 46 47 Analysis (see homework instructions): 48 49 50