follow the instructions carefully when goong to the sec.gov/edgar. make sure you go throigh the 10k filing type for 8/26/2020 (for the fiscal year ended 06/27/2020) the company name is Sysco Corp. i have includes multiple pictures of answer choices to choose from. let me know if you have any questions.

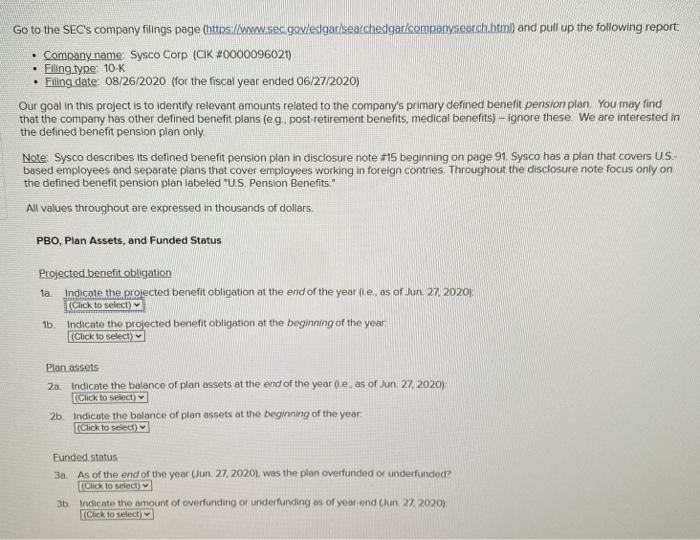

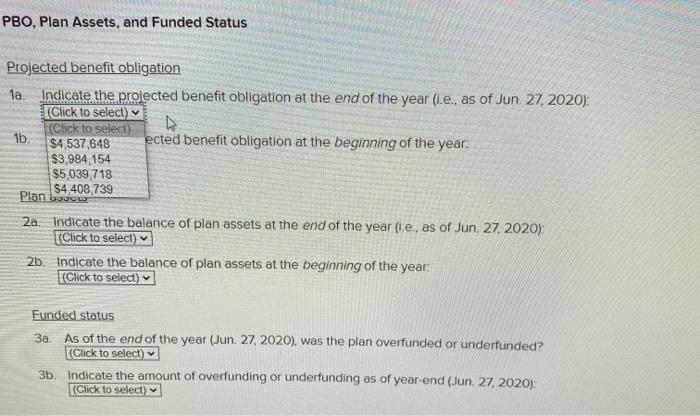

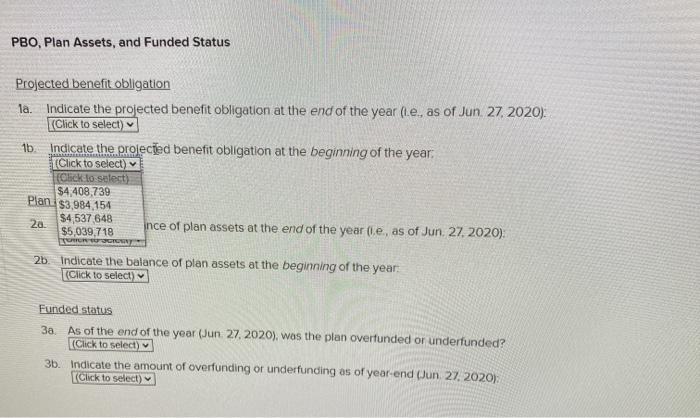

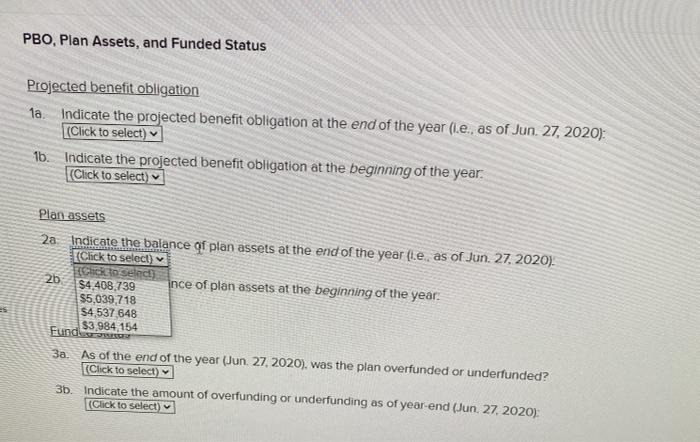

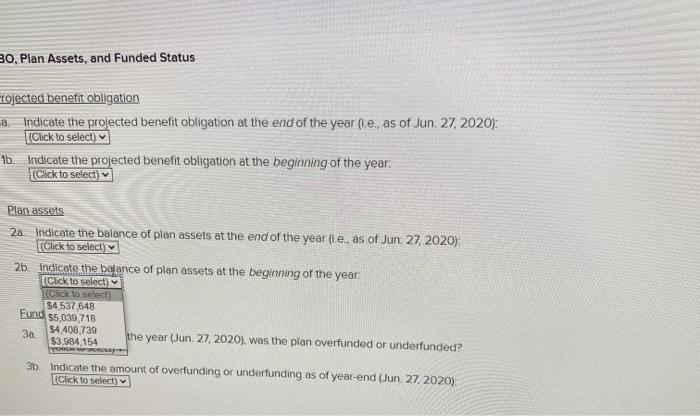

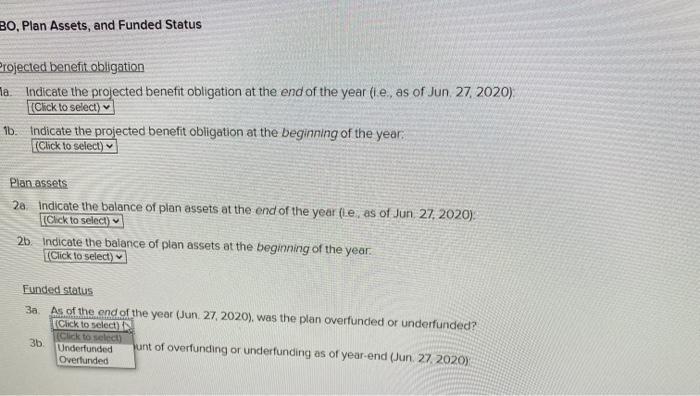

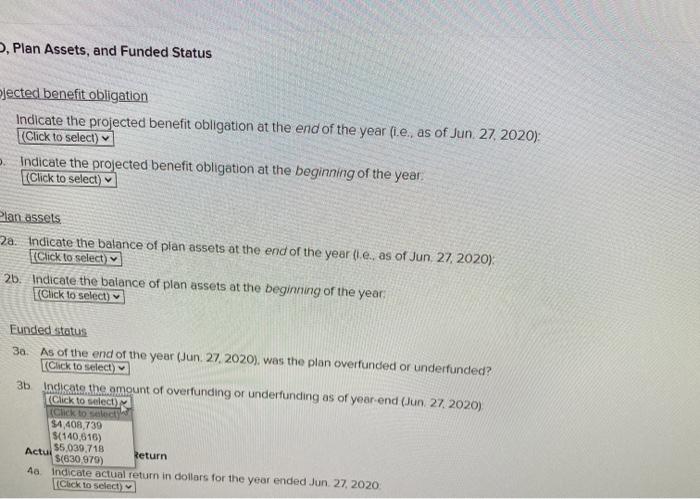

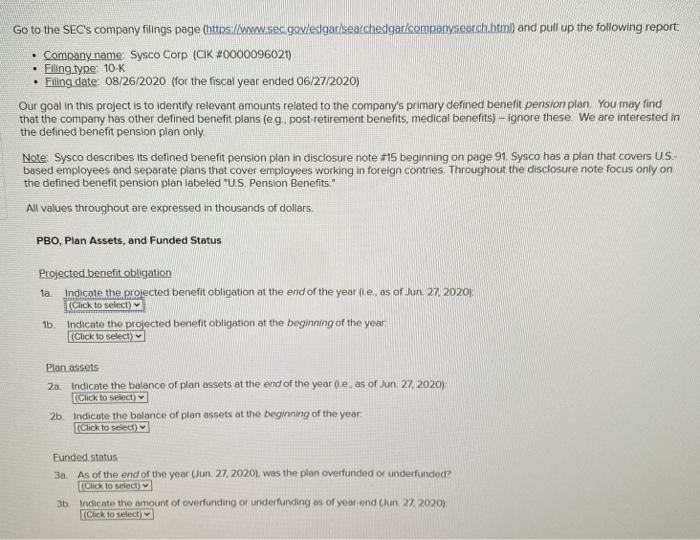

Go to the SEC's company filings page (https://www.sec.gov/edgar/searchedgor/companysearch.btmb and pull up the following report Company name: Sysco Corp (CK #0000096021) Filing_type: 10K Filing date: 08/26/2020 (for the fiscal year ended 06/27/2020) Our goal in this project is to identity relevant amounts related to the company's primary defined benefit pension plan You may find that the company has other detined benefit plans (eg. post-retirement benefits, medical benefits) - ignore these. We are interested in the defined benefit pension plan only. Note Sysco describes its defined benefit pension plan in disclosure note #15 beginning on page 91 Sysco has a plan that covers US based employees and separate plans that cover employees working in foreign contries. Throughout the disclosure note focus only on the defined benefit pension plan labeled "US, Pension Benefits." All values throughout are expressed in thousands of dollars. PBO, Plan Assets, and Funded Status Projected benefit obligation la indicate the projected benefit obligation at the end of the year ie as of Jun 27 2020 Click to select) Indicate tho projected benefit obligation at the beginning of the year (Click to select) 1b Plan assets 20. Indicate the balance of plan assets at the end of the year (le, as of Jun 27, 2020) Click to select) 21. Indicate the bolonce of plan assets at the beginning of the year Click to select) Funded status 3a. As of the end of the year (Jun.27.2020), was the plan overfunded or underfunded? (Click to select 36. Indicate the amount of overfunding or underfunding as of year-end Oun 27 2020) Click to select) PBO, Plan Assets, and Funded Status Projected benefit obligation la Indicate the projected benefit obligation at the end of the year (le, as of Jun 27. 2020): (Click to select) (Click to select) 1b. $4,537,648 ected benefit obligation at the beginning of the year. $3,984,154 $5,039,718 $4 408,739 Planc 2a. Indicate the balance of plan assets at the end of the year (ie, as of Jun. 27. 2020) (Click to select) 2b. Indicate the balance of plan assets at the beginning of the year. (Click to select) Funded status 3a. As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? (Click to select) 3b. Indicate the amount of overfunding or underfunding as of year-end (Jun. 27, 2020); (Click to select) PBO, Plan Assets, and Funded Status Projected benefit obligation 1a. Indicate the projected benefit obligation at the end of the year (le, as of Jun 27 2020): (Click to select) 1b Indicate the projected benefit obligation at the beginning of the year. (Click to select) folick to select) $4,408,739 Plan $3,984,154 20. $4,537 648 nce of plan assets at the end of the year (le, as of Jun, 27, 2020) $5,039,718 TROR OG 26. Indicate the balance of plan assets at the beginning of the year (Click to select Funded status 3a. As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? (Click to select) 36. Indicate the amount of overfunding or underfunding as of year-end (Jun 27. 2020); (Click to select) PBO, Plan Assets, and Funded Status Projected benefit obligation 1a. Indicate the projected benefit obligation at the end of the year (e. as of Jun 27, 2020): Click to select) 16. Indicate the projected benefit obligation at the beginning of the year. (Click to select) 20 Plan assets 2a. Indicate the balance of plan assets at the end of the year (i.e as of Jun. 27, 2020). (Click to select) Click to selec $4.408.739 ince of plan assets at the beginning of the year. $5,039,718 $4,537 648 Fisinds $3,984 154 3a. As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? (Click to select) 3b. Indicate the amount of overfunding or underfunding as of year-end (Jun 27, 2020): Click to select) 30, Plan Assets, and Funded Status a rojected benetit obligation Indicate the projected benefit obligation at the end of the year (ie, as of Jun 27, 2020): (Click to select) 16. Indicate the projected benefit obligation at the beginning of the year. (Click to select) Plan assets 2a. Indicate the balance of plan assets at the end of the year fi.e., as of Jun 27, 2020) Click to select) 2b. Indicate the balance of plan assets at the beginning of the year Click to select) Click to select) $4,537,648 Fund $5,039,718 30 $4.408,739 $3,984 154 the year (Jun.27.2020), was the plan overfunded or underfunded? 30. Indicate the amount of overfunding or underfunding as of year-end (Jun.27.2020) Click to select) BO, Plan Assets, and Funded Status Projected benefit obligation Ta Indicate the projected benefit obligation at the end of the year (ie, as of Jun 27, 2020) (Click to select) 16. Indicate the projected benefit obligation at the beginning of the year. Click to select) Plan assets 20. Indicate the balance of plan assets at the end of the year (le, as of Jun 27. 2020). Click to select) 2b. Indicate the balance of plan assets at the beginning of the year. (Click to select) Funded status 3a As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? Click to select) (Click to select 3b Underfunded Junt of overfunding or underfunding as of year-end (Jun.27. 2020) Overfunded Plan Assets, and Funded Status Djected benefit obligation Indicate the projected benefit obligation at the end of the year (ie, as of Jun 27, 2020): (Click to select) Indicate the projected benefit obligation at the beginning of the year. Click to select) Plan assets 2a. Indicate the balance of plan assets at the end of the year (e., as of Jun, 27, 2020) Click to select) 20. Indicate the balance of plan assets at the beginning of the year (Click to select) Funded status 30. As of the end of the year (Jun.27. 2020), was the plan overfunded or underfunded? Click to select 3. Indicate the amount of overfunding or underfunding as of year-end (Jun 27, 2020) (Click to select (Click to see $1,408,739 (140 616) Actul $5,030.718 Return $(630 979) 40. Indicate actual return in dollars for the year ended Jun 27, 2020 Click to select) Go to the SEC's company filings page (https://www.sec.gov/edgar/searchedgor/companysearch.btmb and pull up the following report Company name: Sysco Corp (CK #0000096021) Filing_type: 10K Filing date: 08/26/2020 (for the fiscal year ended 06/27/2020) Our goal in this project is to identity relevant amounts related to the company's primary defined benefit pension plan You may find that the company has other detined benefit plans (eg. post-retirement benefits, medical benefits) - ignore these. We are interested in the defined benefit pension plan only. Note Sysco describes its defined benefit pension plan in disclosure note #15 beginning on page 91 Sysco has a plan that covers US based employees and separate plans that cover employees working in foreign contries. Throughout the disclosure note focus only on the defined benefit pension plan labeled "US, Pension Benefits." All values throughout are expressed in thousands of dollars. PBO, Plan Assets, and Funded Status Projected benefit obligation la indicate the projected benefit obligation at the end of the year ie as of Jun 27 2020 Click to select) Indicate tho projected benefit obligation at the beginning of the year (Click to select) 1b Plan assets 20. Indicate the balance of plan assets at the end of the year (le, as of Jun 27, 2020) Click to select) 21. Indicate the bolonce of plan assets at the beginning of the year Click to select) Funded status 3a. As of the end of the year (Jun.27.2020), was the plan overfunded or underfunded? (Click to select 36. Indicate the amount of overfunding or underfunding as of year-end Oun 27 2020) Click to select) PBO, Plan Assets, and Funded Status Projected benefit obligation la Indicate the projected benefit obligation at the end of the year (le, as of Jun 27. 2020): (Click to select) (Click to select) 1b. $4,537,648 ected benefit obligation at the beginning of the year. $3,984,154 $5,039,718 $4 408,739 Planc 2a. Indicate the balance of plan assets at the end of the year (ie, as of Jun. 27. 2020) (Click to select) 2b. Indicate the balance of plan assets at the beginning of the year. (Click to select) Funded status 3a. As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? (Click to select) 3b. Indicate the amount of overfunding or underfunding as of year-end (Jun. 27, 2020); (Click to select) PBO, Plan Assets, and Funded Status Projected benefit obligation 1a. Indicate the projected benefit obligation at the end of the year (le, as of Jun 27 2020): (Click to select) 1b Indicate the projected benefit obligation at the beginning of the year. (Click to select) folick to select) $4,408,739 Plan $3,984,154 20. $4,537 648 nce of plan assets at the end of the year (le, as of Jun, 27, 2020) $5,039,718 TROR OG 26. Indicate the balance of plan assets at the beginning of the year (Click to select Funded status 3a. As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? (Click to select) 36. Indicate the amount of overfunding or underfunding as of year-end (Jun 27. 2020); (Click to select) PBO, Plan Assets, and Funded Status Projected benefit obligation 1a. Indicate the projected benefit obligation at the end of the year (e. as of Jun 27, 2020): Click to select) 16. Indicate the projected benefit obligation at the beginning of the year. (Click to select) 20 Plan assets 2a. Indicate the balance of plan assets at the end of the year (i.e as of Jun. 27, 2020). (Click to select) Click to selec $4.408.739 ince of plan assets at the beginning of the year. $5,039,718 $4,537 648 Fisinds $3,984 154 3a. As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? (Click to select) 3b. Indicate the amount of overfunding or underfunding as of year-end (Jun 27, 2020): Click to select) 30, Plan Assets, and Funded Status a rojected benetit obligation Indicate the projected benefit obligation at the end of the year (ie, as of Jun 27, 2020): (Click to select) 16. Indicate the projected benefit obligation at the beginning of the year. (Click to select) Plan assets 2a. Indicate the balance of plan assets at the end of the year fi.e., as of Jun 27, 2020) Click to select) 2b. Indicate the balance of plan assets at the beginning of the year Click to select) Click to select) $4,537,648 Fund $5,039,718 30 $4.408,739 $3,984 154 the year (Jun.27.2020), was the plan overfunded or underfunded? 30. Indicate the amount of overfunding or underfunding as of year-end (Jun.27.2020) Click to select) BO, Plan Assets, and Funded Status Projected benefit obligation Ta Indicate the projected benefit obligation at the end of the year (ie, as of Jun 27, 2020) (Click to select) 16. Indicate the projected benefit obligation at the beginning of the year. Click to select) Plan assets 20. Indicate the balance of plan assets at the end of the year (le, as of Jun 27. 2020). Click to select) 2b. Indicate the balance of plan assets at the beginning of the year. (Click to select) Funded status 3a As of the end of the year (Jun 27, 2020), was the plan overfunded or underfunded? Click to select) (Click to select 3b Underfunded Junt of overfunding or underfunding as of year-end (Jun.27. 2020) Overfunded Plan Assets, and Funded Status Djected benefit obligation Indicate the projected benefit obligation at the end of the year (ie, as of Jun 27, 2020): (Click to select) Indicate the projected benefit obligation at the beginning of the year. Click to select) Plan assets 2a. Indicate the balance of plan assets at the end of the year (e., as of Jun, 27, 2020) Click to select) 20. Indicate the balance of plan assets at the beginning of the year (Click to select) Funded status 30. As of the end of the year (Jun.27. 2020), was the plan overfunded or underfunded? Click to select 3. Indicate the amount of overfunding or underfunding as of year-end (Jun 27, 2020) (Click to select (Click to see $1,408,739 (140 616) Actul $5,030.718 Return $(630 979) 40. Indicate actual return in dollars for the year ended Jun 27, 2020 Click to select)