Follow this working but use the numbers that are given in the question !!!, This working is for another question with same working but different numbers. PLEASE BE VERY CAREFUL AND ACCURATE.  HERE IS THE QUESTION TO BE SOLVED

HERE IS THE QUESTION TO BE SOLVED

will upvote if figures are accurate & correct.

will upvote if figures are accurate & correct.

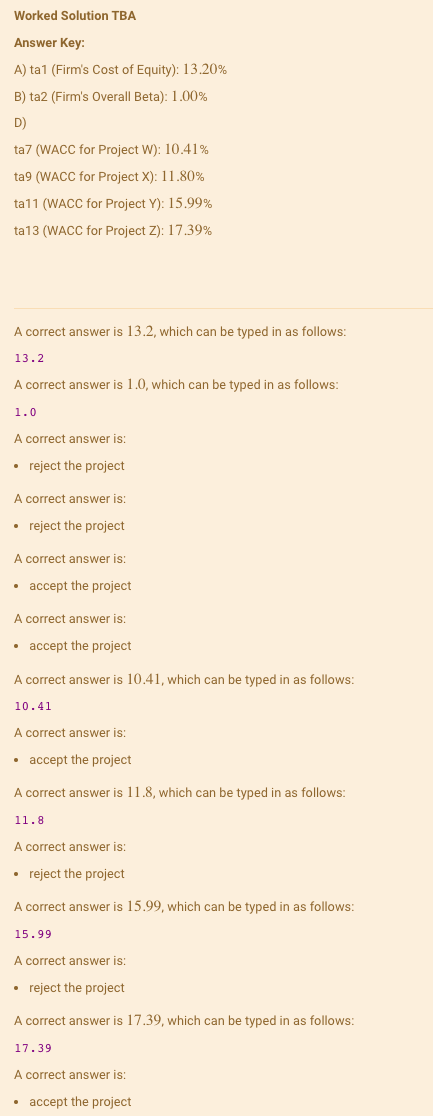

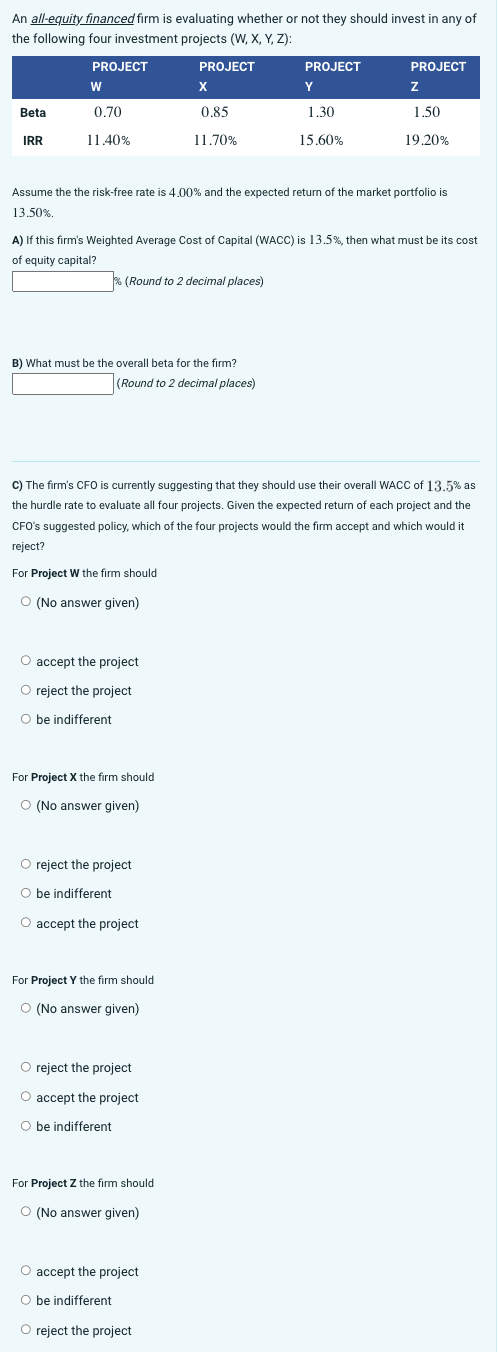

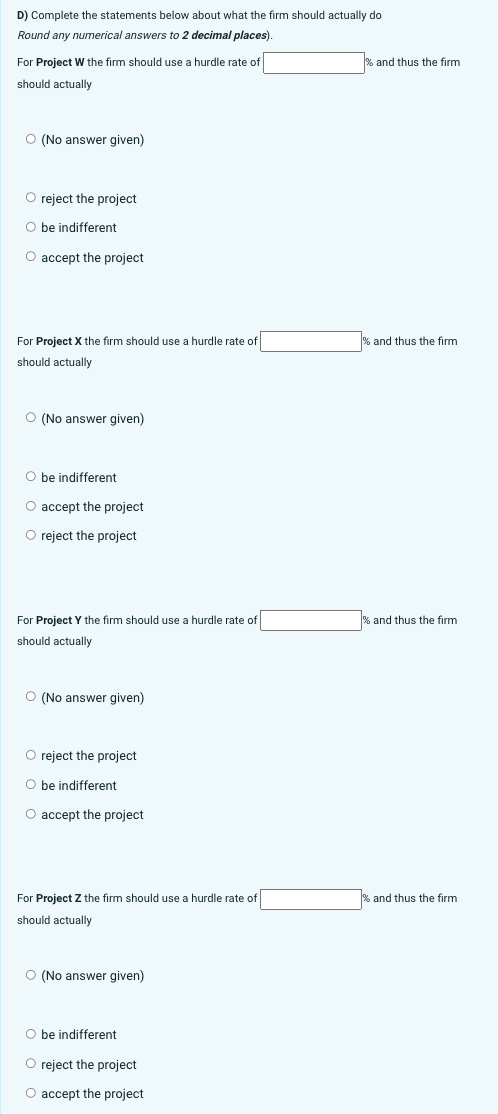

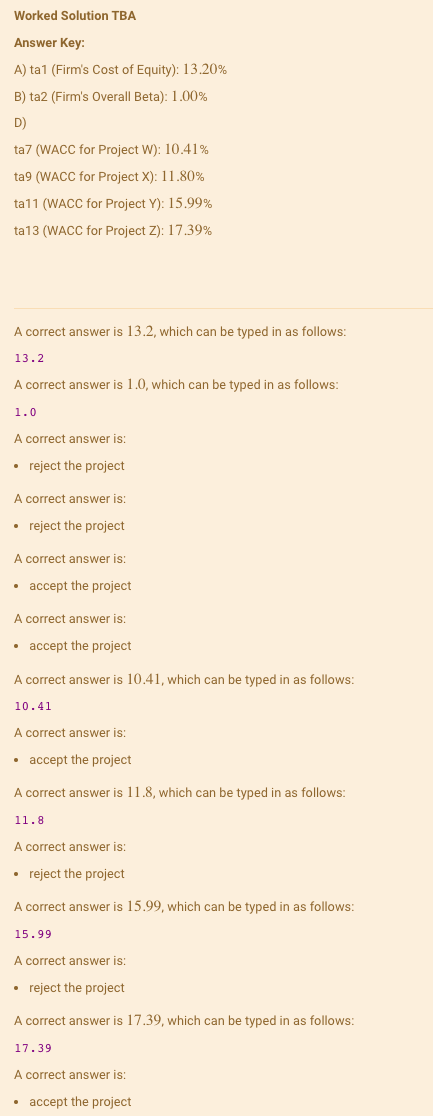

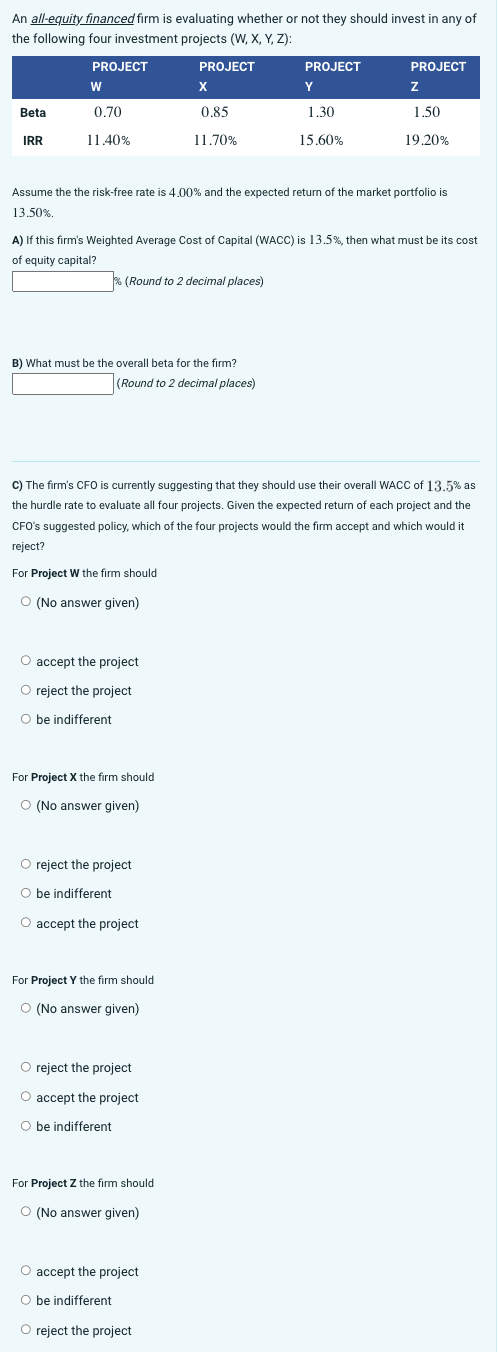

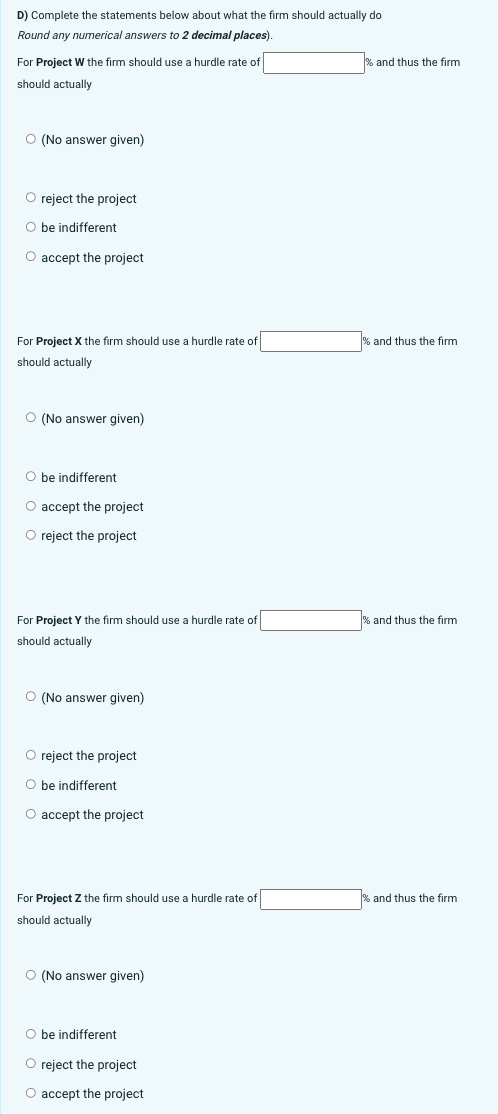

A correct answer is 13.2 , which can be typed in as follows: 13.2 A correct answer is 1.0 , which can be typed in as follows: 1.0 A correct answer is: - reject the project A correct answer is: - reject the project A correct answer is: - accept the project A correct answer is: - accept the project A correct answer is 10.41 , which can be typed in as follows: 10.41 A correct answer is: - accept the project A correct answer is 11.8 , which can be typed in as follows: 11.8 A correct answer is: - reject the project A correct answer is 15.99 , which can be typed in as follows: 15.99 A correct answer is: - reject the project A correct answer is 17.39 , which can be typed in as follows: 17.39 A correct answer is: - accept the project An all-equity financed firm is evaluating whether or not they should invest in any of the following four investment projects (W,X,Y,Z) : Assume the the risk-free rate is 4.00% and the expected return of the market portfolio is 13.50% A) If this firm's Weighted Average Cost of Capital (WACC) is 13.5%, then what must be its cost of equity capital? \% (Round to 2 decimal places) B) What must be the overall beta for the firm? (Round to 2 decimal places) C) The firm's CFO is currently suggesting that they should use their overall WACC of 13.5% as the hurdle rate to evaluate all four projects. Given the expected return of each project and the CFO's suggested policy, which of the four projects would the firm accept and which would it reject? For Project W the firm should (No answer given) accept the project reject the project be indifferent For Project X the firm should (No answer given) reject the project be indifferent accept the project For Project Y the firm should (No answer given) reject the project accept the project be indifferent For Project Z the firm should (No answer given) accept the project be indifferent reject the project D) Complete the statements below about what the firm should actually do Round any numerical answers to 2 decimal places). For Project W the firm should use a hurdle rate of % and thus the firm should actually (No answer given) reject the project be indifferent accept the project For Project X the firm should use a hurdle rate of % and thus the firm should actually (No answer given) be indifferent accept the project reject the project For Project Y the firm should use a hurdle rate o: % and thus the firm should actually (No answer given) reject the project be indifferent accept the project For Project Z the firm should use a hurdle rate of % and thus the firm should actually (No answer given) be indifferent reject the project accept the project

HERE IS THE QUESTION TO BE SOLVED

HERE IS THE QUESTION TO BE SOLVED

will upvote if figures are accurate & correct.

will upvote if figures are accurate & correct.