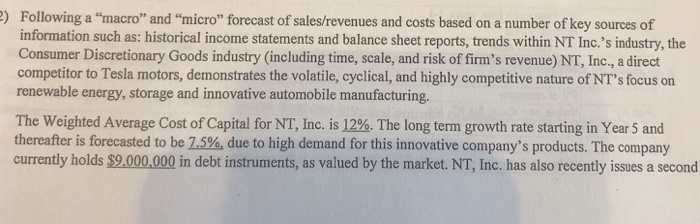

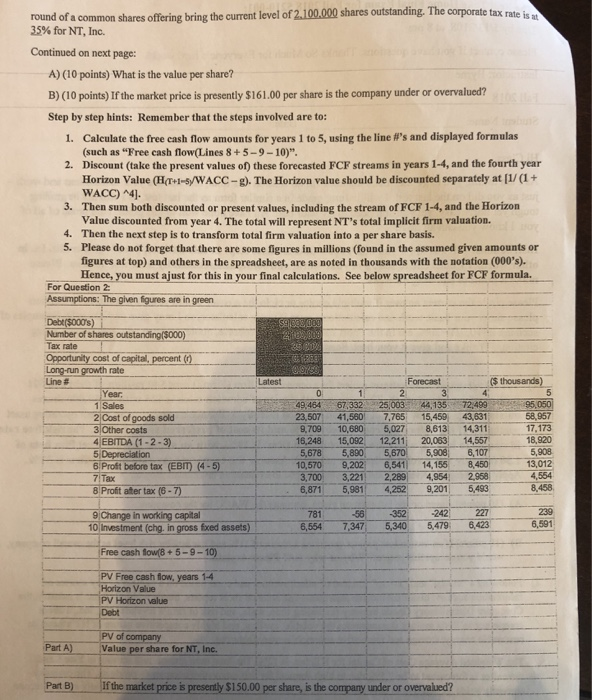

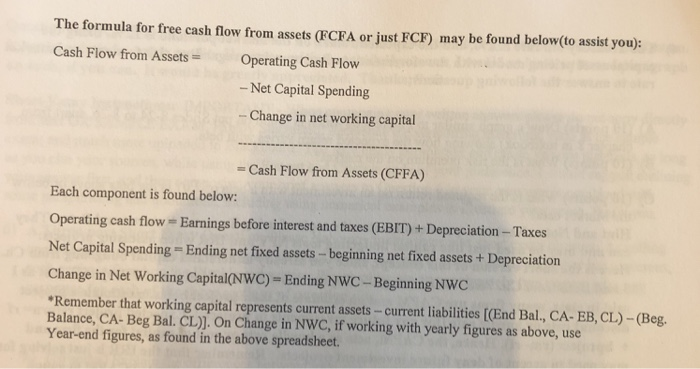

)Following a "macro" and "micro" forecast of sales/revenues and costs based on a number of key sources of information such as: historical income statements and balance sheet reports, trends within NT Inc.'s industry, the Consumer Discretionary Goods industry (including time, scale, and risk of firm's revenue) NT, Inc., a direct competitor to Tesla motors, demonstrates the volatile, cyclical, and highly competitive nature of NT's focus on renewable energy, storage and innovative automobile manufacturing. The Weighted Average Cost of Capital for NT, Inc. is 12%. The long term growth rate starting in Year 5 and thereafter is forecasted to be 7.5%, due to high demand for this innovative company's products. The company currently holds $9.000,000 in debt instruments, as valued by the market. NT, Inc. has also recently issues a second shares offering bring the current level of 2,100,000 shares outstanding. The corporate tax rate is a 35% for NT, Inc. Continued on next page: A) (10 points) What is the value per share? B) (10 points) If the market price is presently $161.00 per share is the company under or overvalued? Step by step hints: Remember that the steps involved are to: Calculate the free cash flow amounts for years l to 5, using the line #'s and displayed formulas (such as "Free cash flow(Lines 8+5-9-10)" Discount (take the present values of) these forecasted FCF streams in years 1-4, and the fourth year Horizon Value (HT I-s/WACC-g). The Horizon value should be discounted separately at [/a+ wACC) ^41. Then sum both discounted or present values, including the stream of FCF 1-4, and the Horizon Value discounted from year 4. The total will represent NT's total implicit firm valuation. Then the next step is to transform total firm valuation into a per share basis. Please do not forget that there are some figures in millions (found in the assumed given amounts or figures at top) and others in the spreadsheet, are as noted in thousands with the notation (000's). Hence, you must ajust for this in your final caleulations. See below spreadsheet for FCF formula. 1. 2. 3. 4. 5. For Question 2 Assumptions: The given figures are in green Debt($000's Number of shares outstanding($000) Tax rate Opportunity cost of capital, percent Long-run growth rate Line # Latest ($ thous ands) 49 464 67,33225,0034413572.499 23,507 41,560 7,765 15,45 43,631 9,709 10,680 5,027 8,613 14,311 16,248 15,082 12,211 20,063 14,557 5,678 5,890 10,570 9,202 6,541 14,155 8,450 3,700 3,221 2289 494 2968 6,871 5,981 4,252 9,201 5,493 1 Sales 2 Cost of goods sold 3 Other costs 4 EBITDA (1-2 5 Depreciation 58,957 17,173 18,920 5,908 5,908 6 Proft before tax (EBT) (4-5 7 Tax 8 Profit after tax (6-7 13,012 4,554 239 6,591 56 -352 -242 9 Change in working capital 10 Investment (chg in gross fxed assets) 781 6,564 7,347 5,340 5,479 6,423 Free cash towB+5-9-10 PV Free cash flow, years 14 PV Horizon value Horizon Value Debt PV of Part A)Value per share for NT, Inc. Part B) if the market price is presently $150.00 per share, is the company under or overvalued? The formula for free cash flow from assets (FCFA or just FCF) may be found below(to assist you): Cash Flow from AssetsOperating Cash Flow Net Capital Spending -Change in net working capital -Cash Flow from Assets (CFFA) Each component is found below: Operating cash flow Earnings before interest and taxes (EBIT)+Depreciation- Taxes Net Capital Spending- Ending net fixed assets -beginning net fixed assets + Depreciation Change in Net Working Capital(NWC Ending NWC-Beginning NWC Remember that working capital represents current assets-current liabilities (End Bal., CA- EB, CL)-(Beg. Balance, CA- Beg Bal. CL). On Change in NWC, if working with yearly figures as above, use Year-end figures, as found in the above spreadsheet