Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are (a) a condensed summary of the General Fund budget adopted by the village of Croton- on-Hudson, New York for the fiscal year

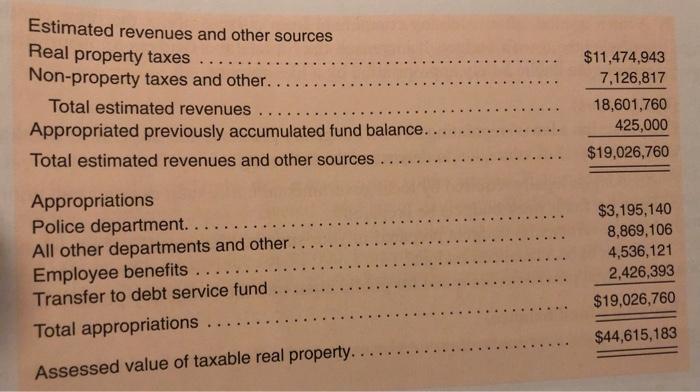

Following are (a) a condensed summary of the General Fund budget adopted by the village of Croton- on-Hudson, New York for the fiscal year 2017-2018, and (b) the total assessed value of taxable proper- ties in the village. Prepare the journal entry to record the budget and compute the property tax rate per S1.000 of taxable assessed value. Estimated revenues and other sources Real property taxes .... Non-property taxes and other... $11,474,943 7,126,817 Total estimated revenues.. Appropriated previously accumulated fund balance. 18,601,760 425,000 Total estimated revenues and other sources $19,026,760 Appropriations Police department... All other departments and other.. Employee benefits Transfer to debt service fund.. $3,195,140 8,869,106 .... 4,536,121 2,426,393 ... .. $19,026,760 Total appropriations $44,615,183 Assessed value of taxable real property...

Step by Step Solution

★★★★★

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Account Title Explanation Debit Credit Estimated Real Property Taxes 11474943 Estimated Non Propert...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started