Answered step by step

Verified Expert Solution

Question

1 Approved Answer

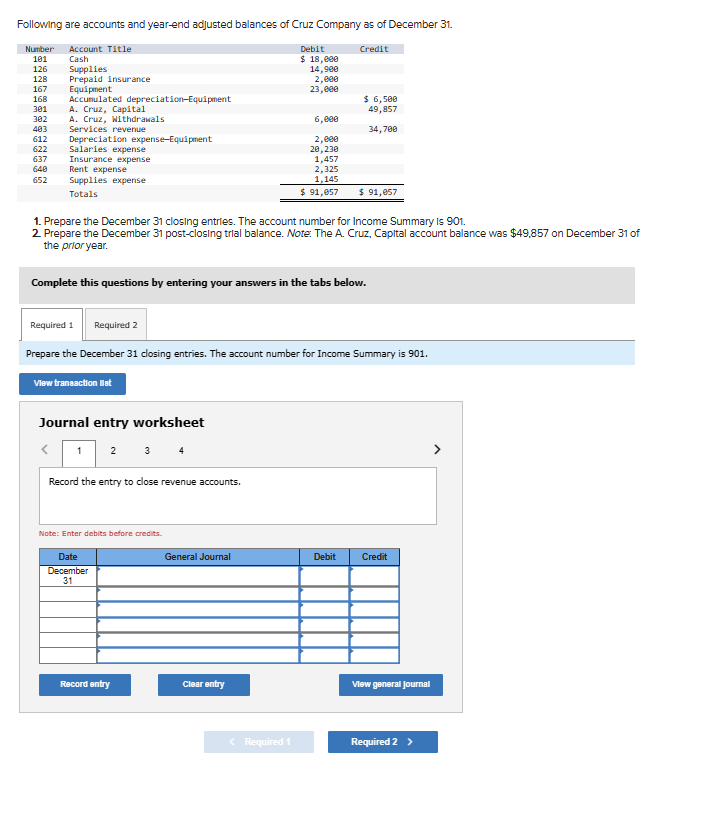

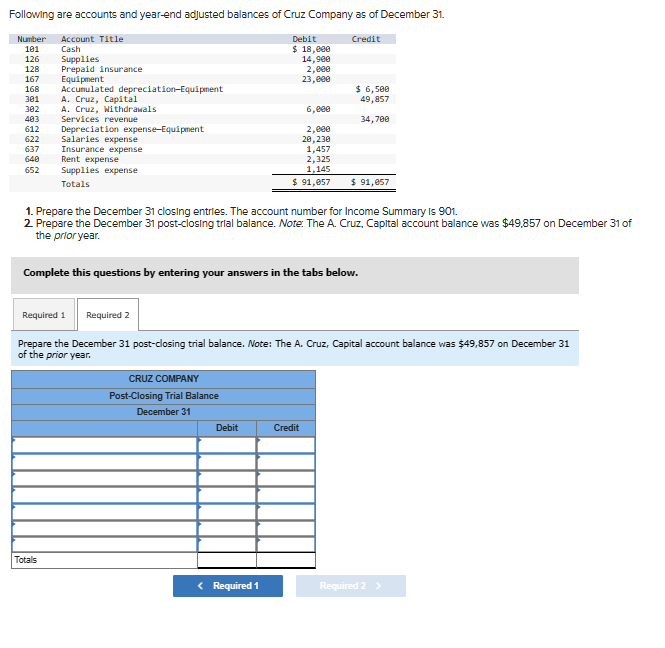

Following are accounts and year-end adjusted balances of Cruz Company as of December 31. Number Account Title Credit 101 Cash 126 Supplies 128 Prepaid

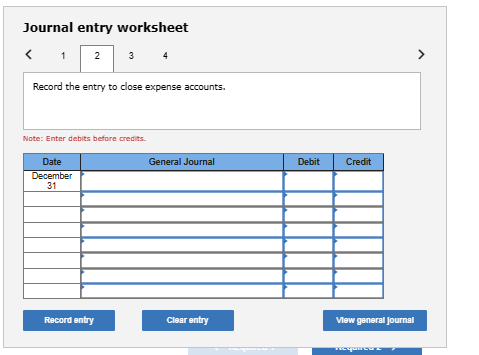

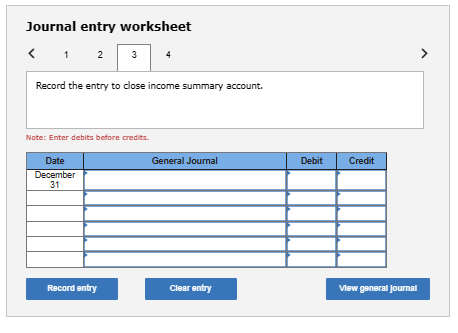

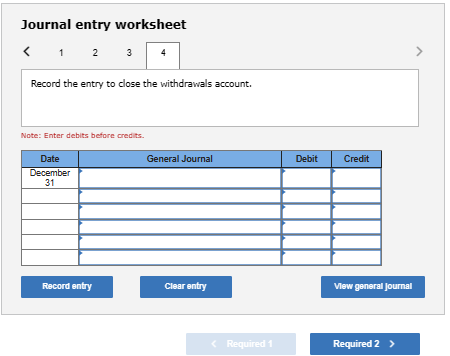

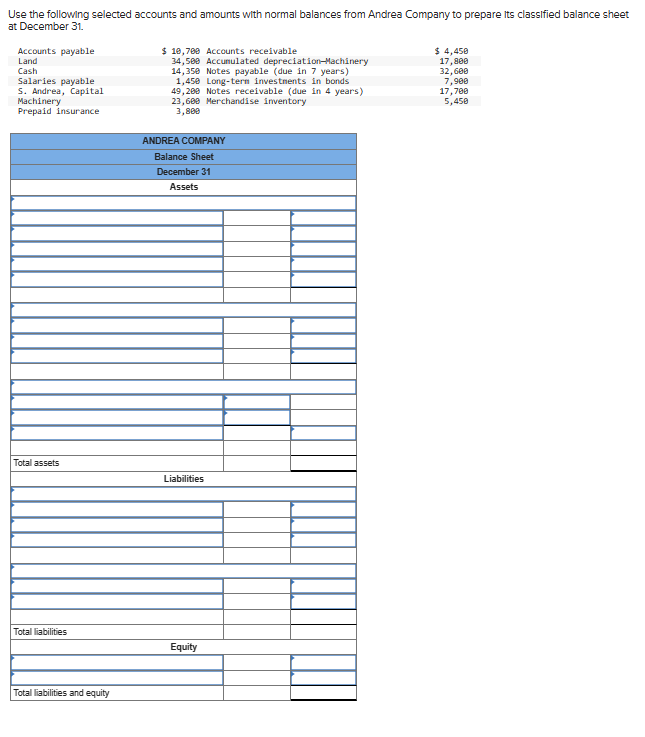

Following are accounts and year-end adjusted balances of Cruz Company as of December 31. Number Account Title Credit 101 Cash 126 Supplies 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation-Equipment 301 A. Cruz, Capital 302 A. Cruz, Withdrawals 403 Services revenue 612 Depreciation expense-Equipment 622 637 640 652 Salaries expense Insurance expense Rent expense Supplies expense Totals Journal entry worksheet < 1 2 3 4 1. Prepare the December 31 closing entries. The account number for Income Summary is 901. 2. Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $49,857 on December 31 of the prior year. Record the entry to close revenue accounts. Complete this questions by entering your answers in the tabs below. Note: Enter debits before credits. Required 1 Required 2 Prepare the December 31 closing entries. The account number for Income Summary is 901. View transaction list Date December 31 Record entry Debit $ 18,000 14,900 2,000 23,000 General Journal 6,000 2,000 20,230 1,457 2,325 1,145 $ 91,057 Clear entry < Required 1 $ 6,500 49,857 34,700 $ 91,057 Debit Credit View general Journal Required 2 > Journal entry worksheet < 1 2 3 Record the entry to close expense accounts. Note: Enter debits before credits. Date December 31 Record entry 4 General Journal Clear entry Debit Credit View general Journal recquico a Journal entry worksheet < 1 2 3 Record the entry to close income summary account. Note: Enter debits before credits. Date December 31 4 Record entry General Journal Clear entry Debit Credit View general Journal Journal entry worksheet < 1 2 3 4 Record the entry to close the withdrawals account. Note: Enter debits before credits. Date December 31 Record entry General Journal Clear entry < Required 1 Debit Credit View general Journal Required 2 > Following are accounts and year-end adjusted balances of Cruz Company as of December 31. Credit Number Account Title 101 Cash 126 128 167 168 301 302 403 612 Depreciation expense-Equipment 622 637 640 652 Supplies Prepaid insurance Equipment Accumulated depreciation-Equipment A. Cruz, Capital A. Cruz, Withdrawals Services revenue Salaries expense Insurance expense Rent expense Supplies expense Totals Totals Required 1 Required 2 1. Prepare the December 31 closing entries. The account number for Income Summary is 901. 2. Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $49,857 on December 31 of the prior year. Complete this questions by entering your answers in the tabs below. Debit $ 18,000 14,900 2,000 23,000 CRUZ COMPANY Post-Closing Trial Balance December 31 Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $49,857 on December 31 of the prior year. Debit $ 6,500 49,857 34,700 6,000 2,000 20,230 1,457 2,325 1,145 $ 91,057 $ 91,857 < Required 1 Credit Required 2 > Use the following selected accounts and amounts with normal balances from Andrea Company to prepare its classified balance sheet at December 31. Accounts payable Land Cash Salaries payable S. Andrea, Capital Machinery Prepaid insurance Total assets Total liabilities Total liabilities and equity $10,700 Accounts receivable 34,500 Accumulated depreciation-Machinery 14,350 Notes payable (due in 7 years) 1,450 Long-term investments in bonds 49,288 Notes receivable (due in 4 years) 23,600 Merchandise inventory 3,800 ANDREA COMPANY Balance Sheet December 31 Assets Liabilities Equity $ 4,450 17,800 32,600 7,900 17,700 5,450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Closing Entries for December 31 1 Revenue and Expense Accounts to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started