Question

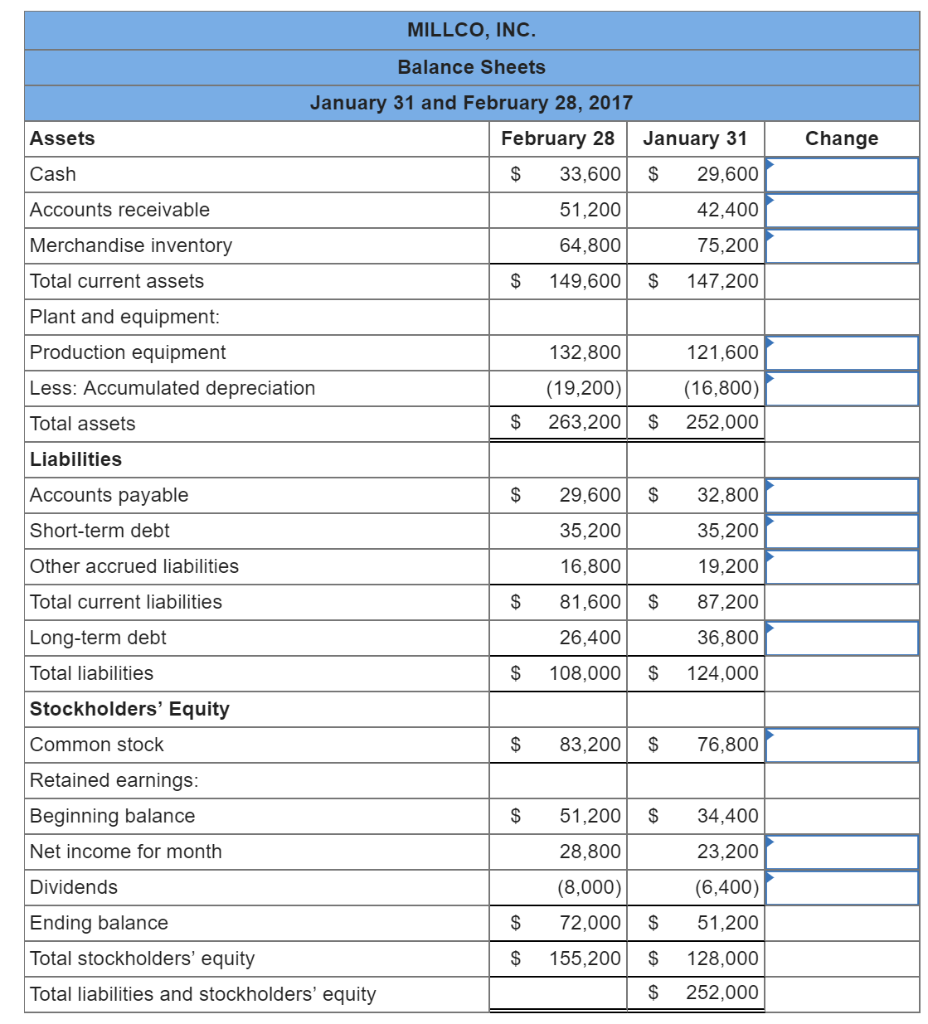

Following are comparative balance sheets for Millco, Inc., at January 31 and February 28, 2017: MILLCO, INC. Balance Sheets February 28 and January 31, 2017

Following are comparative balance sheets for Millco, Inc., at January 31 and February 28, 2017:

| MILLCO, INC. | |||||||

| Balance Sheets | |||||||

| February 28 and January 31, 2017 | |||||||

| February 28 | January 31 | ||||||

| Assets | |||||||

| Cash | $ | 33,600 | $ | 29,600 | |||

| Accounts receivable | 51,200 | 42,400 | |||||

| Merchandise inventory | 64,800 | 75,200 | |||||

| Total current assets | $ | 149,600 | $ | 147,200 | |||

| Plant and equipment: | |||||||

| Production equipment | 132,800 | 121,600 | |||||

| Less: Accumulated depreciation | (19,200 | ) | (16,800 | ) | |||

| Total assets | $ | 263,200 | $ | 252,000 | |||

| Liabilities | |||||||

| Accounts payable | $ | 29,600 | $ | 32,800 | |||

| Short-term debt | 35,200 | 35,200 | |||||

| Other accrued liabilities | 16,800 | 19,200 | |||||

| Total current liabilities | $ | 81,600 | $ | 87,200 | |||

| Long-term debt | 26,400 | 36,800 | |||||

| Total liabilities | $ | 108,000 | $ | 124,000 | |||

| Stockholders' Equity | |||||||

| Common stock, no par value, 32,000 shares authorized, 24,000 and 22,400 shares issued, respectively | $ | 83,200 | $ | 76,800 | |||

| Retained earnings: | |||||||

| Beginning balance | $ | 51,200 | $ | 34,400 | |||

| Net income for month | 28,800 | 23,200 | |||||

| Dividends | (8,000 | ) | (6,400 | ) | |||

| Ending balance | $ | 72,000 | $ | 51,200 | |||

| Total stockholders' equity | $ | 155,200 | $ | 128,000 | |||

| Total liabilities and owners' equity | $ | 263,200 | $ | 252,000 | |||

Required:

a. Calculate the change that occurred in cash during the month. You may assume that the change in each balance sheet amount is due to a single event (for example, the change in the amount of production equipment is not the result of both a purchase and sale of equipment). Because the retained earnings section of the balance sheet is, in and of itself, an analysis of the change in the retained earnings account for the month, the row for net income and dividends should be entered as the February amount and not the change. Use the space to the right of the January 31 data to enter the difference between the February 28 and January 31 amounts of each balance sheet item.

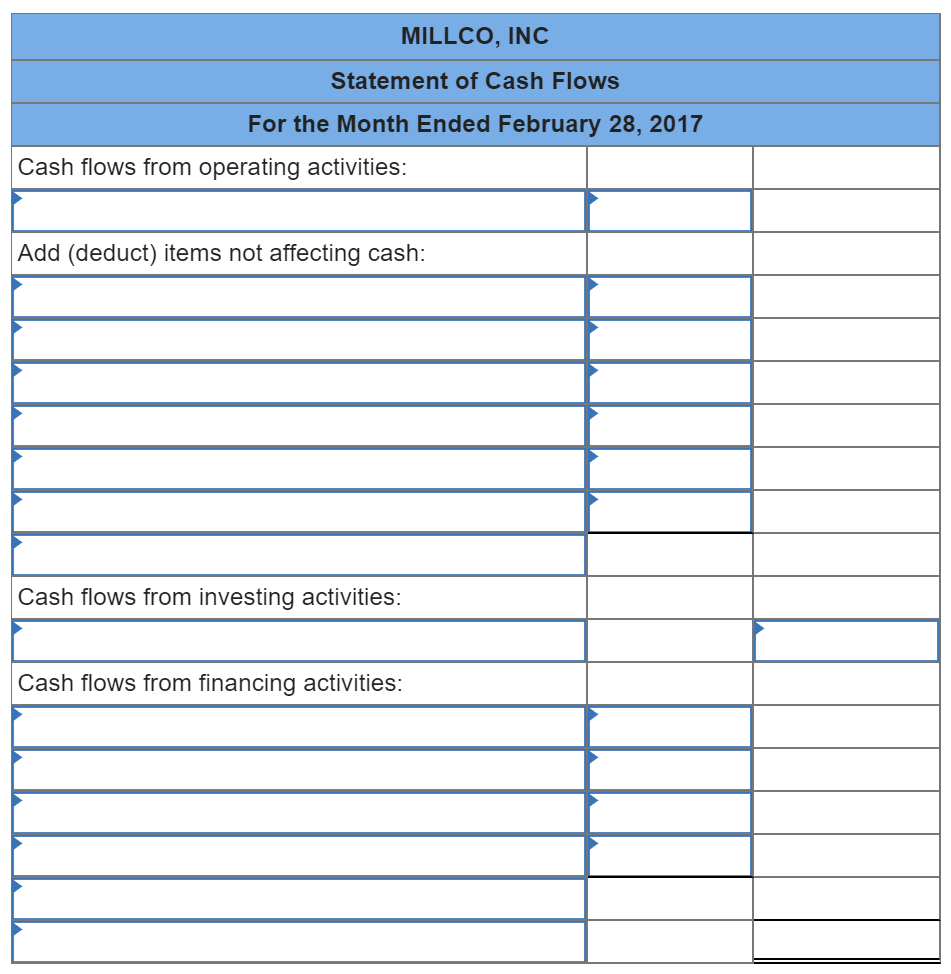

b. Prepare a statement of cash flows that explains above changes? (Amounts to be deducted should be indicated by a minus sign. )

MILLCO, INC Balance Sheets January 31 and February 28, 2017 Change Assets Cash Accounts receivable Merchandise inventory Total current assets Plant and equipment Production equipment Less: Accumulated depreciation Total assets Liabilities Accounts payable Short-term debt Other accrued liabilities Total current liabilities Long-term debt Total liabilities Stockholders' Equity Common stock Retained earnings Beginning balance Net income for month Dividends Ending balance Total stockholders' equity Total liabilities and stockholders' equity February 28 January 31 $ 33,600 S 29,600 42,400 75,200 S 149,600 147,200 51,200 64,800 132,800 (19,200) S 263,200 $ 252,000 121,600 (16,800) $29,600 S 32,800 35,200 19,200 $81,600S 87,200 36,800 $ 108,000$ 124,000 35,200 16,800 26,400 $ 83,200 76,800 $ 51,200 34,400 23,200 (6,400) $ 72,000 51,200 $155,200$ 128,000 $ 252,000 28,800 (8,000) MILLCO, INC Statement of Cash Flows For the Month Ended February 28, 2017 Cash flows from operating activities: Add (deduct) items not affecting cash: Cash flows from investing activities: Cash flows from financing activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started