Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are descriptions of land purchases in four separate cases. 1. At the midpoint of the current year, a $40,000 check is given for

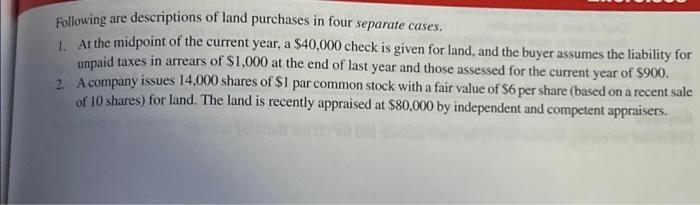

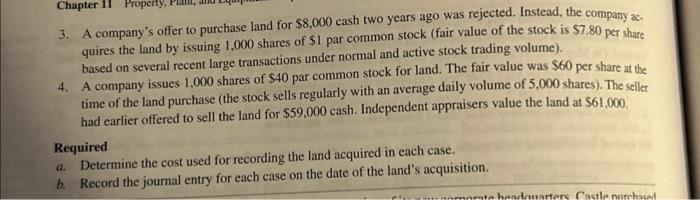

Following are descriptions of land purchases in four separate cases. 1. At the midpoint of the current year, a $40,000 check is given for land, and the buyer assumes the liability for unpaid taxes in arrears of $1,000 at the end of last year and those assessed for the current year of $900. 2. A company issues 14,000 shares of $1 par common stock with a fair value of $6 per share (based on a recent sale of 10 shares) for land. The land is recently appraised at $80,000 by independent and competent appraisers. Chapter 11 Property, 3. A company's offer to purchase land for $8,000 cash two years ago was rejected. Instead, the company ac- quires the land by issuing 1,000 shares of $1 par common stock (fair value of the stock is $7.80 per share based on several recent large transactions under normal and active stock trading volume). 4. A company issues 1,000 shares of $40 par common stock for land. The fair value was $60 per share at the time of the land purchase (the stock sells regularly with an average daily volume of 5,000 shares). The seller had earlier offered to sell the land for $59,000 cash. Independent appraisers value the land at $61,000. Required a. Determine the cost used for recording the land acquired in each case. b. Record the journal entry for each case on the date of the land's acquisition. nomorate headquarters Castle nurchased

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTIONS a To determine the cost used for recording the land acquired in each case we need to consider the specific details provided for each transaction 1 Case 1 Land purchase price 40000 Unpaid tax...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started