Answered step by step

Verified Expert Solution

Question

1 Approved Answer

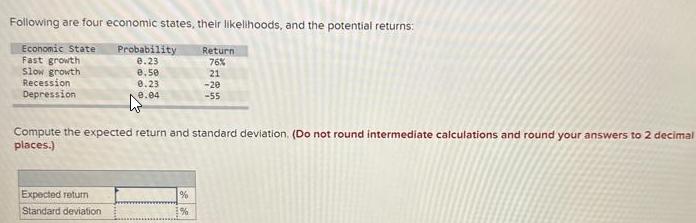

Following are four economic states, their likelihoods, and the potential returns: Economic State Fast growth Slow growth Recession Depression Probability 0.23 0.50 0.23 0.04

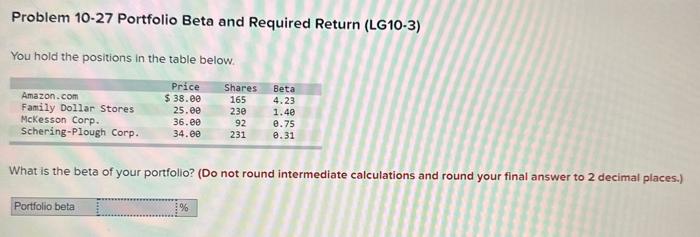

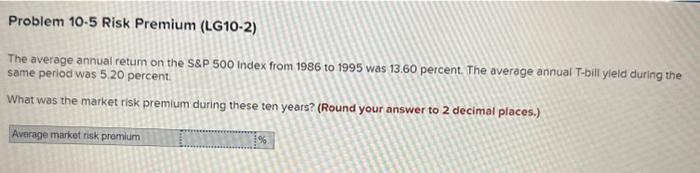

Following are four economic states, their likelihoods, and the potential returns: Economic State Fast growth Slow growth Recession Depression Probability 0.23 0.50 0.23 0.04 Expected return Standard deviation Compute the expected return and standard deviation. (Do not round intermediate calculations and round your answers to 2 decimal places.) Return 76% 21 -20 -55 % % Problem 10-27 Portfolio Beta and Required Return (LG10-3) You hold the positions in the table below. Price $38.00 Portfolio beta Amazon.com Family Dollar Stores McKesson Corp. Schering-Plough Corp. What is the beta of your portfolio? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 25.00 36.00 34.00 Shares 165 230 92 231 % Beta 4.23 1.40 0.75 0.31 Problem 10-5 Risk Premium (LG10-2) The average annual return on the S&P 500 Index from 1986 to 1995 was 13.60 percent. The average annual T-bill yield during the same period was 5.20 percent. What was the market risk premium during these ten years? (Round your answer to 2 decimal places.) Average market risk premium %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculate the expected return and standard deviation Calculate the expected return mean return first Expected Return Probability of Fast Growth Retu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started