Answered step by step

Verified Expert Solution

Question

1 Approved Answer

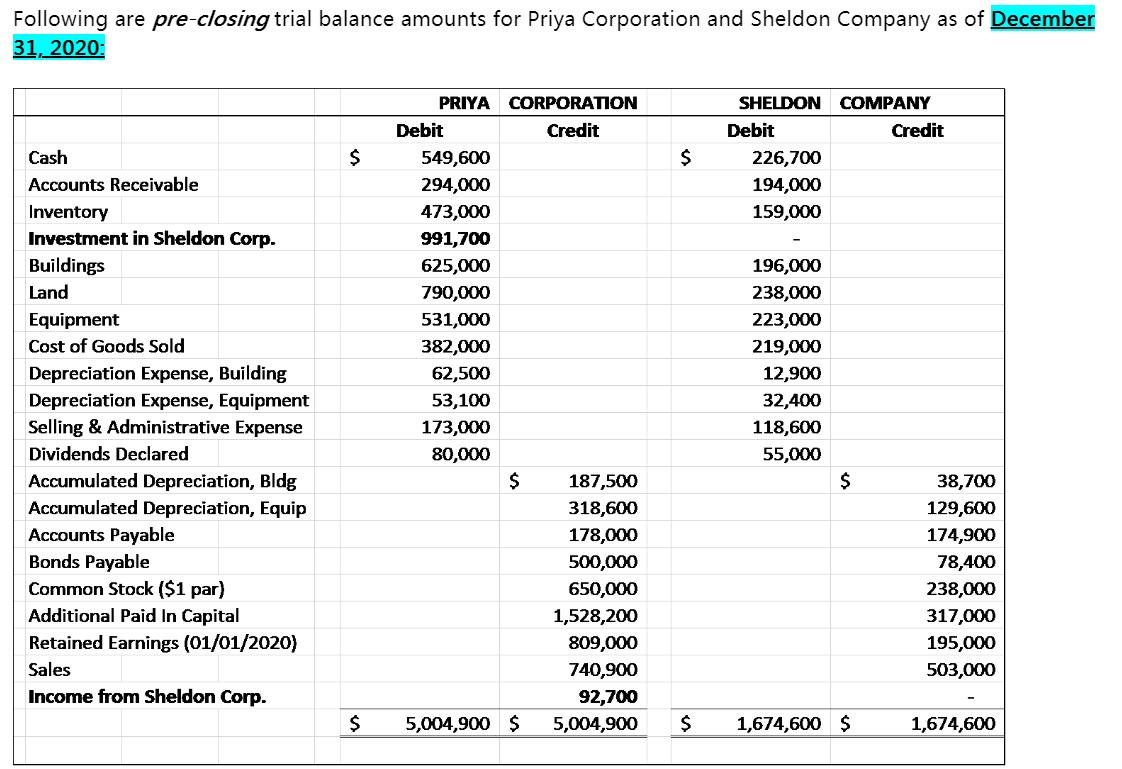

Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2020: PRIYA CORPORATION SHELDON COMPANY Debit Credit Debit

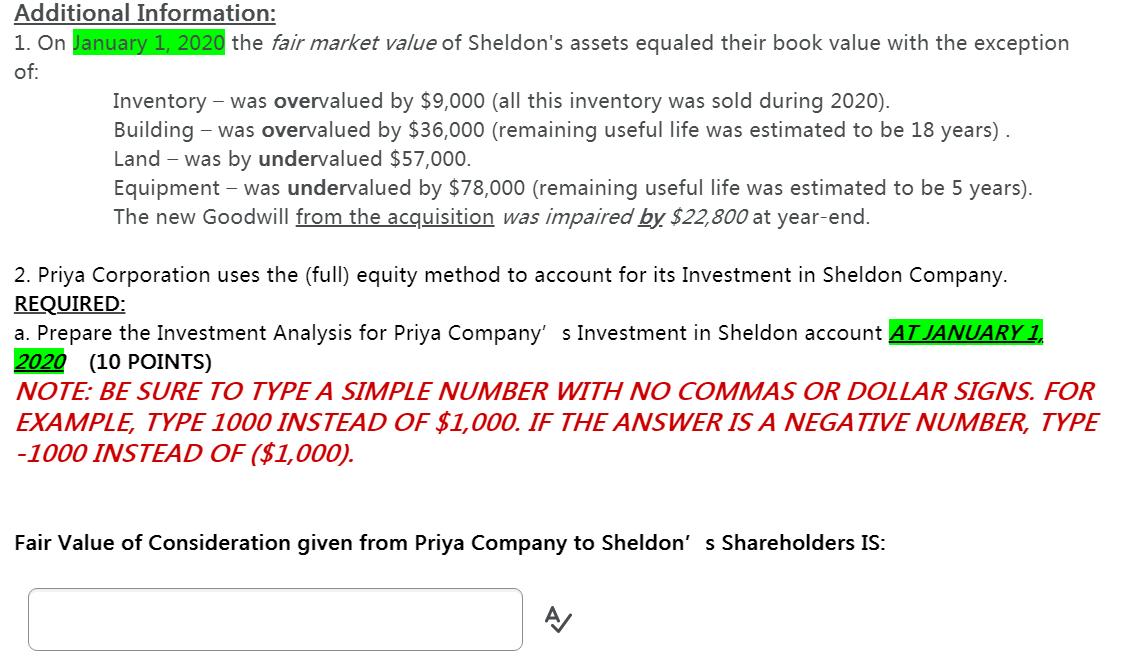

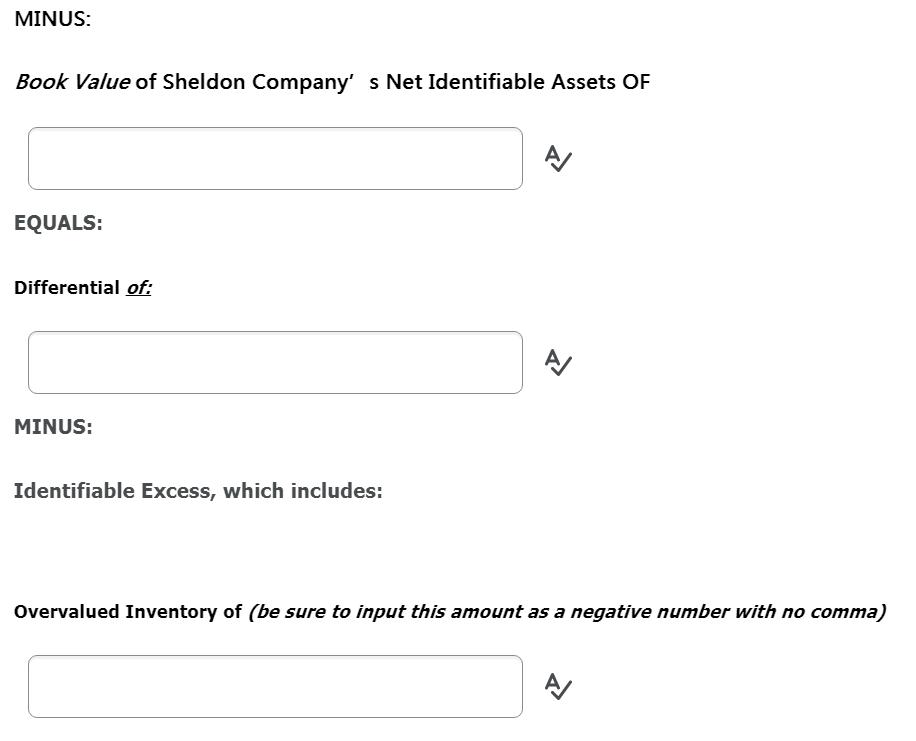

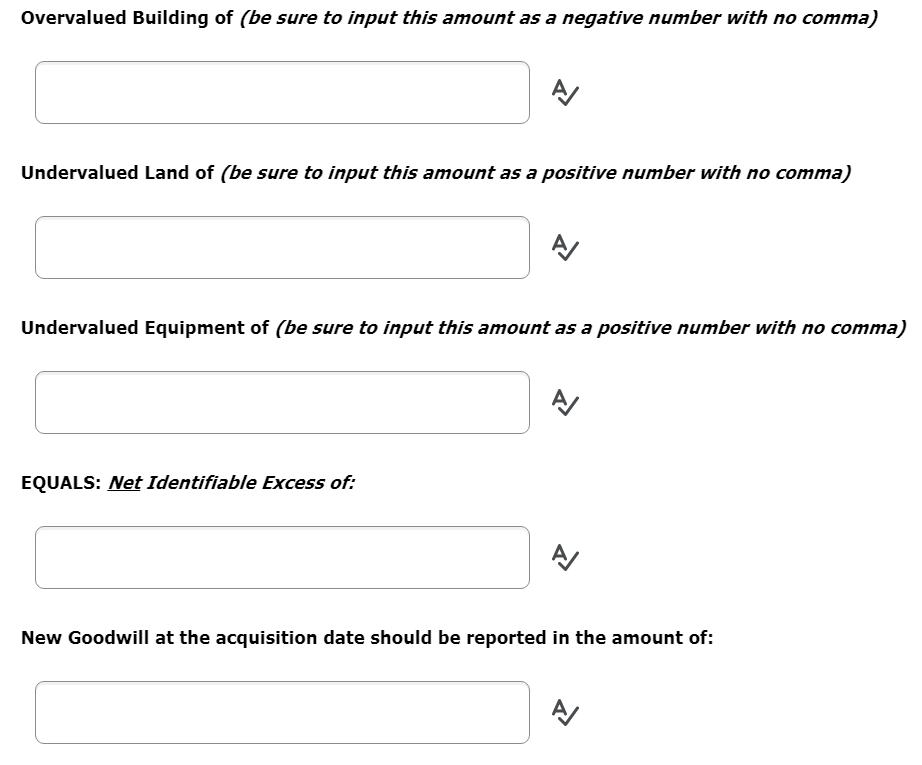

Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2020: PRIYA CORPORATION SHELDON COMPANY Debit Credit Debit Credit Cash $ 226,700 Accounts Receivable 194,000 Inventory 159,000 Investment in Sheldon Corp. Buildings 196,000 Land 238,000 Equipment 223,000 Cost of Goods Sold 219,000 Depreciation Expense, Building 12,900 Depreciation Expense, Equipment 32,400 118,600 Selling & Administrative Expense Dividends Declared 55,000 Accumulated Depreciation, Bldg Accumulated Depreciation, Equip Accounts Payable Bonds Payable Common Stock ($1 par) Additional Paid In Capital Retained Earnings (01/01/2020) Sales Income from Sheldon Corp. 549,600 294,000 473,000 991,700 625,000 790,000 531,000 382,000 62,500 53,100 173,000 80,000 $ 187,500 318,600 178,000 500,000 650,000 1,528,200 809,000 740,900 92,700 $ 5,004,900 $ 5,004,900 $ $ $ 1,674,600 $ 38,700 129,600 174,900 78,400 238,000 317,000 195,000 503,000 1,674,600 Additional Information: 1. On January 1, 2020 the fair market value of Sheldon's assets equaled their book value with the exception of: Inventory - was overvalued by $9,000 (all this inventory was sold during 2020). Building - was overvalued by $36,000 (remaining useful life was estimated to be 18 years). Land - was by undervalued $57,000. Equipment - was undervalued by $78,000 (remaining useful life was estimated to be 5 years). The new Goodwill from the acquisition was impaired by $22,800 at year-end. 2. Priya Corporation uses the (full) equity method to account for its Investment in Sheldon Company. REQUIRED: a. Prepare the Investment Analysis for Priya Company's Investment in Sheldon account AT JANUARY 1, 2020 (10 POINTS) NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE ANSWER IS A NEGATIVE NUMBER, TYPE -1000 INSTEAD OF ($1,000). Fair Value of Consideration given from Priya Company to Sheldon's Shareholders IS: MINUS: Book Value of Sheldon Company's Net Identifiable Assets OF A/ EQUALS: Differential of: A MINUS: Identifiable Excess, which includes: Overvalued Inventory of (be sure to input this amount as a negative number with no comma) A/ Overvalued Building of (be sure to input this amount as a negative number with no comma) Undervalued Land of (be sure to input this amount as a positive number with no comma) Undervalued Equipment of (be sure to input this amount as a positive number with no comma) A/ EQUALS: Net Identifiable Excess of: New Goodwill at the acquisition date should be reported in the amount of:

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here are the Entries along with working notes for clarification All amounts are Basic Consolidation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started