Answered step by step

Verified Expert Solution

Question

1 Approved Answer

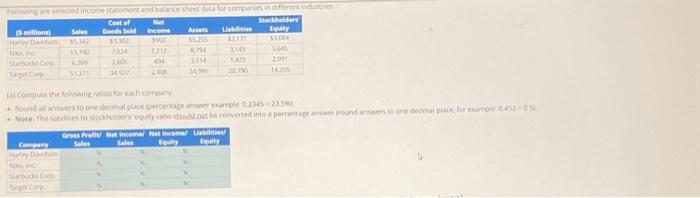

Following are selected income statement and balance sheet data for companies in different industries. Cost of Goods Sold ($ millions) Harley-Davidson Nike, Inc. Starbucks Corp.

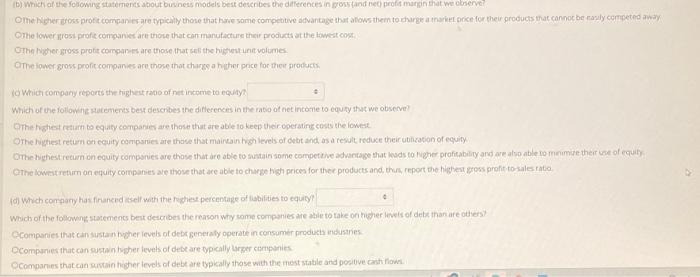

Following are selected income statement and balance sheet data for companies in different industries. Cost of Goods Sold ($ millions) Harley-Davidson Nike, Inc. Starbucks Corp. Target Corp. Sales $5,342 13,740 6,369 51,271 Company Harley-Davidson Nike, Inc. Starbucks Corp. Target Corp. $3,302 7,624 2,605 34,927 % % 96 96 Net Income $960 1,212 494 2,408 Assets $5,255 8,794 3,514 34,995 96 % % 96 (a) Compute the following ratios for each company. Round all answers to one decimal place (percentage answer example: 0.2345 = 23.5%). Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer (round answers to one decimal place, for example: 0.452 = 0.5). Gross Profit/ Net Income/ Net Income/ Liabilities/ Sales Sales Equity Equity Liabilities $2,171 % % % % 3,149 1,423 20,790 Stockholders' Equity $3,084 5,645 2,091 14,205

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started